Domestic demand drives Eastern Europe’s recovery

Growth in the CEE region is being driven by a combination of domestic demand and investments from external sources, increasing its resilience, although worries remain about Turkey and Russia in particular

Last year, investments in Central and Eastern Europe (CEE) turned a corner. Positive signs of recovery based on improved business and consumer sentiment, as well as increasing domestic demand, have helped investments to pick up in almost all CEE countries.

A good mix of revived domestic demand and increased investments will be the pulling forces of growth for CEE economies in 2015.

Poland and Hungary already have higher levels of investment versus 2008. It is mainly domestic savings and EU transfers which are in the driving seat of financing investments, while foreign direct investments are becoming less important for CEE.

Combined with improved consumer sentiment in the region, CEE growth is not solely export-driven. This increases the resilience of GDP growth in the region against potentially worsening external demand.

The eurozone economy has now gained some speed as well. The bond purchase programme by the European Central Bank is in full swing. Additional liquidity flows into the global financial markets and supports the prices of numerous asset classes. Erste Group expects euro corporate bonds and high-yield bonds – also in CEE – to continue putting in a moderately positive performance and we remain cautiously positive about global equities. Potential can be seen particularly in the European markets. However, volatility might increase, and temporary corrections cannot be ruled out.

The unemployment rate and inflation are likely to only justify a first rate hike by the ECB in 2017. Given the very diverse set-up of the global economic recovery, a balanced portfolio – a mixture of equities, which are positive in a growth scenario, and bonds which are positive in a stagnation scenario – is more important than ever. There are still interesting possibilities for investors to build up wealth even in a difficult environment and we believe investments in the CEE bond and equity market will contribute in a positive way to investors’ portfolio performance.

CEE bond markets currently show the following characteristics: real economic growth in the CEE region is moderate to solid, with the exception of Russia. The economic improvement in the eurozone helps. Inflation rates are low and still falling, with the exception of Russia and Turkey. The latter are in real trouble, with a high current account deficit in Turkey, plus increased political risk premium and capital flight in Russia.

With the exception of the rouble and Turkish lira, currencies are relatively stable. Low inflation supports bonds in many CEE countries. An important premise for the region is the assumption there will be no further escalation of tensions between Ukraine and Russia.

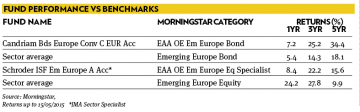

Our current investment recommendation for those looking to participate in the CEE bond market is the Candriam Bds Euro Convergence Investment fund, whose top investments are in Hungary, Poland and Turkey. Since all our clients are familiar with the region, do business and spend most of their time there, we recommend they also cover their asset allocation to emerging market bonds through CEE.

We continue to be positive on the CEE equity markets category in Austria as well as in Hungary and the Czech Republic. In particular, Hungary has a rich valuation, nicely reflecting its earnings growth momentum. Poland is our bet, seeing the potential for finally translating its superior macro story into a re-rating of earnings. We are neutral on Turkey, with some upside risk.

Valuation/growth is not clearly heading in any particular direction and headlines might continue to run the market. Russia and Greece remain widely speculative issues, while Russia might have used most of its immediate bottoming out potential. We remain cautious on smaller markets, due to size concerns, even though earnings growth momentum is showing a positive trend in Croatia and Romania.

Erste’s current recommendation for investments in CEE equities is the Schroder ISF Emerging Europe fund with top holdings in Russia, Turkey and Poland. The fund puts its focus on defensive large caps, mainly in the sectors of energy, basic materials, financial services (Akbank) and consumer defensive (Lukoil, Norilsk Nickel).

Peter Ipkovich, Head of Private Banking CEE of Erste Group Bank AG