Fund flows reflect rising client demand for responsible solutions

Cameron Falconer, Aviva

The fund management industry has taken investor interest in ESG seriously, although a lack of standards can make selection difficult

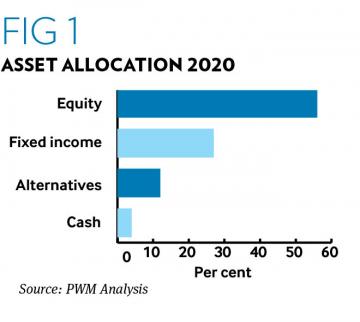

Fund managers’ approach to sustainability, as well as transparency and reporting around their investment processes are increasingly driving fund selection decisions, as partly shown by findings from PWM’s annual analysis of fund flows over the past 12 months from our panel of asset allocators (see tables below).

This attitude reflects rising client demand for sustainable solutions and growing awareness of a correlation between ESG materiality and financial performance. Yet the risk of greenwashing, improvable data quality, and lack of industry standards make selecting sustainable funds a challenging task.

“ESG considerations are vital,” says Richard Troue, fund manager at Hargreaves Lansdown, the UK’s largest investment platform with more than £100bn ($134bn) in AuM.

“This is not to say that we expect fund managers to count out entire sectors or exclude large parts of their investment universe purely on ESG grounds, but we do expect them to seek out businesses that can endure and prosper.”

Companies that are not well run, and which disregard environmental and social factors, put themselves at unnecessary risk, whether it be from damage to reputation, falling foul of regulators, or simply not future proofing the business, adds Mr Troue.

Increased focus on sustainability may not always manifest itself in the selection of ESG labelled funds, though.

The fund managers which Mr Troue selects for PWM’s ‘fairly conservative client with a balanced strategy’ consider ESG as part of their process, but none are run with a specific ESG mandate.

The challenge is in ensuring ESG is taken seriously across the board, but without putting long-term performance and diversification in jeopardy, says Mr Troue.

Discussions around the integration of ESG factors into the investment process are generally part of the qualitative assessment of an investment strategy.

“Given the emerging and differentiated approaches to ESG, we find taking a more qualitative approach helps us form a more complete picture of what good integration looks like,” explains Cameron Falconer, senior manager research analyst at Aviva Investors.

“However, we rely heavily on quantitative tools and data sets to drive our conversations with managers, with the aim of understanding how truly aligned a fund is to its promised ESG approach or sustainability objectives.”

At the very minimum, managers must assess ESG materiality as a form of risk management, explains Mr Falconer, although increasingly managers have started considering ESG as a lens from which to view new investment opportunities.

Climate risk remains front of mind for investors, and the threat that global warming poses to companies is something fund managers can no longer ignore when building portfolios.

“If anything, Covid-19 has served as a warm-up act for climate change, which will inevitably be a more costly and technical problem to solve,” says Mr Falconer. Adaptation and mitigation will challenge existing business models through increased regulatory burden, changing customer preference and costs associated with direct and indirect impacts on business operations.

“We need to ensure managers are considering these consequential developments when making investment decisions,” he says. The “more astute” managers will be the ones finding new opportunities arising from these challenges in areas such as clean energy, carbon capture and electric vehicles.

While ESG risk scores, Co2 emissions and climate scenarios are now an integral part of due diligence, the costs of transition to a greener economy, or transition risk, may have an impact on returns too, points out Giovanni Becchere, head of portfolio management at ABN Amro Investment Solutions, the multi-management centre of expertise of ABN Amro Bank.

“For instance, fossil fuels are increasingly becoming stranded assets. This is one of the reasons why the managers we select increasingly exclude such activities,” he explains.

Fund managers’ approach to sustainability will become “increasingly important” at Kleinwort Hambros, as the UK bank, part of Société Générale, plans to incorporate sustainability considerations into its wider investment offering, having launched its responsible investing strategy over the past 12 months.

The biggest challenge is to find suitable funds in the alternative space, as many strategies “may not continue to function with the extra constraints imposed”, says Paul Hookway, senior fund analyst at Kleinwort Hambros.

