Swiss moves over bank secrecy could go global

Switzerland’s suspension of secrecy laws suggests global cooperation over tax strategy is possible, but wealth managers need to raise their game if they are to guide clients through this new world

Switzerland’s cabinet is to take a motion to its parliament to temporarily suspend client secrecy laws in order to allow Swiss banks to co-operate with the US authorities and resolve the long-running disputes over tax evasion.

The one-year suspension of the banking secrecy law will allow individual Swiss institutions to assist the Department of Justice (DoJ) with its enquiries and settle accounts.

Following the decision made by UBS in 2009 to rid itself of civil and criminal charges relating to tax evasion, Swiss banking institutions and the Swiss government have been under increasing pressure. Yet, the bank secrecy laws have left the country in legal limbo – banks have been unable to respond to tax enquiries and the government has been unable to change the law or negotiate alternative arrangements.

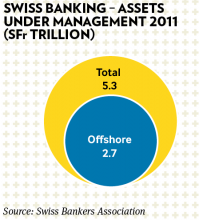

The pressure has proved so great that many firms have withdrawn offshore banking services to American citizens as the US government has attempted to force Swiss banks to compensate it for hiding taxable wealth from the taxman. All the while, the confidence of clients in Swiss banking has been eroding and the industry has paid a hefty price.

Welcome news

This temporary suspension should therefore be seen as welcome news. It will apply to all institutions with American interests, not just the private banks the DoJ is known to be tracking actively. In exchange for paying fines and, where required, providing information about the services offered, banks will be safe from prosecutions.

To be clear, the suspension will not extend to client data, including account information. Instead, banks will be able to share information about the nature of their relationships with their US clients; thus allowing the DoJ to investigate further under the existing double-tax treaty. Moreover, any banks that choose to cooperate with the DoJ will be required by the Swiss government to protect their employees.

This approach may well prove to be a simpler way for Switzerland’s banks to clear up the problem of undeclared assets than the other routes that have been explored in recent years, such as the Rubik agreements, which were fraught with political difficulties.

Indeed, in a similar vein, the European Union’s finance ministers last month also agreed a mandate to negotiate a tax accord with Switzerland. The accord will also revise current tax sharing rules and create an anti-avoidance initiative.

These moves flag that governments are increasingly drawing together elements of a global tax strategy. And, if this is how such cooperation will play out, then the message is clear: regardless of the individual tax codes and legal processes of individual countries, global authorities will expect their citizens to pay a fair rate of tax.

Moreover, the Swiss government’s move may well set a global precedent and other centres may follow suit in terms of co-operation with US authorities and others.

Overall, such moves should be welcomed, as they help to eliminate some of the perversities that exist across various tax codes. However, it is now incumbent on the wealth industry to consider its position in light of this enhanced co-operation. After all, it moves the great tax debate into uncharted waters, where there becomes a marked distinction between the letter of the law and its spirit.

Rise to the challenge

The challenge for wealth managers is that this, in turn, introduces an element of judgement into how they manage the tax affairs of their clients and errors in that judgement are inevitable.

Such risks can only be minimised through enhanced engagement with policymakers and taxation authorities to ensure the issues on both sides are understood and to achieve a common understanding of how such “fairness” can be achieved when it comes to the complex affairs of the world’s wealthy.

The problem for the global industry is that its own mechanisms for such complex negotiations are fragmented and the industry itself has long avoided a proactive position on these issues. But, the sands are shifting and clients will expect to rely on the expertise of their advisers to guide them through this changing topography. A considered course of action is required.

James Horrax is senior associate at wealth management think-tank Scorpio Partnership