Team and track record paramount in private equity

Private equity may have fallen out of favour in recent times, but investors with medium-term horizons can find attractive returns in the asset class, as long as they select managers with proven experience

The long-term and essentially illiquid nature of private equity, together with the wide dispersion of fund returns over the past decade, makes the process of selecting the right fund manager a critical consideration.

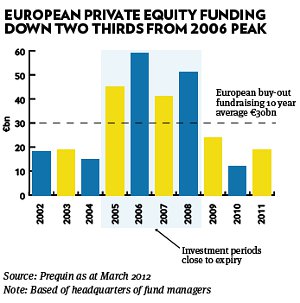

Despite some managers generating excellent superior, steady, albeit long-term, returns in recent years, private equity, like other long-term less liquid alternative asset classes, has fallen out of favour. Shorter investor horizons, general de-risking, risk aversion and a clamour for sustainable income streams – which private equity funds do not deliver – have all served to undermine private equities’ investment attractions.

For the asset class itself, the troubled economic environment has delayed the transition to peak profitability anticipated by managers at the time investments were made, while hostile and volatile markets and some high profile IPO flops have provided a difficult backdrop for private equity exits and trade sales. This has meant the average gestation period for private equity has extended up to three to five years. Declining investment sentiment is reflected in the difficulty managers are experiencing attracting new funds and in a widening of the discount to net assets in public closed end investment trusts.

Yet, for patient and disciplined investors with medium-term investment horizons, now is a good time to bed down new private equity investments. Investments made during recessionary times when the asset is most unloved have historically generated the most profitable medium-term returns. This is because when capital is scarce, investment returns tend to be attractive. Private equity investors provide an important source of capital and liquidity for expanding companies and innovative entrepreneurs.

For investors, the benefit of private equity investment has been attractive long-term returns relative to other assets, which can be expected to outperform public markets over the long-term. Correlation with public markets has now increased with the adoption of the fair market value accounting standard.

It is in the nature of private equity that not all ventures will prove successful. In a portfolio of 10 to 20 holdings, some investments will fail, others more than double or treble, and perhaps one or two will provide a 10 x jackpot. Most managers target a 2-3 x multiple for a diversified fund over eight to 12 years life giving 15-20 per cent IRRs (internal rate of return) after fees.

Manager selection

It is important to select talented managers with proven experience, preferably over more than two business cycles. Picking successful managers is an art, not a science. However, an experienced team who have worked together through different market cycles and yet achieved consistent results with a disciplined portfolio construction process is important.

The best managers combine first-hand knowledge of their chosen sector with an acute understanding of the challenges facing entrepreneurs growing businesses. Due to the higher-risk nature of private equity, not all companies that look good at the outset are actually successful to fruition; the manager must therefore utilise his or her understanding of the sector to be able to locate more winners than losers. Ideally, managers should also add value as trusted advisors or non-executives over the life of the investment and thereby actively contribute to the companies’ growth and evolution.

Timing instincts are important too, particularly with respect to knowing how long a company will take to develop and when the appropriate time will be for a trade sale or flotation. A good manager must be able to balance the trade-off between exiting an investment early – and perhaps not fully exploiting the opportunity – with risking a potential dilution of value by exiting too late.

In the absence of reliable benchmarks for the private equity industry, it is advisable to look at the continuing performance of like funds with the same maturity profile. It is also important to consider the performance of public equity funds on the grounds that locking capital away for a period of 10 or 12 years justifiably demands handsome rewards.

Lastly, being results focused and knowing the importance of being patient and not investing capital quickly is also a key ingredient. There is much truth in the old cliché that a poor manager in a good market frequently does less well than a good manager in a tough market.

Dan Briggs is chief investment officer at Fleming Family & Partners