Emerging markets see light at end of the tunnel

The prospects for emerging markets look better than they have done for some time while equity valuations remain attractive. Is now the time to invest?

When making asset allocation decisions in recent years, most investors have pushed emerging market equities firmly to one side. Valuations may have been appealing, but most argued the asset class did not have much else going for it.

But many of the headwinds that had been battering so many developing economies at last appear to be on the wane. Commodity prices may at last have reached the bottom, China’s economic transition has steadied and the US Federal Reserve has tempered its planned interest rate rises, and with that, the strength of the dollar. But those attractive valuations remain, so is now the time for investors to take the plunge and move back in?

“We are really talking about a turning point here compared to the last four or five years,” says Jan Dehn, head of research at Ashmore, adding that although emerging markets have suffered from a slowdown in recent years, they have held up better than expected due to the strength of their fundamentals.

Great debate

Is now the time to invest in emerging markets?

Have emerging markets turned a corner? Citi Private Bank and BofA Merrill Lynch give their views

IMF forecasts released in April expect economic growth to accelerate in emerging markets while the developed world slows, which should attract investors. “And if people start channelling money back into emerging markets then there will be money for finance, for consumption and so forth, which will feed into that growth,” he adds.

A low-growth environment should not always be seen as a negative, believes Anthony Cragg, senior portfolio manager at the Wells Fargo Emerging Markets Equity Income Fund. “Companies tend to become more efficient, more productive, and more shareholder-friendly,” he explains.

“They also become more likely to consider stock buybacks and dividends in a slower-growth environment.”

Investors should consider following a dividend approach across all emerging markets, says Mr Cragg. A dual focus on dividends and growth can help dampen portfolio volatility because it typically favours better-quality companies with strong cash flows, strong balance sheets, and responsible management teams that allow companies to more consistently pay higher dividends, he explains.

CHINA CALMER

Fears over slowing growth in China was one of the big reasons global stockmarkets endured a torrid start to 2016, but the widespread belief is now that the situation in the country is not as bad as had been feared.

“The China factor is no longer playing adversely on the asset class,” says Patrick Mange, head of APAC and emerging market strategy at BNP Paribas Investment Partners.The country has been reforming its economy and the fear was that this would lead to slower growth. But China’s thirteenth five-year plan revealed that the government will be prioritising growth over reforms for the coming period, with the target of expanding the real economy by at least 6.5 per cent each year until 2020.

“There is no doubt that China will have to address the question of unsustainable debt leverage at some stage, with funding tensions in the corporate sector already starting to materialise,” he warns. “But in the absence of any exogenous shock, China still has enough ammunition to postpone painful deleveraging and difficult reforms until better times.”

The Chinese authorities made a mistake in not admitting their reform process was going to mean slower growth, believes Wayne Bowers, chief investment officer for international markets at Northern Trust Global Investments. “They stuck to the 7.5 per cent figure, which was a real error. It would have been acceptable to admit that this would mean lower growth, but that growth has more longevity to it.”

Part of the reform process in China is the transformation of the country from an export-led economy to a domestic consumption one, a trend that is playing out in other Asian countries as well.

“The region is transitioning from the world’s factory into the world’s consumption centre,” says Rahul Chadha, co-CIO at Mirae Asset Global Investments. He highlights the internet and e-commerce sectors, along with travel and tourism, insurance, healthcare, retail, and health and fitness. In terms of countries, Mirae advises investors to look for those with good demographics and low consumer debt levels – India, Indonesia and the Philippines stand out.

Emerging market equities have faced myriad problems in recent years – Mr Chadha lists the Fed rate hike overhang, a strong US dollar, weak commodity prices and geopolitical uncertainties in selective countries – but he believes many of these headwinds have now lessened. “Asian economies have become more resilient to deal with potential external shocks in terms of having strong fiscal and external balances,” says Mr Chadha, while growth remains very healthy in pockets of the economy that benefit from structural tailwinds.

