Bright spots remain despite gloomy European outlook

Deflationary pressures, political issues, slowing growth and international trade wars are all buffeting European companies, yet opportunities can be found

Faced by slowing growth and low inflation, in late July, the European Central Bank gave a clear signal that it intends to join the US Federal Reserve in enacting looser monetary policy in an effort to rejuvenate its economy.

Outgoing president Mario Draghi, who will be replaced by Christine Lagarde in October, said the economic outlook was getting “worse and worse” and paved the way for a cut in interest rates in September and further quantitative easing.

False comfort

The market has been comforted by the expectation that central bankers stand ready to provide more liquidity to keep the long economic cycle going, says Sam Morse, manager of Fidelity European Values Trust.

“Investors have seen this before and know that increased liquidity buoys all asset markets, including continental European equities, even if the benefit to the global economy is more questionable,” he explains.

Yet there is a risk that investors will be disappointed by the scale of monetary easing in the months ahead. “Or perhaps, the greater risk is that easier policy fails to kick-start global economic and corporate earnings growth.”

His strategy is to focus on attractively-valued companies which are able to sustain consistent dividend growth, but notes that the challenge of finding companies that meet both of those conditions has led to a reduction in the number of names in his portfolio.

“This suggests that the stock markets of continental Europe may be due a more difficult period ahead,” warns Mr Morse.

The medium-term economic outlook in Europe should improve thanks to fiscal easing and more ECB support, believes Fahad Kamal, chief market strategist at Kleinwort Hambros, while any stabilisation of the Chinese economy should also filter through. But any recovery could be jeopardised by renewed US-China trade tensions, and despite attractive valuations and high dividends, the firm holds only a neutral position in the asset class.

He also questions just what the ECB has left in terms of ammunition. “While in the US, the Fed has hinted that cuts are possible, the European Central Bank has less room for manoeuvre as deposit rates are already negative and a new round of asset purchases is not yet on the cards. Fiscal easing may well prove a necessary adjunct.”

Global problem

The ECB’s dovishness may well help European equities, says Antoine Lesne, head of SPDR Emea strategy and research at State Street Global Advisors, but slower growth cannot be reignited on its own if it is a global phenomenon linked to rising geopolitical uncertainty and the negative effects of trade wars, he warns.

“The ECB’s actions can provide a buffer on a relative basis, but we do not believe we are close to seeing the ECB starting to buy equities outright and support the market,” says Mr Lesne.

Since the European economy is more open to global trade than the US or even China, it is no surprise that weakness in manufacturing PMIs is most visible in Europe where most major countries have been in contraction over the past few months, he says. Yet the bigger drag on performance for European equity indices has actually been the financial sector, believes Mr Lesne, which is less directly exposed to the trade tensions but remains “embroiled” in the aftermath of the financial crisis, the ultra-low rate environment and capital pressure.

Central bank actions mean there have been several periods since the financial crisis where there has been asset reflation despite weak economic growth and this has kept investors interested in equities, explains Olav Chen, head of allocation at Storebrand Asset Management, Norway’s largest asset manager.

“If they hadn’t acted in this way we would probably have been underweight European and global equity,” he explains. “So by starting to ease again they are helping keep us at a neutral weight.”

However the recent moves are unlikely to be a game changer, he warns, rather it is more likely to be a case of diminishing returns. That is unless they were to do something really unexpected, adds Mr Chen.

“Like buying equities, for example. They could do it. Look at the Bank of Japan. That would be a game changer. That would boost confidence. And you cannot rule it out, especially were Europe to be heading towards a recession.”

A recession is unlikely, he believes, and says that descriptions of Europe as “the new Japan” are wide of the mark, as despite facing similar demographic challenges, such as an ageing workforce, Europe has a much greater mobility of labour.

But the situation in Germany does worry Mr Chen, with its automotive sector at particular risk from tariffs. “Germany has been one of the stars since the financial crisis. But the protectionist trade wars could be a negative structural headwind for Europe, and Germany in particular, which has been one of the biggest export engines.”

