Fund selection - December 2013/January 2014

Each month in PWM, 9 top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Graham Duce

Co-head of UK multi- manager funds, Aberdeen Asset Managers. Based in London

“It’s been a challenging environment for investors in emerging markets this year. However, we believe corporate fundamentals remain sound and valuations are at more attractive levels since the summer sell-off. Our position in the J O Hambro Global Emerging Markets Fund has performed relatively well, but we have sold the entire holding and rotated into the Findlay Park Latin American Fund. We therefore achieve greater exposure to the Latin American region which has underperformed the mainstream GEM indices. But more importantly, we gain access to an excellent bottom up stockpicker in Rupert Brandt.”

Peter Fitzgerald

Head of Multi-Asset Retail Funds, Aviva investors. Based in: London, UK

“We resisted the temptation to reduce our allocation to equities during the month, preferring instead to maintain our relatively high equity allocation. A neutral position would be 50 per cent equities 50 per cent bonds so one can observe that we are overweight equities, underweight fixed income and overweight cash. We continue to believe fixed income is riskier than equities and prefer to balance our equity holdings with cash, floating rate securities and a very select number of alternatives.”

Christian Jost

Executive director and chief investment officer, C-Quadrat Kapitalanlage AG. Based in: Vienna, Austria

“We reduced the exposure in European sovereign bonds with a short duration and increased the investment grade bond allocation. We kept European and global large caps equities exposure at 20.75 per cent, while maintaining 25 per cent in government and sovereign bonds and money market, with 28.75 per cent in investment grade and high yield bonds. Developed and emerging equities represent respectively 29.5 per cent and 3.5 per cent of the portfolio, while property equities account for 4.75 per cent, and alternative strategies 8.5 per cent of total assets.”

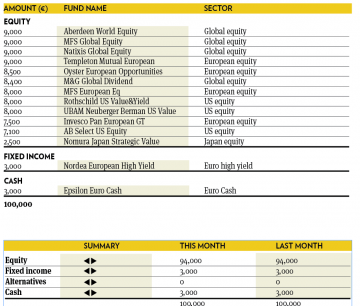

Management selection team

Eurizon Capital. Based in: Milan, Italy

“We took profit on our positioning in Vanguard US Opportunities, after its strong outperformance since the beginning of the year. We reinvested into Alliance Bernstein Select US Equity, a lower tracking error fund, tilted towards large and mid caps. We also took profit on our GLG Japan CoreAlpha position. We reinvested into Nomura Japan Strategic Value, a more diversified Japanese equity fund. The portfolio is still overweight equities, European High Yield, and Euro Cash and underweight Euro Government bonds. The portfolio under-performed its benchmark in October with allocation to cash and fund selection in US equities detracting.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C investments,. Based in: London, UK

“The temporary resolution to the US debt ceiling and positive economic news from Spain gave markets the impetus to continue their solid run. Europe just pipped the US to the top spot with JOHCM Continental European Fund outperforming the market as our best performer. Japan gave back some of the previous months gain as the only market to lose money in the month, albeit marginal. Our worst performer was the F&C Macro Bond fund which marginally underperformed Morant Wright Japan. Equity markets have made strong gains year to date, and while economic figures are surprising on the upside, in the main, we are conscious of volatility in the short term.”

Sebastien Bonnet

Head of Financial Engineering FundQuest, BNP Paribas Group. Based in: Paris, France

“Uncertainties on the stability of the US Federal State have been dampened with a new financing law this month. Volatility which rose at the beginning of the month, has been subsequently reduced, and the markets have called for some more risk, granting new historical records for equity indices.

We maintain our views on the necessity of some equity risk in the portfolio. We have taken the opportunity offered by a lower interest rates environment to introduce some high yield investments and to shorten the portfolio’s global duration.”

Lionel De Broux

Manager selection specialist, IPCM, ING Private Management

Based in: Luxembourg

“Over the last month, the strategy succeeded to perform in line with its objectives. On the positive side, our cautious allocation to fixed income was supportive. In particular, our exposure to asset allocation funds and alternative strategies supported the performance. On the negative side, results from global and European equity funds as well as our over-exposure to Asia were detrimental. We have decided to cut the allocation to emerging markets by redeeming the Fidelity South East Asia and to invest the proceeds into F&C European Small Cap.”

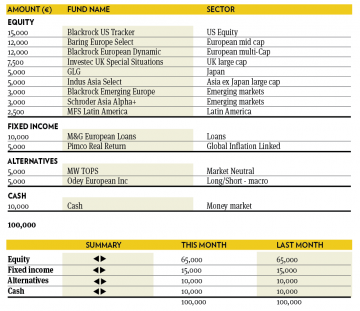

Bernard Aybran

Head of manager selection, Invesco. Based in: Paris, France

“We kept the overall shape of the balanced portfolio unchanged over October, with a low, albeit positive duration, a meaningful exposure to the equity markets and a fully invested portfolio. The only change was adding another actively managed fund at the expense of a systematic one. Fixed income markets might go through an environment that differs meaningfully from the past 30 years, when a secular decrease of interest rates took place. Even if no sharp increase is expected in major Western interest rates, many models based on past data might have a tough time adapting.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“Last month’s move into the long/short equity fund Blackrock EDEAR has worked well. We believe our combination in the alternative space is well balanced after the change. In equities M&G Global Dividend fund shows a bit of waning momentum as their underweight in industrials has weighed on performance. Our other equity holding, JO Hambro Global Select, has a thematic approach resulting in overweights to cyclical sectors such as technology and industrials. Our view is that the current trend of equity markets seeking growth and cyclicality will continue. We have decided to reduce somewhat in M&G in favour of the JO Hambro fund.”