“Our data suggest that companies with the highest or improving ESG scores outperform those that do not, and we rely on their managers to select and identify best performing companies,” he says.

Social and governance aspects are important drivers of corporate performance too. For instance, underlying companies that employ diverse staff enjoy 2.3 times higher cash flow per employee, according to strategic consulting firm Bersin by Deloitte.

Indeed, evidence shows diverse teams perform better in all areas of life, including investment management, all factors being equal. In an industry still heavily dominated by white male fund managers, this remains an unfulfilled ambition in many cases.

“When selecting managers, we take ESG considerations into account, including governance and social aspects, such as inclusion and minorities representation,” explains Ian Crispo, global head of hedge fund and mutual fund selection for Deutsche Bank Wealth Management.

This means engaging actively with asset managers to understand how they address these issues and what type of measures they have taken to increase diversity, which is “one of the tenets of investment success,” adds Mr Crispo.

The biggest benefit is diversity of ideas and viewpoints. “The more diverse teams are, the more different the perspectives, approaches and angles they bring to the table. This results in greater performance and robustness of asset managers’ investment processes and decision making,” he says, describing his fund selection team as very diverse by race, gender, nationality, culture and origins.

The more complex the asset class and the type of investments, the more evident the benefits, he states, pointing out that active managers benefit from diversity more than passive strategies such as ETFs.

Challenges

The growth of ESG-data driven assets is impressive, according to analysis by research firm Opimas, having doubled to $40tn over the past four years. European ESG funds may even outstrip conventional strategies by 2025, according to PWC forecasts, as they are set to reach between €5.5tn ($6.7tn) and €7.6tn by 2025, comprising between 41 per cent and 57 per cent of total mutual fund assets in Europe. This is up from 15.1 per cent at end-2019.

“With such staggering growth of funds in the sustainable space, the challenge of greenwashing has really come to the forefront,” says Aviva Investors’ Mr Falconer. “We spend a lot of time trying to untangle often slick marketing collateral from the actual investment proposition.”

One of the strongest indicators of commitment to sustainability can be found within a firm’s culture, he adds. “When senior leaders help drive the sustainability agenda we tend to see more honest and open conversations occurring around ESG at the fund management level.”

Despite huge client interest in sustainable investing, it is hard to find sustainable funds with long track records and stable teams and processes, reports ABN Amro’s Mr Becchere.

“We have seen many sustainable funds change their approach or teams, or even completely abandon sustainable investing over the years. In that sense, it is a relatively young asset class, making it challenging to properly assess a team’s investment skill over a full market cycle,” says Mr Becchere. His firm started selecting these solutions in the 2000s.

“Going forward, we may see a ‘war for talent’ in which asset managers compete for investment teams with existing, multi-year track records. That will cause an additional challenge for fund selectors,” he maintains.

While the inclusion of ESG data in fund databases has made it possible to systematically screen fund databases by ESG characteristics, the next step is to apply ESG screens for idea generation. But there are still many hurdles, explains Mr Becchere, notably around quality and accuracy of ESG data and certainly outside large caps and developed markets. The firm is still expanding its offering of sustainable solutions, aiming to offer clients funds ranging from ‘financial first’ to ‘impact first’ investments.

The multimanager investments team at Eurizon Capital, the asset management arm of Italian heavyweight Intesa Sanpaolo Group, started interrogating fund houses around their ESG approach only last year. This factor will become “a must” in the next two years, not only for all European fund houses, but also for all the other fund houses that aim at selling their products in Europe, believes Silvia Tenconi, portfolio manager and fund analyst, multimanager investments & unit linked at the firm.

Today, more than 90 per cent of funds in the multimanager team’s buy list integrate ESG analysis in their investment process. “The real issue is that a common playing field is still not available, and only with proper due diligence you can understand if it is greenwashing or real ESG integration,” adds Ms Tenconi.

In some asset classes, selecting sustainable solutions is particularly challenging. This is the case of funds in the government bond space, as there is little and not homogenous analysis in this space.

