Fund selection - October 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“Equity markets have been reacting in a logical fashion to recent news and, on balance, continued their gradual move upwards. Events including the German elections, central bank announcements and North Korea missile tests appear to be analysed and absorbed without much drama. The ‘back to normal’ sentiment is underway across equity, bond and currency markets. We keep our portfolio unchanged, favouring stocks over bonds, with a regional preference for Europe and emerging markets. We continue to favour value stocks over growth in both Europe and the US.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“September was a very positive month for the portfolio rewarding our patient approach to investing. The value trade reasserted itself as markets reacted to more hawkish comments from the Fed. This resulted in steeper interest rate curves globally benefitting our European bank position which returned 5.3 per cent in euro terms and reversed all of August losses. We also saw good performance from Hermes US SMID, a fund that is well positioned to capitalise on any tax cuts in the US should they materialise.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“Increased talk of normalisation of central bank policy caused gyrations in currency and bond markets in a month that also saw heightened political tension over North Korea and significant disruption from hurricanes. Victory for Angela Merkel in the German elections failed to buoy the fortunes of the euro which weakened, flattering positive returns from global equity markets. The best performer was the euro hedged Schroder ISF Japanese Opportunities fund with the Old Mutual UK Specialist Equity Euro Hedged fund the laggard.”

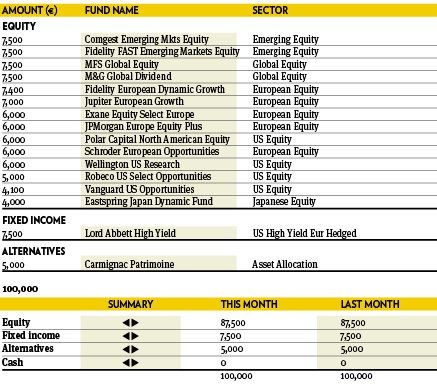

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended September with a positive performance. Top contributors were Fidelity European Dynamic Growth, Exane Equity Select Europe and M&G Global Dividend, while Carmignac Patrimoine and Comgest Emerging Markets lagged. The recovery in US small caps boosted Vanguard US Opportunities and Robeco US Select Opportunities. Geopolitical tensions eased in September and central banks confirmed their benign posture towards the markets. We did not make any changes, as the environment is favourable to risky assets.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“The UN Security Council’s management of the North Korean crisis pushed geopolitical risk to the back-burner. Solid economic data in US, European and emerging areas augur an improvement of global macro economic environment. As expected, global equities achieved their eleventh consecutive monthly gain in September. US tax reform re-emerged as a market topic. In this context, we reinforce positons/allocation in equities, in particular on European markets, and we extend our exposure to small caps on US equity markets.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“September is likely to be marked as the global turning point in monetary policy. The Fed will start to unwind QE from October and is likely to raise rates again, as is the Bank of England. Bond yields rose as these events unfolded. We modestly reduced cash, adding to the existing holding of JO Hambro Continental European. We switched the Lyxor US TIPS Tracker into the Invesco Sterling Bond Fund and removed our CTA exposure, selling our holding of the Lyxor Epsilon Global Trend Fund. In its place we added the Lyxor/Tiedemann Arbitrage Strategy.”

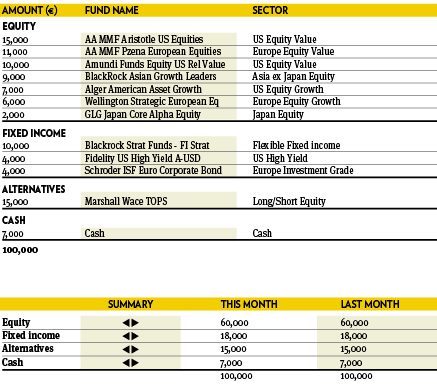

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The portfolio retained its overall shape as risk markets rallied strongly, while long rates crept mildly higher. Two themes were increased. First, Japan, supported by attractive valuations and a healthy earnings growth. Second, the US-listed biotech sector, which has mostly been overlooked for a while. This was at the expense of broader US and global equities. The spread between actively managed funds was wide alongside the gap between value and yield. Fixed income benefitted from high yield exposures,while FX positioning mattered a great deal.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“My portfolio was set up for a UK investor and as such what happens between the $ and £ can and often does have a significant bearing on performance. Brexit saw all our overseas holdings increase in value as sterling swooned. However the weakness of sterling put a rocket up the market as all those lovely overseas dollar and euro profits came home being worth more to the sterling investor. Recent dollar weakness means all our dollar dominated funds (global bonds, US equities, Asian Equities) are at the bottom of the pile while the UK funds are top of the pops.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“The Pictet Total Return – Agora Fund is an event-driven market neutral hedge fund focused on finding pre-announced opportunities in the large cap European equity market. An improving macro picture, reduced political risk and inflows into Europe are all good reasons for a healthy stock picking environment re-emerging in contrast to the last 18 months. Manager Elif Aktug has been smart and not greedy during that period where the market has been unfavorable for the strategy, but now has a brighter view and opportunities are likely to abound going forward.”