Fund selection - February 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The first two weeks of Donald Trump’s presidency have triggered weakness of the US dollar, consolidation in equity markets and tensions in bond markets with yields pointing upward and spreads widening in Europe. While acknowledging the uncertainty of this new global political environment, we also observe solid macroeconomic and microeconomic fundamentals. We remain confident in our overweight in equities and underweight in bonds as well as in our selection of managers which favours value oriented strategies in Europe and the US.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“January saw the dollar index falling below 100 for the first time since Mr Trump was elected. This reversal in currency strength reflects market uncertainty surrounding the 45th president of the United States. Emerging markets were the primary beneficiary with Pinebridge Asia ex Japan Small Cap the stand-out performer. The blend of Baillie Gifford and GLG Japan has also already begun to pay dividends with a smoother return profile. We remain happy with the shape of the portfolio and have made no changes this month.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“Following his inauguration, President Trump moved swiftly in signing executive orders to effect some of his campaign promises, though little has been said of the more significant tax changes or infrastructure spending. The BGF Asian Growth Leaders was the strongest performer of the selection. The top down driven CF Odey Odyssey fund was the worst, losing ground as markets rotated. With economic growth generally surprising on the upside fears of inflation have gathered pace; we expect a very rotational and volatile market to develop through the year.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended the month with a positive performance. The main contributors were the emerging markets equity funds, Comgest and Fidelity, followed by Wells Fargo US All Cap Growth. Albeit US rates rose rather sharply in the fourth quarter of 2016, we think further rises will be smoother, thus not so damaging for emerging markets, where we keep a sizeable position. In Europe, political turmoil could keep volatility high, but a strengthening economic cycle should warrant some positive results. We made no changes to the portfolio.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Equity markets started 2017 with significant gains in emerging markets and the US. Our US market tilt is still strong, yet we shifted our focus from European Reits to emerging markets and reinforce European defensives and smaller companies. This theme shot up in 2016 and we expect it to continue. Portzamparc PME shone bright in January, with a selection of small and mid-cap French companies, the fund outperformed both small caps and the CAC 40. We have an overall defensive strategy and are still cautious about adding risk.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“In January, a proportion of the Trump ‘inflation trade’ unwound, resulting in a marginally weaker dollar and lower bond yields. Despite this, most equity markets continued to rally, many reaching new highs as economic data globally continued to support. Emerging markets rallied due to the weak US currency however European equities were marginally weaker. The uncertain political outlook in Europe coupled with concerns over the reduction in asset purchases announced by the ECB appears to be weighing on both equity and sovereign bond markets in the region.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The equity portfolio has been tweaked some more in favour of a mid-cap biased all-weather European fund. Alternatives have been trimmed somewhat in order to fund a new investment in a very specific fixed income fund: a portfolio of globally diversified inflation-linked bonds hedged against duration. This investment gives an exposure to the breakeven rates, which have been rising in tandem with the overall reflation theme. Fixed income is now close to one third of the portfolio, with a meaningful exposure to credit, both investment grade and high yield.”

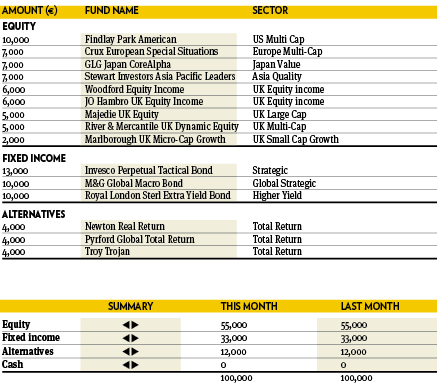

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“We are in the year of the ‘Fire Rooster’. Early performance and market skittishness seems to be living up to the name. My limited understanding of roosters is that, like stockmarkets, they are unpredictable in every way apart from the fact they will to attack you when you turn your back. We are positive on equites but are concerned about the US market being two standard deviations expensive on the cyclically adjusted PE ratio (CAPE). Last time we were here was 1995 ahead of a major boom and bust in technology stocks.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“The market neutral hedge fund Pictet Agora is focused on finding pre-announced opportunities in the large cap European equity market. After a dip during Q3 last year, the performance has recovered and year to date the fund is up 1.8 per cent. Portfolio manager Elif Aktug has proven her ability to identify good prospects on both the long and short side. For 2017 we expect more cross dispersion which should provide good opportunities for this long/short strategy. The market neutral characteristics of the fund also give a low correlation to equity markets which is desirable.”