A well-designed ESG analysis can help fund managers better understand idiosyncratic risk and in the long run can add value by avoiding risky businesses, adds Gaia Resnati, portfolio manager and fund analyst at Eurizon Capital.

This was one of the reasons that drove the Italian firm to integrate ESG factors into its investment process three years ago, launching more than 50 sustainable funds since then.

Measuring the impact funds generate on the environment and society is one of the greatest problems, since there is no standardised methodology, adds Ms Resnati. “Many providers rate the same company in very different ways, making it very difficult to compare different funds consistently. And many companies are not rated, since it is a costly analysis.”

Growth drivers

An important growth driver for sustainable investing is regulation. In the EU, the Sustainable Finance Disclosure Regulation (SFDR), due to come into effect in March 2021, will require financial advisers to discuss and document all clients’ attitudes and preferences towards sustainable investing, and is expected to greatly increase client demand.

Some firms have anticipated regulatory requirements. Nordea introduced sustainability discussions with clients a couple of years ago. “Sustainability has been an integral part of our conversation with customers; we ask them about their ESG preferences and offer sustainable portfolio solutions, which are aligned with our asset allocation strategy,” says Kerstin Lysholm, head of investments at Nordea Wealth Management.

This new approach has generated an increased demand for “high sustainability level” products, which have risk/return characteristics aligned with traditional asset allocation strategies. The new disclosure regulation will contribute to generate increased demand for products that can be used as building blocks in ESG focused portfolios too, believes Ms Lysholm.

SFDR imposes new transparency obligations and periodic reporting requirements on asset management firms too, at both a product and manager level. While increased transparency is needed, fund managers have their reservations.

“Even though we welcome more clarity towards investors and to avoid ‘greenwashing’, there is always the risk of over regulation,” comments ABN Amro’s Mr Becchere. “The requirement to report on concrete ESG targets will be beneficial for data providers, but at the same time will mean increasing costs for asset managers.”

Funds benefit from ESG focus

Increased interest in sustainability may explain a few notable changes in PWM’s league tables of brands and funds from our panel of fund selectors. These include fund platforms acting as gatekeepers to banking and asset management groups managing more than $4tn of client assets.

Among the 90 third party brands selected by our panel, for the first year since PWM analysis started six years ago the top spot has been taken by Wellington Management, the Boston-headquartered investment management firm with more than $1tn in assets under management.

Leveraging its dedicated ESG research team, and its 50 plus global industry analysts who engage with companies on ESG issues, the firm integrates ESG factors in many of its funds and portfolios, while also offering impact funds focused on generating positive, measurable impact.

Its core US Equity Research Fund ranks first in PWM’s league table for the second consecutive year, being appreciated for its sector neutral approach, with distributors recognising the value of the firm’s research engine, which is at the base of the firm’s investment process in all its portfolios.

BlackRock and its family of ETFs, iShares, the world’s largest asset manager and world’s largest provider of ETFs respectively, feature in second and third position. Despite both firms having an extremely wide range of solutions, the products used by our asset allocators in PWM’s portfolio are only a handful. For BlackRock, these include three European funds, the continental flexible, the dynamic and absolute alpha fund strategies, as well as an emerging market debt solution. For iShares, the strategies that feature in our fund selectors’ portfolios are the S&P 500 ETF, both hedged and not hedged, and the continental Europe fund.

London-based investment management Hermes Investment Management features in PWM’s league table of top 10 asset management brands for the third consecutive year. It has a long history of embedding sustainability in investment processes, and is appreciated for its dedicated steward team and pure approach to impact investing, although it started distributing to wealth and multi-managers less than 10 years ago.

Among the 144 third-party funds selected by our asset allocators, sustainable labelled funds which have made it to the top 10 include AAF Parnassus US Sustainable Equities, the fund managed by Parnassus Investments on a sub-advisory basis for ABN Amro Investment Solutions. The firm, founded in 1984, is considered one of the sustainable pioneers in the US.