Fund selection - November 2018

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“Despite market turbulence, economic and company fundamentals remain solid. We continue to prefer the relative attractiveness of stocks over bonds. Within the fixed income portfolio we increase the exposure to emerging market debt by adding a new fund managed by Neuberger Berman and specifically invested in local currency emerging markets debt. We believe that the recent emerging markets turmoil in financial markets will not translate into widespread balance of payments problems or widespread recessions in emerging markets. In this context investing in local-currency emerging markets debt can provide an additional return, as these currencies are expected to return to more normal levels after having been beaten down over the past year.”

Luca Dal Mas

Senior fund analyst, Aviva Investors. Based in: London, UK

“October has been a very challenging month for risk assets. Rising interest rates, the US mid-term elections and uncertainty around global trade dominate the agenda. We adjusted our overall risk allocation to preserve capital. The relative stability of local currency emerging market debt allowed us to switch part of that exposure into hard currency debt. We also added Janus Henderson UK Absolute Return to the alternatives bucket based on their ability to navigate volatile markets, which is significant in the current environment.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“The combination of political and corporate news weighed heavily on sentiment in October, resulting in falling equity markets and a moderate shift into government bonds as China and the US continued to posture over trade at a time when Q3 earnings from the US companies failed to surprise on the upside as the market has started to expect. Italian budget wrangling and Brexit talks dominated headlines nearer to home. Asian markets fared the worst with the CC Asian Focus find the worst performer of the selection, with the Vontabel TwentyFour Global Unconstrained Fund the best performer, though still losing ground on the month. Having feared a pickup in volatility for some time, we remain conscious of the scope for gyrations to continue as we move towards the end of the year.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“In October, performance was negative. There were no positive contributors. The biggest detractors were Jupiter European Growth and Fidelity European Dynamic Growth. We still think equities are the best allocation this year, and that October represented a correction and not the beginning of a bear market. Hence, we increased our position in Vanguard US Opportunities. We reduced our position in Carmignac Securité to fund Vanguard’s purchase. Albeit volatility is becoming higher by the day, fundamentals still support a good exposure to equities, in our view.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Equity markets sentiment sharply reversed during October. On the back of this market trend, the portfolio, designed as dynamic with 67 per cent in equities, suffered. Considering a stronger probability of a recovery than a sell off before the year end, we give preference to stocks over bonds. We believe the market correction to be overdone given the favourable economic environment, i.e. positive surprises observed during the recent US earnings’ season. Thus, we keep the portfolio unchanged.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers. Based in: Bristol, UK

“Like Special Forces training, investing is a test of resilience. The market puts people in stress positions and gets them to do things they shouldn’t or don’t want to do. While fund managers should follow the style that works for them, the fund buyer should always search for diversification. Not doing so invites totally unnecessary pressure, which increase the chances of making a mistake. Over the years I have heard of investors ‘giving it all to Woodford’ or ‘selling all my UK holdings’. Investors should celebrate having parts of a portfolio doing badly as these can be your saviour when the market changes direction.”

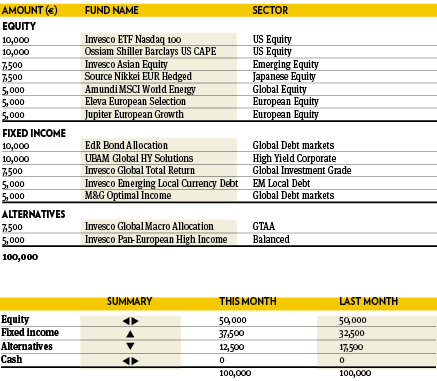

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“In October, the balanced portfolio remained on the same trend as on September, redeeming some more multi-asset and alternative funds to re-invest the proceeds on the fixed income side. While most multi-assets funds have been struggling to profit from the market turbulence, some valuation opportunities appeared in several asset classes, allowing us to initiate an investment in emerging bonds denominated in local emerging currencies, bringing a sizeable yield that would be very hard to find elsewhere. The rest of the portfolio remains unchanged as most funds behaved consistently with their own style biases.”

.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“We took advantage of the sharp sell-off in equities to modestly increase our US exposure, reducing the cash weighting to fund, adding to the Lyxor ETF S&P 500, increasing our US exposure. Value performed strongly in the US, on a relative basis, reversing the long trend of growth’s outperformance. This maybe a blip or a longer term reversal of the trend, but with no clear view we opted to add broad market exposure rather than biased to growth or value. Equities remain our preferred asset class as valuations remain supportive, even more so given recent market falls.”

Lea Vaisalo

Chief Portfolio Manager, Nordea investments. Based in: Copenhagen, Denmark

“October turned out to be a volatile month, with risk-off dominating the markets. While the main worries have been the same as earlier this year, namely rising interest rates, the global growth outlook is now also in question. We think the fears are exaggerated, and stick to our positive view of equities versus fixed income. Q3 reporting is in full swing, and so far the results are encouraging, giving continued support for equities. We stick to our overweight in energy and materials and underweight bond proxies telecoms, utilities and consumer staples. We recommend diversifying the overweight from China to emerging markets more broadly, as we expect commodity prices to go higher and Chinese easing to give support. Within fixed income, we stick to a neutral call given lack of relative value opportunities. Overall, we balance the growth and equity tilts with the allocation to stable equities and a multi-asset factor allocation within the alternatives bucket.”