Unwelcome developments

The trade war is developing in an ominous way for Europe, agrees Jeffrey Sacks, head of Emea investment strategy at Citi Private Bank, as it is likely that President Trump will pivot his attentions towards the continent.

“Rhetoric will get more tense and headlines more acrimonious, and that won’t help sentiment within Europe,” he explains. “This will all impact on corporates’ willingness to borrow.” Mr Sacks points to agriculture, liquified natural gas, aircraft subsidies and the automotive sector as the areas where Europe’s involvement in the trade wars is likely to focus.

Citi is slightly underweight Europe, but does believe there are pockets of opportunities to be found. Perhaps surprisingly, Mr Sacks points to the banking and automotive sectors, though warns you have to be selective.

“Banks give us an average price to book of 0.7, with an average ROE of 13 per cent and rising, with core Tier 1 balance sheets in the low teens which is comfortable. And dividend yields of anything between 4 and 7.5 per cent for leading banks.”

The automotive sector, meanwhile, has certain stocks which are priced around six or seven times prospective earnings, he says, with dividend yields of 8 or 9 per cent.

“They really need a catalyst, and that could be things like the results of the 232 investigation [the US’s probe into auto tariffs]. But if you are holding these stocks, and the catalyst doesn’t come through, well then at least you are getting well paid with dividends.”

At a country level, Citi particularly likes Switzerland, which may be at a premium to the rest of Europe, but in this case it is justified, says Mr Sacks. The earnings outlook is decent and driven by companies with strong franchises which is giving them pricing power in which is generally a weak pricing environment. “It is also a country with gives us exposure to a sector which we like, which is healthcare,” he adds.

QE has not had the impact on growth that was expected, but Europe has not had synchronised fiscal stimulus, and the one country that has been begged to do it is Germany

Were President Trump to put tariffs on the automotive sector it would be a big problem for Germany, says César Perez, head of investments and CIO at Pictet Wealth Management, but he believes that, eventually, Europe as a whole would benefit.

“QE has not had the impact on growth that was expected, but Europe has not had synchronised fiscal stimulus, and the one country that has been begged to do it is Germany,” explains Mr Perez.

The country’s Grand Coalition government means it has been “tough” for them to carry this out, he says. “But if they are in further trouble, I know for a fact that German politicians are starting to talk about further fiscal stimulus. And we need the Germans to spend because that can stimulate Italy and others.”

Pictet has been negative on equities for a couple of months. It sees the European banking sector as cheap, but not profitable enough, and would rather play it through debt. The major theme Mr Perez likes in Europe is domestic equities, as government support seems to be forthcoming, for example with the rise of the minimum wage in France. In terms of sector positioning, he advises investors to be a bit more defensive.

Although at first glance it might not seem that there are many reasons to be too cheerful about European markets, the headwinds the region faces mean it is often overlooked by investors, says Gergely Majoros, member of the investment committee at Carmignac. Indeed the political structure of the eurozone, being composed of numerous countries, is fragmented and quite complicated to understand for foreign investors, he says, while issues like Brexit are not helping.

“But even though opportunities are less obvious and more difficult to identify, they do exist,” he says. “European markets may need a more granular approach from investors.”

Carmignac is focused on quality names in Europe, seeking well managed visible growth companies, with the greatest number to be found within the technology, healthcare and consumer sectors.

Europe has some quality companies and great global brands, says Donny Kranson, lead European portfolio manager at Vontobel Asset Management. “The baseline demographics in Europe are not particularly attractive, with low population growth and people already at high levels of disposable income. So companies have had to look abroad for growth.”

Europe also has companies with “top notch” corporate governance, he explains. “The region is ahead of other countries when it comes to thinking about ESG issues, and that matters in the long run in terms of future regulations that are going to come in.”

Europe is trying to become more dynamic, says Mr Kranson, with start-up tech companies in London and Berlin, for example. “But for the most part it’s not Silicon Valley,” he warns, adding that it can be a struggle for companies which have been around for a long time, which many in Europe have, to stay agile and dynamic.

