Fund selection - December 2016

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Senior portfolio manager - Multi management & Solution, AA advisors. Based in: Paris, France

“Despite a continuing favourable environment for equities, including low interest rates and moderate economic growth, some challenges are expected in the near term. In terms of earnings, moderate economic growth will translate into moderate earnings growth. Over the last five or so years there has been a price-earnings expansion, however the majority of the rerating has already taken place. So, with equities having returned to their near-term highs, we decide to reduce risk by trimming the equity allocation across all regions while keeping a style bias in favour of growth-oriented strategies in both Europe and the US.”

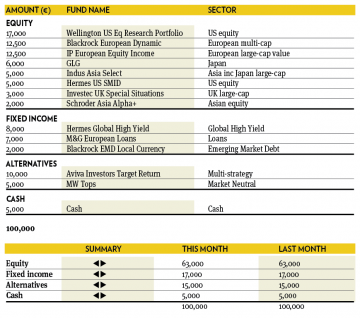

Thomas Wells

Fund manager, multi-assets, CFA, Aviva Investors. Based in: London, UK

“After a tumultuous few months November proved to be relatively calm. With the Fed rate rise in December all but inevitable, the dollar rallied benefiting our portfolio due to its large dollar exposure. This month we did make one fund switch; redeeming out of the passive BlackRock US tracker and replacing it with the active Wellington US Equity Research Portfolio. The Wellington fund is a core proposition, composed of 27 underlying industry sleeves each managed by a dedicated research analyst. The analysts look to generate outperformance through bottom up stock selection – something that they have achieved across most time periods.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“November saw markets in something of a holding pattern following a strong October as the positive dovish signals from the European and Chinese central banks continued to be offset by signals from the US Federal Reserve that a rate rise was probable at their December meeting assuming the economic data remained reasonable and in the absence of “unexpected shocks”. The dollar rose significantly as the likely actions of the central banks diverged with the growing expectation of further stimulus from the ECB resulting in the US market being the strongest performer in euro terms, with emerging markets the laggard though still making gains. The Polar North American fund compounded the positive moves of its base market as the best performer of the selection with the Kames High Yield fund the laggard losing ground in the month. As we enter the final month of the year we remain cautiously optimistic on the outlook for markets, with central bank action being a key factor in the coming weeks.”

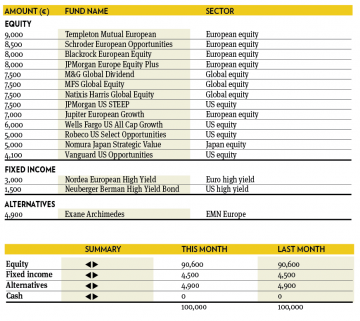

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“November was another positive month for equities, the US dollar and the Japanese yen. All these allocations contributed to the performance of our portfolio. Among the top contributors were Vanguard US Opportunities, Wells Fargo US All Cap Growth and Jupiter European Growth. Worst performer was Nordea European High Yield, although its return was positive in absolute terms. We are disappointed with our global and European value managers, still lagging significantly behind the market. We kept the portfolio unchanged during the month: we still prefer equities, high yield and alternatives to government bonds and cash.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Financial markets are currently in a status quo situation since we do not expect the ECB to raise interest rates as the Fed has planned to. In this environment, volatility should remain stable. In general, we believe low growth and low inflation should favour high-yield bonds. However, we are retaining a substantial amount of risk in the portfolio. We have significantly increased exposure to risk arbitrage and equity market neutral strategies to benefit from the current high activity in merger and acquisitions, without over exposing ourselves to the equity market.”

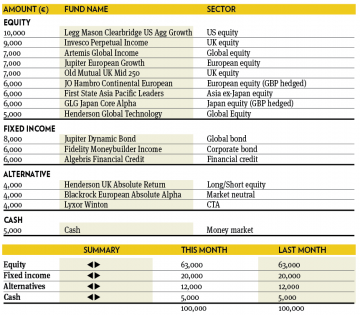

Peter Haynes

Investment director, SGPB Hambros. Based in: London, UK

“Equity markets ended the month in positive territory despite the events in Paris with investors continuing to focus on future central bank policy. The continued strength of US employment lead the Federal Reserve to shift its focus back to the home economy and the hint that the long delayed rate rise might finally happen in December. Within the portfolio, we remain overweight in equities with emphasis on Europe and Japan with an underweight and low duration position in fixed income. Within the alternatives allocation we continue to favour long/short and market neutral equity funds. The holding of Henderson UK Absolute Return has been a stand out performer returning over 6.5 per cent year to date against a background of falling equity markets.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio remained quite stable in November in terms of the overall balance of main asset classes. While it is not representative of the average situation over the past few years, a meaningful proportion of actively managed European equity funds outperformed their index so far this year, which benefited the portfolio. As opposed to this, in the US equity space, a very limited number of actively managed funds outperformed the market, which made us stick to ETFs when getting exposure to the US market. The performances of fixed income funds have been very different from one fund to the other.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“Despite marginal disappointment from the ECB as well as the likelihood for the first rate hike for almost a decade in the US this month we maintain our equity weightings as well as the bias towards spreads within fixed interest. We continue to be concerned about the pressure for increasing yields within fixed interest, so in addition to preferring to allocate to alternatives (Ucits absolute return products), this month we have switched the all maturity high yield position in Axa to a short duration high yield fund managed by Muzinich – to control duration levels on the model portfolio.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“Investing according to ESG is a theme that has come more and more in focus and this has led to the fund industry starting to adopt their supply accordingly. The global equity fund SEB Hållbarhetsfond Global has a quantitative investment process model firstly excluding companies that underperform from a sustainability aspect but the model secondly also has an inclusion perspective by adding specific environmental criteria regarding carbon emission, toxic waste and water stress. We are convinced companies that include aspects of ESG in their operations are more successful in the long term creating positive performance for the investors and add this fund to the portfolio. We finance the new holding by reducing in the global equity fund M&G Global Dividend Fund. The rising dividend style of the fund has not worked so well for some time and we somewhat reduce the exposure in this instrument.”