Private banks prepare for the biggest wealth transfer in history

Josef Stadler, UBS

Over the next 20 years the world will witness the largest ever transfer of billionaire wealth. This will create huge opportunities for private banks, but also poses big challenges for the wealth management industry

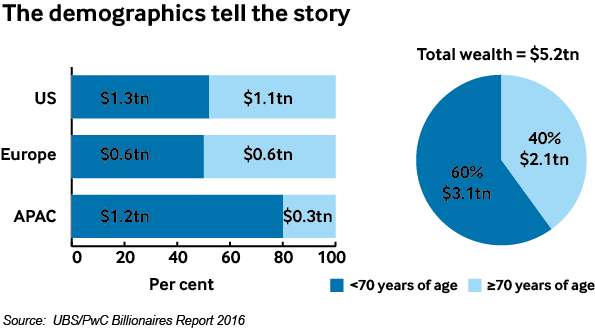

Private banks have a once in a lifetime opportunity to assist billionaire clients with their succession plans, as the upcoming largest-ever wealth transfer will see less than 500 people hand more than $2.1tn – a figure equivalent to India’s GDP – to their heirs in the next 20 years.

After two decades of exceptional wealth creation, this unprecedented transfer of wealth is the result of two major converging trends, according to the latest annual UBS/PwC Billionaires report.

The ageing of ultra-rich baby boomers, the majority of whom are more than 70 years old, coincides with the first-ever handover of billionaire wealth for most of Asia’s young economies – where more than 85 per cent of billionaires are first generation.

Short-lived wealth

But billionaire wealth is often short-lived, mainly due to business risk and dilution. Around 70 per cent of the billionaire fortunes that have fallen below the billion-dollar mark since 1995 have not remained intact beyond the first generation, and a further 20 per cent were gone by the end of the second, according to the report.

There is only one region, Europe, which stands out as the home of multi-generational billionaires. Germany and Switzerland, in particular, are the countries with the greatest share of ‘old’ wealth.

“The way European billionaire families transfer their wealth could be a role model for the rest of the world,” believes Josef Stadler, head of global UHNW at UBS Wealth Management. The bank serves more than 60 per cent of global billionaires.

Long-lasting families tend to have a “healthy” proportion of their assets invested in operating units, with a clear view on business continuity, a common philosophy and understanding of their purpose and values, whether formally articulated in a family charter or informally communicated. Also, they start planning for succession at an early stage.

“Families that have a big business should think about succession planning when they are aged 50 to 55, at the latest,” says Mr Stadler.

Time for a change?

However, this huge transfer of wealth also poses big challenges for wealth managers, as the majority of new cohorts replace their parents’ financial advisers.

Banks are still perceived as a safe place to keep money. But millennials, in particular, who are digitally active, conscious and demanding, are setting new expectations for the investment market and do not trust banks’ advice and products.

Stats from the UBS/PwC Billionaires Report 2016

- The total number of billionaires in the world rose by 50 to 1,397 in 2015.

- Total billionaire wealth fell by $300bn to $5.1tn. Average wealth fell from $4bn in 2014 to $3.7bn in 2015

- The fall was driven by transfer of assets within families, commodity price deflation and appreciating US dollar, impacting non-dollar assets

- Asia - led by China - created one billionaire every three days, accounting for more than half of new billionaires in 2015. Wealth creation continues in the US, but is slowing

- Europe has the greatest number of multigenerational billionaires at 182 (54%), the US has 175 and Apac 76

That UBS, the world’s largest private bank, will be launching a robo-advice service in the UK during November, to attract self-directed younger clients – the potential ultra-wealthy of the future – is a clear sign that even traditional institutions must keep up with the times. This move signifies a clear break from the bank’s tradition of secretive, behind closed-doors conversations.

The minimum investment for users of the new platform, UBS SmartWealth, is just £15,000 ($16,600), a fraction of the £2m usually required to open a UBS private bank account.

The bank – whose labs in Singapore, Zurich and London actively research new technologies and innovations – has plans to extend its robo-advice service globally, moving into Europe and Asia in 2017.

“Technology is changing the way financial services are delivered,” says Dirk Klee, COO of UBS Wealth Management. “The launch of UBS SmartWealth shows that digital innovation is not the sole reserve of start-ups.”

It may be true that “Generation X would rather go to the dentist than to a banker, and all want digital,” says Mr Stadler, referring to the bank’s market research findings.

“But when it comes to managing big fortunes, strategic advice, M&A or succession planning, clients want a face-to-face discussion with their trusted advisers and digitisation matters less. What matters is the human factor, and that will never go away,” he states.

In order to retain clients and be “relevant” to them, particularly in the delicate phase of wealth transfer, private banks need to have a global presence and adopt a holistic approach. This includes meeting clients’ needs for their business, managing key risks of generational wealth transfer and catering to clients’ passions, by offering for example philanthropy services.

“Investment performance is important, but not the most important factor,” says Mr Stadler. Adapting investment advice to meet millennials’ strong demand for sustainable and impact investing is also critical, he states.

“Billionaires have their wealth distributed across multiple advisers, and what sets an adviser apart from others is that word ‘holistic’, their ability of looking at the ‘health’ of wealth,” says Michael Spellacy, partner and global wealth leader at PwC US.

“That trusted role may or may not give that wealth adviser a greater share of their money, but it becomes very important in the billionaire preservation and transfer of wealth.”