“With all this disruption happening across sectors, you have to find companies that have this sort of mentality. When you are talking to these companies you need to make sure they are not relying on the past but are looking to the future.”

But the European IT sector is underestimated, believes Marcus Morris-Eyton, portfolio manager, European equities, at Allianz Global Investors. “It is a lot bigger, and a lot better, than many people believe. It does lack the consumer internet names, but it has a very deep industrial IT sector.”

Allianz’s largest position is in SAP, the German software company, which is attractively valued when compared to others in the space, he says, and also highlights Dassault Systemes, Temenos and ASML.

Unloved

Indeed European equities are an area of opportunity for investors, argues Kasper Elmgreen, head of equity investment platform at Amundi. They have fallen out of favour in recent years and has underperformed global and US stockmarkets for seven out of the last 10 years, he says, due to weak earnings growth and political risks.

“But taking a step back from the external macro environment, internal demand dynamics in Europe are relatively strong with strong employment, rising wages and the strongest fiscal stimulus in over 10 years on the way,” says Mr Elmgreen.

Meanwhile the company fundamentals that underpin the asset class are quite strong, he says, with low levels of financial leverage relative to other geographies as well as strong cash flow generation.

“We are therefore cautiously optimistic on European equities and would prefer Europe to the US or emerging markets at this stage,” adds Mr Elmgreen.

VIEW FROM MORNINGSTAR: Growth managers outperform as investors seek stability

European markets bounced back in the first half of 2019. The global economy has continued to slow on the back of the US-China trade war and uncertainties in Europe have remained, but a more favourable stance from central banks has once again provided support for stockmarket prices.

The broad-market index MSCI Europe was up 15.9 per cent in the first six months of 2019. Once more, investors favoured companies with defendable revenue streams and strong growth potential. The growth version of the MSCI Europe Index outpaced its value counterpart by a wide margin, widening further the performance gap seen in recent years. In that context, growth-oriented managers have tended to do better than others.

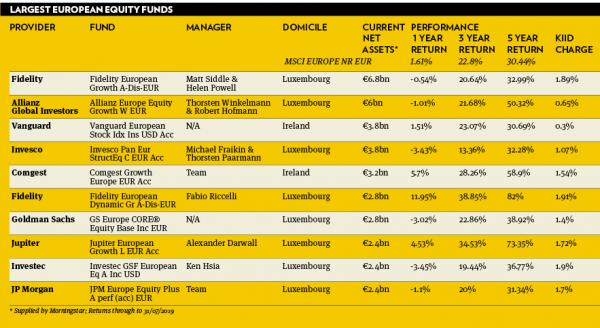

Silver-rated Fidelity European Dynamic Growth was among the most successful funds over the last 12 months with a 11.9 per cent gain. The strategy, led by Fabio Riccelli, outpaced its peers thanks to solid stock selection across sectors.

The manager’s high-conviction, bottom-up approach can lead to periods of underperformance when his top picks are out of favour. That said, we think his record is very robust and repeatable. Mr Riccelli benefits from Fidelity’s extensive research firepower. The fund’s size bears watching however after recent inflows lifted the strategywide assets to around €3bn ($3.35bn). Fidelity European Growth, managed by Matt Siddle, has an even larger asset base at €7bn. The fund is less nimble than peers, but the manager has handled it well so far, making good use of strong analytical resources since he took over the fund in 2012.

Jupiter European Growth was also a strong performer. Some of the fund’s highest-conviction positions performed strongly. With lead manager Alexander Darwall stepping down later in the year, we have however become more cautious about the potential of this strategy. Mark Nichols, who comes from Threadneedle, will assume the role as sole manager.

Mr Nichols is experienced but has no track record as sole manager. The fund’s Morningstar Analyst Rating was downgraded to Neutral from Gold on April 2, 2019.

Mathieu Caquineau, CFA, Associate Director, Manager Research, Morningstar