Global asset tracker: Geopolitical risk dominates asset allocators’ outlook

PWM’s second asset allocation survey comes at a time when economic fundamentals are expected to play a much more prominent role in asset valuations, while managing volatility will also remain key

Despite increased geopolitical risk, mainly deriving from two key shock events last year – the election of business tycoon Donald Trump as US president, and the UK’s decision to leave the European Union, which have further emboldened populist movements in Europe – the global economy is going to plod along. The world’s GDP is expected to expand by 3.1 per cent in 2017.

After several years of extremely loose central banks policies, which hugely inflated assets values, this may at last be the year when economic fundamentals have a much more prominent role to play in determining asset prices, with a clear shift of emphasis to budgetary and fiscal policy. This is the underlying conviction driving asset allocation decisions at private banks, although managing increased volatility will be key (see Fig 1).

Mr Trump’s promise of putting “America first” may well be achieved through an autocratic style of leadership, set to dismantle historical political and trade alliances, endanger global peace and fuel social discrimination. But his promised pro-growth agenda seems to have reinforced investors’ confidence in the economic recovery, which has resulted in a general lift of global markets since the election. The reflation policy is expected to generate positive effects on global earnings, which will be reflected in stock prices, and investors may expect higher risk-adjusted returns in portfolios this year (see Fig 2).

These are headline results to emerge from PWM’s second annual Global Asset Tracker survey (GAT), based on interviews with chief investment officers, heads of asset allocation and chief investment strategists of 38 selected, mainly global and regional, private banks. Together they manage more than $7.8tn in client assets globally.

EXPECT THE UNEXPECTED

“We are living in a riskier environment because we have some pretty notable geopolitical risk,” acknowledges Katie Nixon, CIO, Wealth Management at Northern Trust. “But it is very hard to judge what the actual implications of this geopolitical risk will be.”

After all, market reaction to Mr Trump’s election, to Brexit or even to the Italian constitutional referendum which led to the government’s collapse, has not been what pundits had anticipated.

“It’s important to recognise we were starting to see fundamental improvement in the economy and earnings before the election, and Trump’s pro-growth policy – even after the puts and takes associated with some of his other policies – will be an accelerant to growth in the US,” continues Ms Nixon. As a consequence, the US bank has a “high conviction call” on US equities and US high yield bonds, funded by significant underweight to investment grade fixed income.

The panel of respondents is, however, split on whether markets have reacted rationally to Mr Trump’s election or have overreacted, with the former group in the majority (see Fig 3).

“Markets have reset to a new reality,” says Jeffrey Mortimer, director of investment strategy at BNY Mellon Wealth Management. “We think they are, generally, priced rationally, although they may have ‘borrowed’ a bit of 2017’s return by rallying so quickly after the election.”

Political ‘noise’ could impact the economy in the medium term but will have relatively little impact this year, states Paul Donovan, global chief economist at UBS Wealth Management. “As a rule of thumb, politicians are not as important as they think they are, because the underlying economic trends are fairly well established,” he says.

However, the potential for disruption with regards to politics lies in two not unrelated areas. The first is an “outright trade war”. “Global supply chains are now so interwoven that an outright trade war, such as imposing tariffs on imports, will have significant consequences on US inflation, shortages of goods, and potentially escalating to hit wider consumer confidence,” he says.

Also, a very disruptive trade environment could send negative signals to the investor community and impact foreign investors’ decision to save in US assets, causing a disorderly move in the dollar.

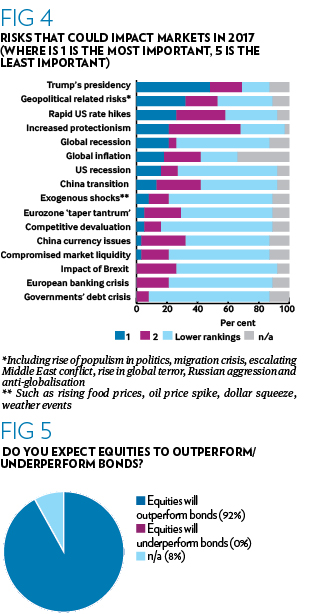

Mr Trump’s presidency is believed to be the single most important market risk in 2017 for almost half of the respondents, followed by geopolitical risk (32 per cent), rapid US rate hikes (26 per cent) and increased protectionism (21 per cent) (see Fig 4).

