Not all plain sailing for Ucits funds

The Ucits brand faces increasing competition from onshore funds, as regulation remains the biggest threat

Over the past two decades, virtually all global asset management firms have launched Ucits-compliant funds for cross border distribution in Asia, in the ambitious attempt to build their business overnight in the fastest growing mutual fund market in the world.

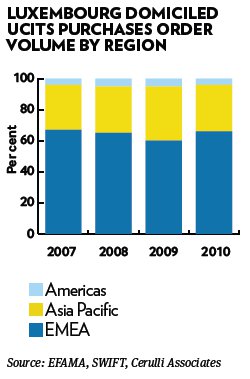

In 2008, a study by the European Fund and Asset Management Association found that 90 per cent of net sales of Luxembourg or Dublin domiciled Ucits funds were sourced from Asia, although more recent statistics have set the figure to a more realistic 35-40 per cent.

But, despite the fact that Ucits is widely recognised as an international brand, the share of Ucits funds of the total mutual fund assets in Asia is still very small, according to a recent study from Cerulli Associates.

The European brand faces increasing challenges as competition is fierce and it is taking place onshore. “The single biggest threat to international asset managers and Ucits is regulation,” said Shiv Taneja, managing director at Cerulli Associates, speaking at the recent Alfi Global Distribution conference in Luxembourg.

In some markets such as Hong Kong and Singapore, where Ucits penetration is high, regulators are grappling with how to handle the proliferation of products, especially with the introduction of structured funds and funds that use derivatives extensively. “This is especially challenging because after the GFC, there is increasing scepticism about financial innovation and the use of derivatives,” said Sally Wong, CEO at Hong Kong Investment Funds Association (HKIFA).

“It seems there is a general tendency to opt for something basic and plain vanilla and this generates an increasing gap between the development in the product space and the expectations of the community.”

In other markets, such as Taiwan, the success of offshore and Ucits products is driving local regulators to become more protective of their domestic industry. In China and India, arguably the countries with the highest wealth and asset management growth potential, cross border products have very little access: in China through the unpredictable and limited QDII scheme and in India under quota and feeder fund structures.

But in markets such as Malaysia, Thailand and the Philippines, they are impossible to sell. In Korea, where they have been permitted since 1996, Ucits can gain little traction against onshore competition, especially since a change in the tax law made offshore funds, which had enjoyed much success during the boom years of 2006-2007, less tax efficient than onshore domestic products.

Moreover, although for the last seven to eight years cross border products have increasingly drawn investors’ interest, absolute demand for domestic products remains very high. Asian investors have stronger currencies than the US dollar or the euro, they are investing in a region that has generated significantly higher returns than international markets, and it is understandable they do not want to invest cross border, argued Mr Taneja at Cerulli. This is also dependent on the market cycle.

“Building a business in emerging markets is a long-term prospect and going to Asia as if it was one country, one language, one people, one set of regulation and one set of cultural values is just fiction,” he said.

Managers tend to underestimate the importance of looking outside the hubs to launch and run local funds in Taiwan, Korea or India, although the decision to launch onshore funds also depends on the individual organisation, whether it is a big brand, with a substantial global retail footprint, and it is willing to invest heavily in marketing, advertising and promotion.

In other cases, especially in markets where access to the retail segment is not allowed, sub-advisory relationships or joint ventures have proved to be the successful model.

Asia is still a relatively small market – around 78 per cent of global assets under management is sourced from the US and Europe – and managers have got to look to exploit multiple opportunities simultaneously, said Mr Taneja. “There is also a degree of opportunism, because regulation changes so fast in Asia.”

Meanwhile, ongoing discussions on the potential implementation of an Asian funds passport, promoted by the Australian government, may be another threat to the Ucits brand.

Increasingly more Asian asset managers, such as Korea-headquartered Mirae Asset, are moving offshore and launching Ucits platforms. “Asian managers see the advantage of the Ucits platform as they want to be able to sell on a cross border basis in Asia, and then ultimately looking at tapping into Europe and Latin American markets,” observed Justin Ong, partner at PwC from Singapore, currently on a two year secondment in Luxembourg.

But the majority of local fund managers are still unable to sell throughout Asia. “The genesis of the Asian passport programme was really to try and help the local asset managers, particularly those who do not have international reach, to level the playing field, so they could sell their own fund products within their territories in Asia,” said Mr Ong.

“Ucits funds are really a one way street – international managers sell funds into Asia, but Asian funds can’t come across and they can’t even sell funds within Asia,” he said.

If there was ever going to be a Luxembourg or Dublin equivalent in Asia, that opportunity was 15 or 20 years ago, said Mr Taneja, when Hong Kong was the natural choice for a regional centre. After all, Luxembourg’s success derives from having a first mover advantage. Today the situation is different, as for the past 15 years every country in Asia has tried to become the regional centre.

On their side, international asset managers tend to be against the idea of an Asian passport system, partly because they would incur greater costs to recreate another platform and another product structure.

The tsunami of regulation hitting the European fund management industry is yet another challenge for the Ucits brand, as regulators in Asia are finding it increasingly difficult to keep up, even more than European regulators themselves.

Ms Wong at the HKIFA wants European counterparts to explain in depth the relevance of regulatory changes to Asian regulators and calls into question whether the Asian industry should have a greater say in the process, in view of the important fund sales in the region.

Debates on whether to split the Ucits brand into complex or non complex may also bring additional confusion to the market place. Questions arise on how to define these structures. The risk is that non complex products may be wrongly perceived as safe, in the common misconception that simplicity of structures is synonymous with less risk. This is also complicated by distributors’ poor education and knowledge on the products they sell.

But Ms Wong warned about the increasing expansion of Ucits products. “My personal view is that we need to rethink the value proposition provided by Ucits, whether it is not appropriate to brand it as one single product. Because in itself it has expanded so much that it has become a completely different animal and it is beyond comprehension not just to investors but to a lot of regulators.”

The Luxembourg funds industry is now back over the E2,000bn mark

Luxembourg's funds industry suffered a 25 per cent fall in assests during the financial crisis

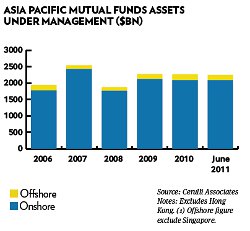

Driven by expanding middle class, new pools of insurance and retirement assets, assets under management in Asia ex Japan and Australia will double by 2015 to $4,000bn, according to forecasts by Cerulli Associates

Although mutual funds have seen their share of overall household wealth erode from 13.6 per cent in 2007 to just 8.4 per cent in 2010, they are projected to double to $2,178bn by 2015, according to Cerulli Associates