Commodities suffer as investors flock to equities

Slowing growth in China has hit demand for commodities while funds have suffered outflows as investors reallocated to equities. But there are opportunities in the sector, for example in metals and timber

While the macro picture for commodities is supportive, the last few months have seen large price swings. After a rally in January, prices retreated again in February and started to recover in March before the bailout package for Cyprus renewed investor concern.

However, the impact of such events is likely to be temporary, and on a six to 12 month view the fundamentals and valuation factors should drive commodity markets higher with single-digit returns of around 6-7 per cent.

Leading economic indicators, global industrial production and commodity consumption are all increasing, driven mainly by the US, so the recovery is less commodity-intensive than in the past, whereas in the previous cycle the main driver was China, although US housing starts are strengthening demand for timber and other components. There are growing indications of attractive valuations in metals as producers start to scale back their capacity expansion plans.

However, commodity funds have experienced massive outflows in the first quarter as investors, disgruntled by poor performance, ploughed back into the equity rally. Precious metals led the way with SPDR Gold Shares ETF alone bleeding out more than $760m (€580m) in assets in the first week of April. Agriculture ETFs have held up best.

Broad-based commodity fund managers are typically 50 per cent invested in energy stocks. “While we are not looking for a material move upwards, oil is well supported at $95-115 for Brent,” says Jonathan Blake, head of natural resources at Baring Asset Management.

“There is demand from the strength of emerging markets which underpins oil and there is less capacity within Opec to meet supply shortfalls. US production has increased and looks buoyant, and a buoyant oil price environment is good for upstream assets. Not all oil markets are as buoyant as Brent – we do invest in companies that can obtain lower priced sources of oil such as US refiners we think are well set to access shale oil and Canada crude oil such as Valero, Marathon Petroleum and Western Refining.”

The Carmignac Commodities fund is similarly 53 per cent invested in energy including transportation companies and coal, with the remaining 10 per cent in precious metals, 4.5 per cent agricultural chemicals and fertilisers and 2.5 per cent in timber primed to benefit from the US construction pick up.

Sandra Crowl, a member of the investment committee at Carmignac Gestion, agrees the US energy market benefits from several influences – firstly the new technology in unconventional extraction methods in gas and oil shale means the US now has to import a lot less gas. This is a cheap source of energy to local companies (ethane for example is 70 per cent cheaper than last year) so some US operators such as Lyondellbasell can take advantage of cheaper inputs than their peers.

Allocations

The Carmignac Commodities fund is 53 per cent invested in energy including transportation companies and coal, with the remaining 10 per cent in precious metals, 4.5 per cent agricultural chemicals and fertilisers and 2.5 per cent in timber primed to benefit from the US construction pick up

Secondly the revolution in oil transportation and in particular the Canadian oil and gas company TransCanada’s planned new pipeline carrying tar sands oil nearly 2,000 miles from Alberta, Canada to the Gulf Coast of Texas should help to reduce the price differential between Brent and West Texas Intermediate.

“There could be further downward pressure on energy costs through potential new transportation links of alternative energy sources such as the Canadian tar sands (heavy oil),” says Ms Crowl. “If approved the $5.3bn Keystone XL pipeline (Alberta to US midWest) could be in place as stated by TransCanada by late 2014 or the start of 2015, and TransCanada could link in with a pipeline already under construction from Oklahoma and Texas. The Keystone project still has to be approved by President Obama although now there is bipartisan support, and approval should be finalised before the summer.”

Fund managers widely believe there are exciting opportunities ahead as major mining companies have cut back on capex in the face of rising operational costs such as higher salaries for higher skillsets, and harder-to-mine fields with lower quality ore. New management teams installed in BHP, Anglo American and Rio Tinto have been under pressure to improve their capital allocations and provide sustainable returns. If they throttle back on capex now, then three years down the line shortages in supply could lead to a price spike. Fund managers argue that investors are worried about near-term noise and are forgetting the structural story. Companies in favour are those that have made an effort to reduce costs by making acquisitions such as First Quantum with Inmet.

Another recent shift in commodity fund exposures has been to add around 2.5-3 per cent to timber companies such as Weyerheauser, prompted by the recovery in US housing. US building permits advanced 4.6 per cent in March, the strongest level since June 2008, helped by lower mortgage rates, monthly QE, which has been reinforced since October, and the renaissance in the market for mortgage backed securities. This construction rebirth is so pronounced it is adding around 0.5 per cent of growth to US GDP.