There are strong reasons why Mr Trump’s “guaranteed” annual economic growth of 3.5 per cent may not happen, says Mouhammed Choukeir, CIO at Kleinwort Hambros. “That level of growth has not been hit in the US for over a decade, and wildly pumping fiscal stimulus into the economy will do nothing to address fundamentally poor demographics – made worse by immigration curbs – or slowing productivity.”

A collapse of the equity market is a top risk for 2017, according to the UK bank. “This is one of the longest bull markets in history, but some areas, such as the US, are very elevated. A collapse would not be unthinkable,” says Mr Choukeir, explaining the importance to seek to invest where valuations are reasonable “to lessen the chances of sharp drawdowns”.

EUROPEAN CONCERNS

Upcoming elections across the continent could redefine the balance of power in the eurozone, with risks of further break-up of the EU, already tested by a potential ‘hard Brexit’. And asset allocators are aware of that.

“Political pressures will rise in Europe in the coming months, with several elections looming,” says Jeffrey Sacks, Emea investment strategist at Citi Private Bank. “Some of the topics that will drive election results are the same that resulted in Trump gaining popularity in the US, such as anti-establishment and anti-elite feelings.”

A key change Citi Private Bank made following Mr Trump’s election was to reduce its exposure to European equities, from neutral to slightly underweight. “What the Trump election win has shown is that Brexit wasn’t a one-off British event, with a Middle England feeling being expressed. The anti-establishment sentiment is more global than that.”

As a result, confidence indicators in Europe could begin to weaken, negatively impacting growth and earnings, and could start to offset the ongoing monetary easing and decent valuations, which are still reasonable, says Mr Sacks.

Markets are “overstating” political risks, believes Didier Duret, CIO at ABN Amro Private Banking. “Democracies are stable and the system of checks and balances are extremely solid in Europe, the UK and the US,” he states. In fact, the first weeks of Mr Trump’s presidency were a strong confirmation of the correct functioning of this system, referring to the block by federal judges on Mr Trump’s executive order of the “Muslim ban”. The forced resignation of Michael Flynn as National Security Adviser over his unauthorised talks with Russia over sanctions was also a clear signal of democracy working.

There is a strong behavioural bias, believes Mr Duret, as people’s outlook for the future is highly impacted by current fears.

Indeed, this bias is confirmed by last January’s GAT survey results, where private bank’s top concerns were China’s slowdown and tumbling oil prices, fears which had just triggered an indiscriminate sell-off in global financial markets. This year China’s mismanagement of transition and reforms features in eighth position.

There is a strong consensus on the higher value of equities over bonds, with 92 per cent of respondents expecting equities to outperform bonds. (see Fig 5). Just more than half of respondents expect developed market equities to outperform EM equities. In the fixed income space, the preference is for EM debt and high yield.

Western Europe, Japan and the US are the most likely regions to attract client money in the next 12 to 18 months. And European, global and Japan equity are the asset classes offering very high or high value or growth opportunity in 2017/2018.

In the equity space, there are strong preferences for specific markets, which may follow a home market bias (see Fig 6).

ABN Amro further increased its overweight exposure to global equities, believing Mr Trump’s pro-growth agenda is supporting “the strong synchronised recovery that was happening before the election”. The Dutch bank particularly favours US, European and Asian stocks. In Europe, the political risk premium, which has been growing since 2012, has further widened this year, while in the US it has shrunk dramatically since Mr Trump’s election, as “markets love the simplicity” offered by the policy mix.

In Europe, political risk is still to come, says Mr Duret, expecting this will reduce after elections. Markets are being rational, pricing in policy risk where the risks lie, as opposed to triggering a global sell-off as past events and this is a positive environment for investing, he says.

Moderate economic growth, continued accommodative monetary policy, earnings recovery and low valuations are key reasons to favour eurozone equities.

“We believe the expected return for eurozone and Japanese equities is higher than for US stocks,” says Florent Bronès, CIO at BNP Paribas Wealth Management.

In Japan, economic growth, even if slower compared to historical standards, will be supported by the yen, which had appreciated on the dollar “for no fundamental reason” in 2016. The depreciation of the Japanese currency, driven by the US elections, has triggered a sharp recovery of the Japanese equity market and the yen is expected to continue to weaken.