From red to amber

The outlook for emerging markets is better now than for several years for five reasons, says Ashmore

Strong EM value proposition

Fixed income yields are higher than when the Fed had rates at 5.375%

Improving EM relative and absolute fundamentals

Sharp improvement in current account balances and competitiveness following a period of tighter financial conditions and currency adjustment

Poorer return prospects in developed markets

Repeated monetary stimuli have exhausted the upside potential

Weaker US fundamentals

Growth challenges mounting

Real exchange rate increasingly uncompetitive

A more balanced outlook for currencies

US dollar increasingly a victim of its own success

Stable dollar makes EM local markets attractive

One theory for investing in emerging markets is that the least volatile way to invest in these regions is to look for global companies with exposure to them. Mr Chadha does not buy into that way of thinking, particularly if looking to access the consumption trend.

“Consumption is very much a domestic story involving local taste and habits,” he explains. “As a result, this is an area where we often find global multinational companies struggle to compete with local companies in terms of product compatibility with local preferences, time to market, and value-for-money proposition.”

In addition, global multinational companies invariably have a sizeable part of their business in developed markets, while local companies offer pure exposure to the emerging markets, adds Mr Chadha.

Emerging markets may be volatile, says Mr Cragg at Wells Fargo, but you do not have to invest in all of them. He is bullish on India over the long-term, although it does face significant challenges. “One distinguishing characteristic of India is that it is much less dependent on the world economy than other emerging countries, which is an advantage in times of slowing global growth.”

Brazil, on the other hand, is experiencing a “perfect storm” of lower oil prices, a prolonged recession, widescale political corruption involving the state-owned oil company Petrobras, and the impeachment process against president Dilma Rousseff.

Others see the political developments in the country as an opportunity. “The recent political developments in Brazil are positive as they will bring in a more centrist government and the potential for economic progress,” says Hiroshi Yoh, portfolio manager of the Janus Emerging Markets Fund.

“The country is not without challenges but a regime that could tame inflation could lift the macro burden. Brazil has some undervalued companies with decent long-term prospects.”

The Rouseff impeachment will take time and she will not go quietly, says Mark Mobius, executive chairman of the Templeton Emerging Markets Group, but the bottom line is that she is finished as a political force.

Regardless of the outcome of the impeachment process, we are optimistic that the current policies process will be beneficial for Brazil

“The big question is the extent to which the new leadership will pursue a truly aggressive reform programme and address all the corruption issues that have been uncovered. Regardless of the outcome of the impeachment process, we are optimistic that the current policies process will be beneficial for Brazil and after these few years of poor development, Brazil will be on its way to a strong recovery.”

Petrobras itself, which is a state-owned company, is in the middle of a big restructuring and would be a beneficiary of a change of government, says John Malloy, co-head of the emerging and frontier market team at RWC Partners, as it could well be allowed to raise prices, sell-assets and deleverage. He also highlights CCR, a toll road company, since the country is still in need of a major infrastructure boost.

The changes in Brazil are part of a wider reform theme that can be seen in other parts of Latin America – he points to the pro-reform government in Argentina and also highlights Venezuela.

RWC is also fairly positive on Russia. “As much as Putin has done damage in the geo-political environment in terms of Crimea and Syria, he has had a hands-off approach to the economy and has allowed the central bank to manage monetary policy very effectively,” says Mr Malloy. “In addition he has cut expenditures dramatically, and as a result you have had a sharp recession but we expect the economy to recover faster than expected.”

RWC has been overweight Russia and continues to be positive on companies such as Sberbank, and the steel sector, where Russian companies are very competitive, in part thanks to the strength of the rouble and its boost to exports.

Because emerging markets have been out of favour for quite some time, US and European institutions and retail investors have been on the sidelines, says Mr Malloy. “So in terms of investment flows, we could be in a position where, at a time when valuations are pretty reasonable, and the economic and earnings data could be on the cusp of recovering, you also have money flowing into the asset class.”

Many fund managers talk about the importance of local and extensive knowledge when it comes to making equity allocations to emerging markets, but for François Savary, chief investment officer at Geneva-based Prime Partners, cost was also a big factor.

