Global players find place for Africa on investment map

Africa’s economic growth is attracting global investors, while wealth managers are seeking business among its HNW population

These days, when we talk about emerging market growth in wealth management the conversation tends to focus on Asia, or possibly the Middle East and Latin America.

Africa, meanwhile, still remains the largely forgotten continent. But there is mounting evidence that global players are turning their attention towards Africa in a bid to harness investment opportunities, as well as the chance to connect with the region’s emerging wealthy.

This month, Bank of China (BoC) announced a strategic business partnership with South African firm Nedbank Group to increase business between China and Africa. The agreement will enable clients of BoC to invest in the continent through Nedbank’s regional network and may be symptomatic of a wider re-focus on investment opportunities in the southern continent.

Earlier this year, a representative of JP Morgan Asset Management commented that Africa is experiencing the largest growth in sovereign wealth funds with over 15 state funds having been set up or considered over the past two years. Nigeria, Africa’s largest producer of oil, inaugurated its $1bn (€750m) fund at the end of 2012, Angola set up a $5bn fund in October and Uganda has release plans to do the same.

And last year, Mark Mobius, executive chairman of Templeton’s Emerging Markets Group, openly stated his view that there may be as many as 200 African billionaires, who will be seeking to legitimise their wealth in a similar way to the state funds. These individuals have often built private conglomerates that they will seek to list in order to authenticate their holdings and to access capital for further expansion.

Sophisticated private investors are also increasingly deploying capital into the continent. For example, Investec Asset Management gained seed capital for its Africa Fixed Income Opportunities fund from UK-based multi-family office Fleming Family & Partners, which was attracted by the ‘high growth relative to other emerging markets, improving governance, and fiscal and monetary reforms’.

In addition to the asset management community, global wealth managers are also turning their attention to servicing the region’s emerging wealthy. According to the RBC-Capgemini World Wealth Report, Africa outperformed the global growth rate and the Asia Pacific growth rate for HNW population and wealth in 2012. The HNW population for Africa grew 9.9 per cent compared to 9.2 per cent globally and 9.4 per cent in Asia.

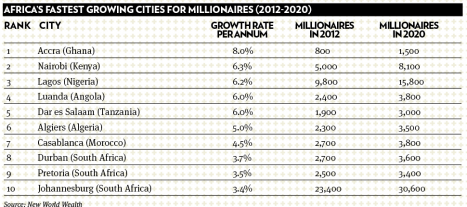

Other research, by New World Wealth, indicates that urban areas on the continent will be the hub for new wealth over the next decade. Perhaps surprisingly, the fastest growing city for millionaires is the Ghanaian capital of Accra.

Annie Catchpole is senior associate at wealth management think-tank Scorpio Partnership