GROWING RETURNS

Agriculture has been an enduring story, based on growing populations, increasing wealth and changing diets leading to tightening inventories. However, the impact of the weather reduces visibility so these assets can surprise on upside and downside. Most fund managers focus their efforts on fertilisers and agriscience companies such as Mosaic Company in the US and Potash Corp.

Droughts in the US last year and Russia in 2011 exacerbated shortages and the supply side of agriculture is much like how the metals space looked at the beginning of the last decade.

A prime focus for BlackRock’s World Agriculture fund is to concentrate on inputs as demand for grains and agricultural produce is generally going up and there is concern about national food security. “It is in the interests of most governments to try to ensure they are self sufficient in food and they invest in mechanisation, fertilisers and agriscience to obtain higher yielding crops,” says portfolio manager Catherine Raw. Favoured companies include firms such as Caterpillar involved in mechanisation in China and grain handlers who are dealing in bigger volumes, including the opening up of Canada to competition.

The incentives for farmers to increase productivity, and high grain and oilseed prices, gives them greater affordability to buy services and items to maximise their output, and the affordability of agrichemicals has never been better so demand should be strong.

In contrast, base metals are largely out of favour. Mr Blake at Barings has nil exposure to steel although demand for the alloy is a mixed picture. While emerging market growth is relatively strong, demand for steel products is not rising as much as supply, which reduces the ability of producers to pass on price increases.

“Also, on the cost side, if one looks at raw coking coal and iron ore, prices still remain at high levels so costs for steel producers are high in a weak demand environment,” adds Mr Blake. “But we do recognise there is some value in the steel space. We look at steel by looking at price to book which currently is 0.7 times – a low would be 0.5 times, which would be when value will begin to emerge.”

Among other metals, copper is scarce and production is at risk in the Congo, Mongolia and other countries where there is not much of a track record of a stable mining industry, while in Chile, North America, and Australia, the grades need to be much higher to generate attractive returns.

There is an oversupply of zinc but large scale operations, Century Mine and Xstrata Brunswick, are coming to the end of their lives. “China is the largest zinc producer but whether it can compensate for those closures is hard to predict as China’s production lacks clarity,” saysBlackRock’s Ms Raw.

The current focus on precious metals has switched away from gold and silver although the Cyprus bailout has shown that tail risk persists. “Precious metals should see diverging developments going forward,” according to Tobias Merath, director and head of commodity and alternative investments research at Credit Suisse.

“Gold and silver are heavily dependent on investment demand, and with investors positioning in more cyclical assets, we think both markets will probably lack the momentum to push much higher,” he says. “Platinum and palladium are more cyclical than gold or silver. At the same time they are less dependent on investment flows and have better valuations. Here we see more upside likely.”

Fund managers typically prefer precious metals such as platinum and palladium and to a lesser extent silver that also have applications in industry such as healthcare and electronics and although more volatile, could decouple from gold over the medium to longer term. Of these, platinum stands out because on a medium-term view there have not been sufficient discoveries and there are the challenges in South Africa, such as labour inflation, the strong rand, and high taxes, so miners do not have free cash to plough into new discoveries.

However, the scale of Chinese demand for precious metals is a game-changer.“Precious metals are an important asset in China as an alternative to equities as it is such a closed market,” says Ms Raw at BlackRock. “I’m of the view that structural challenges facing economies will debase currencies and gold and silver will go higher. That would imply a change of policy in China and an opening up of the system to a floating rate but there is a long way to go before that.”

She likens the actions of the West with QE to the 1980s. “Eventually we will revert to trying to control inflation but not for 10 years. Will precious metals go up again given the austerity? I don’t see liquidity increasing even though policy points that way. If the economy can grow irrespective of austerity then that is when we will see the next leg up in gold prices but there is some pressure in the short term which is why it has come down,” says Ms Raw.

“So: short-term technical issues; medium-term the play-off between economic growth versus austerity; and long-term the structural bull,” she explains.

Ignoring the short-term noise, however, China’s urbanisation target of 53 per cent, which involves the migration of 20 million people into its cities, will require housing and infrastructure. Many of these infrastructure projects have been waiting for the new government to bed in, which traditionally has proved to be a long and drawn-out process.

UNDERLYING STRENGTH

At a time when US equities are trading at near record highs and the dollar is improving, the fact that commodities finished the first quarter little changed from where they were at the end of 2012 indicates some fundamental strength in the sector.

“The overall environment for commodities is still improving,” says Tobias Merath, director and head of commodity and alternative investments research at Credit Suisse.

