Luxembourg seeking new markets to stay ahead of rivals

Charles Muller, Alfi

Alfi's Charles Muller discusses Luxembourg's growing Islamic investments industry and moves promoting Ucits products to Asia

Ever since the Grand Duchy of Luxembourg stepped ahead of its competitors and shaped itself as Europe’s capital of Eurobond issuance in the 1960s, the tiny country bordered by Belgium, France and Germany has continued to re-invent itself.

Luxembourg enjoyed a successful decade in the 1990s, as Europe’s premier location for domiciling and operating cross-border mutual funds under the Ucits regulatory umbrella, now boasting 76 per cent of funds which can be distributed in at least three countries. The latest niche being carved out by the state’s product strategists is that of an Islamic funds centre.

As always, the country’s legislators and promoters have one eye on fiscal requirements. “One of the key ingredients in our legislation for Islamic investments is certainty of how these products are taxed or not taxed,” says Charles Muller, deputy director general of Alfi, the Association of the Luxembourg Fund Industry.

“We are now the biggest Islamic funds centre outside the Muslim world, but it is still early days,” says Mr Muller, aware that his country’s Islamic assets are dwarfed by products domiciled in Saudi Arabia and Malaysia. But Luxembourg has been there before in building up profitable businesses from a standing start, and he knows that once there is a strategy for growth, backed by a supportive financial services industry, you are on the road to success.

“We are not yet experiencing outstanding amounts of net inflows into Islamic funds, but it will be a niche for us,” he adds.

Already, Mr Muller’s staff have accompanied the Duchy’s Grand Duke and Prime Minister on industry roadshows to Saudi Arabia, Qatar and Lebanon. “We are presenting ourselves constantly in the Middle Eastern region, and if we have the means, we will consider opening an office there,” he says.

Alfi opened an office in Hong Kong in November last year, to establish a beachhead for importing Ucits-regulated products into Asia’s fast growing investment field, which is hungry for reputable, quality-controlled funds after Lehman-led product collapses.

“At the moment, there is no real competition for Ucits products in Asia,” believes Mr Muller. “But due to the crisis, Asian regulators are looking more closely at Ucits funds that arrive there,” with some concerns about high-risk strategies being distributed to retail investors.

“They are not saying no, but they are asking more questions,” states Mr Muller, who studied law in both Paris and London before practicing in Luxembourg and holding several senior positions at Banque Générale du Luxembourg, recently absorbed by French bank BNP Paribas.

“As soon a fund uses derivatives, there is a competence test for the retail customer, to see if he understands what he is buying and what the risks are.”

Industry bodies such as Alfi are often criticised for being aloof and divorced from consumer needs, but Mr Muller goes back to the first principles of protecting those customers who lost money in disasters and scandals, triggered by the likes of Lehman and Madoff.

“Lehman minibonds were sold as if they were equivalent to a bank deposit,” he ventures. “Those who bought them were surprised when their money was gone. There has been some compensation, but not everything. There are ongoing demonstrations in Hong Kong outside the regulator’s building. Obviously, this Ucits discussion comes from that crisis.”

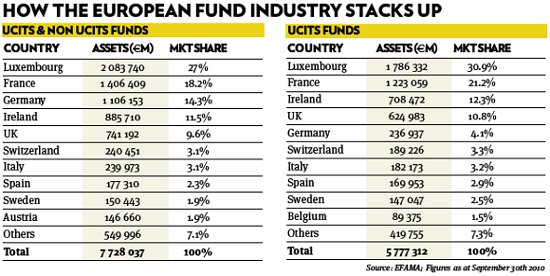

Currently the Asian region, including hotspots in Australia, China, Taiwan and Singapore, is one of the key drivers of Luxembourg’s funds industry, which has reported assets back over the €2,000bn mark and hitting an all time high after a low-point of €1,550bn followed a 25 per cent fall during the 2008 crisis. Alfi is likely to open another regional office in either the Middle East or Latin America to achieve its ambitions. Chilean, Columbian, Peruvian and Brazilian institutions are fast opening up to the notion of investing in Luxembourg-regulated Ucits funds.

Roadshows held in London and New York have drawn many questions from practitioners about regulations, particularly about how to handle Europe’s forthcoming Alternative Investment Fund Managers Directive (AIFMD). This controversial piece of legislation threatens to shape the next 20 years of the world’s funds industry in the same way as Ucits fashioned the last two decades, though perhaps without the same consensus.

New, fiscally-led regulations which came in at the beginning of this year were designed to attract expatriate fund managers wishing to be regulated in Europe under AIFMD into Luxembourg, by allowing relocation costs to be tax deductable.

Although Luxembourg has achieved much of its success as a cross-border funds centre through exploiting the Ucits directive, 1,136 new private equity, real estate and hedge funds have flocked to the country since 2007, when a new regulatory regime which approximates the forthcoming European directive was introduced. “The sentiment that sometimes exists that we are just a Ucits centre is wrong. There are €300bn of non Ucits funds in Luxembourg,” says Mr Muller.

Yet, like elsewhere, there are gripes in the Duchy about the way the directive was cobbled together, apparently as a mistaken response to the 2008 crisis, although Alfi now sees the regime as a workable one, particularly if it is swiftly harmonised with existing Ucits requirements.

One of the key measures will be liability of depositary banks for the assets they are expected to keep in safe custody. This is a thorny issue here, with several court cases regarding liability of Luxembourg service providers to funds that invested with Madoff still pending.

Mr Muller accepts depositary banks need to take greater responsibility than previously for assets in their custody, and that “the number of events where the depositary banks can pass on their liability will be reduced.”

The big change, he says, will be the reverse burden of proof, with a Luxembourg-based custodian now having to prove that it did everything in its power to hold the assets in its safe custody, should anything go wrong.

Yet despite Alfi’s pride in predicting trends, it was not ready for the surge of interest in so-called ‘newcits’ or ‘hedge funds lite’, for which traditional domiciliation battle-lines with old foe Dublin have once more been redrawn.

“When discussions started about AIFMD, traditional hedge fund managers became afraid and started to consider what they could do under the 20-year-old framework of Ucits,” says Mr Muller.

“This followed a move from classical fund managers towards the hedge funds space. This revolution was not foreseen by us or by lawmakers at European level. Nobody realised just how far you could go under Ucits.”

COMPANIES IN PROFIT

So causes the economic burden to shift to the withholding agent itself and, in some cases, the

To avoid the withholding taxes imposed under the Fatca provisions, foreign financial institutions must agree to provide significant and detailed information to the IRS regarding their US clients and withhold a 30% tax on any pass-through payments from their own ‘recalcitrant account-holders’ (those who fail to comply with reasonable requests.