“We do not do stockpicking in emerging markets,” he says, explaining how, when the company recently moved from an underweight to neutral position in the asset class, at the expense of developed market equities, they did that mainly through exposure to the iShares minimum volatility on emerging markets smart beta ETF.

“This was the first time we have used a smart beta ETF,” says Mr Savary. “The performance was similar to a more expensive, actively managed fund and clients are very aware of cost right now.”

TOO SOON

Not everyone is convinced of the arguments in favour of increasing allocations to emerging markets right now though. “It has taken a brave investor to significantly increase their allocations to that space,” says Gavin Rankin, head of managed assets for Citi Private Bank Emea. Markets are currently going through a trading rally, he believes,with some of the strongest performers, such as some Latin American stocks, coming off significant lows.

“We would not advise investors to significantly increase allocations to emerging market equities until we have passed through a period of US economic slowdown, which we think is probably the second part of next year,” cautions Mr Rankin.

Pictet wealth management does not have any exposure to emerging market equities on either a strategic or tactical basis, says Christophe Donay, head of asset allocation and macro research at the Swiss firm, having sold all allocations four years ago.

The major emerging economies are in a transition phase, he explains, which induces a slowdown in economic growth and, by translation, in corporate earnings growth.

Emerging equities may trade at a 20 per cent discount compared to world markets on a 12-month forward price/earnings ratio basis, but investors should not be lured in, he warns.

“At first, this may look appealing. But we think it is a value trap,” says Mr Donay. “In our opinion, the discount is warranted, given a less favourable risk/reward ratio compared to developed markets.”

VIEW FROM MORNINGSTAR: Commodity price rises provide welcome boost

For investors in emerging markets (EM), 2016 has been a far more pleasant experience than the preceding year. In 2015, EM funds saw significant negative returns and underperformance relative to funds investing in developed markets, while through the end of May in 2016 returns have been both positive and slightly ahead of developed market performance.

This turnaround reflects a general increase in global risk appetite and a slight easing of concerns over China, but more importantly there has been a boost to commodity-producing nations through rapid price rises in commodities such as iron ore and oil. Until last month there was also positive news in terms of currencies, with the dollar weakening through 2016, which benefitted EM markets and currencies. This weakness resulted from market expectations that US rate rises would be pushed further out, although more recent comments have led to a modest tempering of that view, with the dollar showing some short term strength as a result. Despite this, commodity-producing countries such as Brazil, Russia and South Africa have shown good returns year to date.

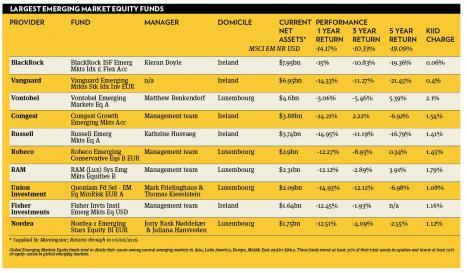

Of the funds shown in the table on page 38, both Comgest and Vontobel hold positive Morningstar Analyst Ratings. The Comgest fund is run by experienced manager Wojciech Stanislawski alongside Emil Wolter. Mr Stanislawski has been part of the management team on this strategy since 1999 and is supported by a large team of analysts. The managers adopt a strategy that is longer term in nature and focuses on businesses with high profitability and the ability to grow independently of the economic cycle.

Vontobel Emerging Markets Equity is managed by Matthew Berkendorf. He took control in March 2016 when the former manager and group CEO, Rajiv Jain, announced that he would be leaving the group. Mr Berkendorf has worked on this fund for 17 years and continues to implement the same investment approach that focuses on high-quality growth stocks producing high ROE and exhibiting pricing power.

The processes of both funds tend to result in limited exposure to cyclical areas of the market and as a result both have shown relative underperformance year to date, however both have produced strong relative performance over medium to longer term timeframes.

Simon Dorricott, senior manager research analyst, Morningstar