The current improvement in economic growth is mainly driven by the US, so the recovery is less commodity-intensive than previous ones, where China was the main driver

“The current improvement in economic growth is mainly driven by the US, so the recovery is less commodity-intensive than previous ones, where China was the main driver. Nevertheless, it is an improvement. Financing conditions point in the same direction. Liquidity remains plentiful making it easier for commodity consumers to finance purchases.”

Mr Merath argues that on the valuation side the asset class on aggregate is not overvalued. “In some sectors such as metals there are even indications of undervaluation as producers are starting to scale back their capacity expansion plans,” he explains.

The typical allocation to commodity funds does not appear to have changed very much in recent years however. Jane Sydenham, investment director at Rathbones, points out that access to the physical product is almost impossible for private investors, who have to use the futures market where they can suffer negative roll over.

“It is quite a tricky sector because there are a lot of different routes and it is easy not to get the return you think you will achieve, so for the most part we tend to use agricultural equity funds such as the Baring Agriculture fund and sometimes the Schroder one and agricultural chemical companies such as Syngenta,” she says.

Rathbones often suggests physically-backed ETFs as a cost-effective way to hold gold, and BlackRock Gold & General, but Ms Sydenham adds there are several risks in mining companies including management, currency, labour, and politics.

There is a sense that investors are picking out individual commodities they think will do well, as divergence across the space is stark and has been increasing.

Ben Yearsley, head of investment research at Charles Stanley, likes active funds First State Global Resources and the BlackRock World Mining IT, and also suggests platinum which is relatively cheap compared with gold, but also highly volatile.

VIEW FROM MORNINGSTAR - DISAPPOINTING RETURNS

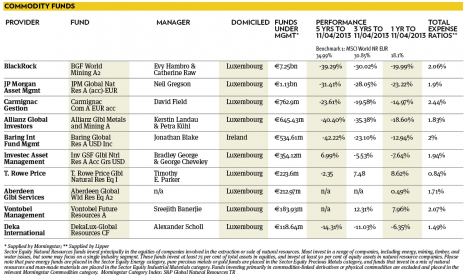

The Morningstar Sector Equity Natural Resources category comprises funds which invest principally in equities of companies involved in the extraction or sale of natural resources (ranging from mining to the oil and gas sector, as well as forestry and agriculture).

The sector has produced disappointing performance for investors over the past five years (up to February 2013 month-end); on average, funds in the category have lost 4.9 per cent in euro terms annualised over the period. By contrast, an investor would have gained 1.7 per cent per annum over the same period by investing in a fund diversified across all sectors (as illustrated by the Morningstar Global Large Cap Blend Equity category average). Over the past 12 months, the underperformance of natural resources funds has been even more dramatic (-14.5 per cent compared to 9.5 per cent for global equity funds).

Furthermore, given the inherent cyclicality of stocks in the sector and their high sensitivity to commodity prices, natural resources funds have been almost 60 per cent more volatile than global equity funds over the long term. This high volatility makes such funds difficult to use and they should typically form only a small part of an investor’s broader portfolio.

The sector’s poor recent returns can be partly explained by the struggles of the mining industry. Gold mines, in particular, have delivered catastrophic performance over the past three years amid concerns about their rising operating costs and the geopolitical risks of operating in increasingly ‘frontier’ markets. Investor demand has also dwindled, with many investors turning to more liquid gold exchange traded products (ETFs and ETCs) instead of gold mines in times of market stress.

One of the funds which suffered most from this trend is BlackRock World Mining, whose -20 per cent return over the past 12 months lands it at the bottom of its category. Managed by veterans Evy Hambro and Catherine Raw, the fund follows a narrower mandate than most competitors, by focusing on basic and precious metals. The team seeks to identify the drivers of each commodity price to help forecast a directional trend that supports their company-level analysis. This covers supply and demand analysis, with the latter increasingly influenced by investor demand.

In spite of its recent struggles, Morningstar analysts still believe the fund is a compelling choice for long-term investors seeking exposure to the mining sector, and have maintained its Gold rating.

By contrast, Bronze-rated Investec GSF Global Natural Resources, which is diversified across all industries in this sector, did a better job at limiting losses (-7.9 per cent) over the past 12 months. Managers Bradley George and George Chevely use a flexible, relatively unconstrained process, which allows them to position the portfolio according to their strongest convictions. The fund recently increased its stake in large energy companies, whose healthy dividend payout was seen as hedge in a time of market uncertainty. The team also prefers to direct its stake in precious metals toward physical gold and platinum ETCs, rather than mining companies, which supported the fund’s relative performance in 2012.

Mara Dobrescu, senior fund analyst, Morningstar France