Take care, not all private equity managers were created equal

The difference in performance between private equity managers is much greater than in public markets, so investors must choose wisely before committing to what tend to be long-term relationships

Private equity, which entails an ownership stake in privately held companies, is becoming a strategic asset class within portfolios of high net worth investors (HNWIs).

Generally, these types of investments entail greater risk than public market securities and are less liquid, given the longer investment horizon required. Historically, qualified investors who can tolerate these characteristics have been rewarded over time, as private equity has been able to meaningfully outperform public equity markets over longer periods. Critical to delivering attractive performance, however, is an ability to identify and obtain access to top-performing private equity managers.

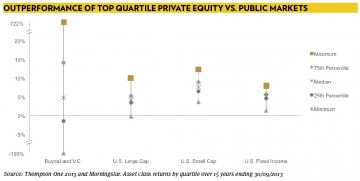

While the primary benefit of investing in private equity is the potential for higher absolute returns, not all managers are alike. In fact, dispersion among private equity managers is significantly greater than in the public markets. As illustrated below, the dispersion between the top-quartile managers and bottom-quartile is nearly 20 per cent. Unlike a mutual fund with daily liquidity, a private equity investor must commit for a long time period, typically seven to 10 years, and sometimes even longer. As a result, it is critical to select strong managers. While the investment industry cautions investors that prior performance is not a guarantee of future results, past performance can be predictive of future returns in private equity. It is important to be able to have access to and identify those managers who can deliver top-quartile performance consistently over time.

A significant difference between public and private markets is the lack of available data and information. The general lack of transparency within this asset class greatly challenges investors’ ability to identify the best private equity managers. Firms that have a dedicated team of investment professionals, who can leverage a network of long-standing industry relationships and uncover new managers through complementary businesses, will be more successful at identifying a pool of potential managers. Once managers are identified, prior performance is typically the starting point for the due diligence process.

While every potential investor will have his or her own due diligence process, detailed information is essential in determining whether top-quartile performance is repeatable. Investors must continually evaluate fund managers to ensure their strategy and investment professionals remain well positioned in the current environment. In terms of fund specifics, consider whether the characteristics, including the economic incentives, investment size, philosophy, industry, geography and opportunity set are similar.

When evaluating the investment professionals and management team, assess whether they demonstrate they can improve, grow and build a business given their particular strategy and target market. Often a more active management approach can be required to streamline existing processes, improve efficiency, expand a business, introduce innovation and create value. These active decisions influence the outcome of their investments and thus, experience within a similar industry or business often proves valuable. If these conditions are similar to those present when a previous fund outperformed, there is a greater chance of replicating that performance.

While investors can invest directly in a single private equity fund, most HNWIs opt for a fund-of-funds approach that provides a well-balanced portfolio and access to top managers. Portfolio construction through fund-of-funds enables investors to participate in the potentially attractive returns of the asset class while minimizing downside risk. The portfolio of funds provides investors with a wider range of underlying private equity partnerships and broader diversification across a range of strategies, industry sectors and geographic regions.

Fund-of-funds often have a lower investment minimum than direct investments. Because of the long-term nature of private equity investments, economic conditions can vary during the course of an investment. Since no one can predict the market, it is prudent to invest across a complete business cycle with investment in several vintage years in order to diversify one’s risk and potential returns.

Private equity is a unique asset class because of its illiquid nature and long-term investment horizon. As such, active decisions about which combination of managers to invest in can have a lasting impact on investment results.

Leo Grohowski, chief investment officer, BNY Mellon Wealth Management