Changing population dynamics top long-term trend for private banks

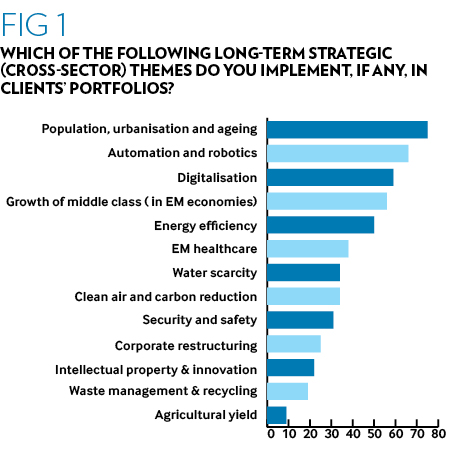

The population, urbanisation and ageing theme is the top cross-sector investment theme according to private banks, with 75 per cent of respondents to PWM’s Global Asset Tracker implementing it in client portfolios

Three-quarters of private banks are implementing the population, urbanisation and ageing theme in client portfolios, according to PWM’s annual Global Asset Tracker survey, making this the most acted upon long-term global trend.

The impact of new technology on the global economy was also clear, with automation and robotics (66 per cent) and digitalisation (59 per cent) second and third in the list.

The continued development of emerging markets is also a popular theme, with the growth of the middle class in those regions (56 per cent) as well as emerging market healthcare (38 per cent) both placing highly.

Meanwhile green trends also being implemented, with energy efficiency (50 per cent), water scarcity (34 per cent) and clean air and carbon reduction (34 per cent) all featuring in wealth managers’ asset allocation decisions.

PWM's annual Global Asset Tracker survey is based on interviews with chief investment officers, heads of asset allocation and chief investment strategists of 38 selected, mainly global and regional, private banks. Together they manage more than $7.8tn in client assets globally. For the full results click here.