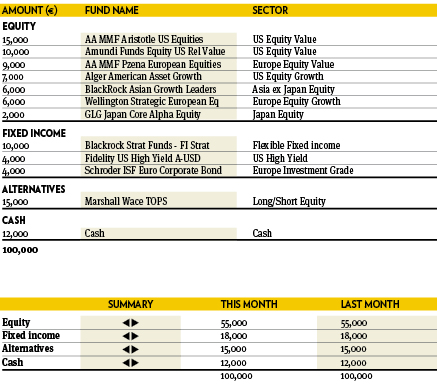

Fund selection - April 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

““US stockmarkets are currently trading around all-time highs and have extended their outperformance over European equities. Over the last couple of years, US equities have benefited from an accelerating economy. More recently, they drew support from President Trump’s fiscal stimulus plans. European stocks, by contrast, were held back by lower growth and the debt crisis. This environment is now rapidly changing and we see signs of improving European economic growth. We therefore reduce exposure to US stocks and increase exposure to European equities.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

““Testament to the phrase ‘markets climb a wall of worry’, it came as no surprise that, despite a busy political calendar, European equities have begun to outperform other developed markets; we expect this to continue. With quantitative easing fast fading as a macro-policy tool, markets are returning to fundamentals. European equities are trading on more attractive price multiples than the US with European companies beginning to see earnings growth. We increased our European equity allocation funded from a reduction in US equity.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“March saw mixed returns with volatility remaining subdued. Economic data remained supportive, while headlines were dominated by politics with the UK triggering the process to leave the EU. Confidence in President Trump’s ability to push through market-friendly policies was dented by his failure to replace Obamacare. Currency markets were volatile. European equities led markets rising strongly in the month with Japan and the US losing a little ground. The BGF Continental European Flexible fund was the best performer of the selection.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended March with a positive performance. The main contributors were Jupiter European Growth, Fidelity FAST Emerging Markets and Exane Equity Select Europe. The main detractor was Eastspring Japan Dynamic. Fundamentals point to a recovery in Europe, and the Fed does not seem too aggressive. We therefore increase exposure to European equities, introducing Fidelity European Dynamic Growth, with a good allocation to high growth mid-caps, which will benefit from a higher level of economic activity. We sold Exane Archimedes.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“During March, financial markets were dominated by US domestic politics. The failure to replace Obamacare has raised doubts among investors about the government’s ability to reach its tax cutting, tax reform and infrastructure spending goals. In Europe, political risks had an impact on government bond markets but not yet on more risky assets. We reshuffled the portfolio in favour of equities and introduced global technology and European small caps. We cut exposure to US corporate and high yield.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“Equity markets had a positive month in March, extending the gains made in the 1st quarter. Valuations are higher than average, particularly in the US, however economic data in the US and Europe continue to be supportive so we are happy to remain positive on the asset class. BlackRock Continental Europe was the strongest performer in line with European equity indices, which outperformed other developed equity markets. We switched out of the iShares S&P 500 Minimum Volatility into a more traditional US ETF but kept the overall asset allocation unchanged.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“In March, all asset classes have been changed. In the alternative bucket, one holding has been fully redeemed as it struggled to outperform cash in any market condition. The proceeds have been reinvested in a go-anywhere, well established fixed income fund, well equipped to cope with the quickly changing landscape. In the equity investments, the US has been increased as they lagged over the first quarter. A new European equity holding has replaced another one previously held as a more mid cap bias makes sense in the context of political uncertainty."

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“My children are not always that sure about the main course at dinner time but always ask for more once we get on to puddings. I retort that ‘you can have too much of a good thing’. In the last few months we, as investors, have had too much of a good thing. Markets have risen strongly and while in the short term this might feel good, this is really just taking away from returns in the future. March has been pretty dull in both in an absolute terms and looking at the relative returns but as investors we should celebrate the tortoise like progress that has been made.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“BlackRock European Diversified Equity Absolute Return is a systematic market neutral equity hedge fund investing in European markets. The fund struggled during 2016, posting double digit negative returns. We have had an active dialogue with the investment manager to build trust in this modern investment toolbox. We understand the market has created volatility, focusing on market leadership rotations, above this fund’s hunting ground. After thorough analysis of the fund and the likelihood of the market to behave differently, our decision is to keep the fund.”