“Markets have been extremely rational,” believes Mr Bronès. “US equities are expensive, but for a reason, as they show above average growth and corporate earnings increasing more rapidly, compared to European equities. These disappointed in terms of earnings growth, but are trading well below the long terms average, in terms of cyclically adjusted price-to-earnings ratio (Cape). On the contrary, US Cape is 20 per cent above its long-term average.

Lower expectations for the growth of the UK economy will have negative implications for continental Europe, but it will be “just a small regional impact”, believes Mr Bronès.

While the old continent is facing significant political risk this year, investors in European equities are paid to take that risk.

“If investors do not take any risk, they are actually taking the risk of not protecting their capital against inflation, which is going to rise, firstly driven by rising oil price and then wage increases, especially in the US and UK.”

THE TRUMP EFFECT

Expectations for tax cuts, infrastructure spending and deregulation in the US have boosted growth expectations, asset prices and the US dollar.

This confidence is also reflected in private banks’ investment decisions, with more than 40 per cent of respondents increasing allocation to US and global stocks, as well as the dollar, while implementing a sector rotation within US equities. Small caps have particularly benefited from the tailwind, and having export quotas below 40 per cent makes them less vulnerable to a stronger dollar.

“We believe that US small caps, the leading asset class since the election, will continue to outperform going forward because they are more immune to potential trade issues, they have a history of outperforming in this part of the economic and market cycle, and have less exposure to currency fluctuations,” says BNY Mellon’s Mr Mortimer.

“Trump’s pro-cyclical measures should benefit cyclical stocks, and sectors like financial sectors, infrastructure and healthcare should perform well with the announced tax and regulatory initiatives,” says Norman Villamin, CIO Private Banking and head of asset allocation at UBP.

Others are more sceptical. “We maintain a neutral stance in our overall allocation on equities,” says Alan Mudie, head of strategy at Société Générale Private Banking. “In the US, while the promised corporate tax cuts will further enhance earnings per share, higher interest rates and a strong dollar represent headwinds. Moreover, valuations are stretched. We are underweight US equities.”

An overweight to US equities is “prudent”, but there is risk of more aggressive US central bank action if growth accelerates and this would result in higher interest rates, says Christian Nolting, global CIO at Deutsche Bank. This explains why the institution remains underweight fixed income.

After Mr Trump was elected, around 40 per cent reduced exposure to fixed income, on which an overwhelming majority of respondents (94 per cent) have an underweight position on a tactical basis (see Fig 7). Around half of them reduced duration in fixed income portfolios, in view of further inflation increases.

A rising dollar, the threat of protectionism and interest rate rises have driven 30 per cent of private banks to reduce their exposure to emerging markets since the US election. However, the same percentage maintains an overweight stance to GEM. Selectivity is crucial, with preference for countries which may be more immune to protectionism.

“We have a positive view on India and Indonesia, because both countries have strong reform momentum, which should help solidify economic growth,” says Willem Sels, chief market strategist, HSBC Private Bank, which has an overweight stance on both emerging market and Asia ex-Japan stocks.

“Also, they are largely domestic markets, which should to some extent insulate them from any threats to global trade restrictions.” HSBC also likes new economy sectors in China, which is also a new conviction view for Standard Chartered.

“We believe demographics, urbanisation and the trend towards greater use of the mobile internet are drivers of faster growth in new economy sectors,” says Alexis Calla, global head, Investment Strategy & Advisory, Standard Chartered. These include technology and services, where earnings growth and valuations are higher compared to the broader market and higher corporate margins support the higher valuation.

BREXIT

Although, surprisingly, nobody believes Brexit will be the single most important market risk for 2017, the UK’s decision to leave the EU has certainly triggered some key changes in portfolios (see Fig 8).

The most important was to reduce exposure to UK stocks (44 per cent), followed by reducing or hedging UK currency and real estate.

The UK economy has been surprisingly resilient since the Brexit vote, with business confidence bouncing back after an initial slump. “However, 2017 is likely to be more challenging as uncertainty around the Brexit negotiations eventually curbs business investment and a weaker pound boosts inflation, hurting real incomes and consumption,” says Standard Chartered’s Mr Calla.

The government has cut its 2017 growth forecast to 1.4 per cent from pre-Brexit estimates of 2.1 per cent, although that remains much higher than consensus estimates which see 0.9 per cent growth next year, the weakest since the 2009 financial crisis.

“While we do not consider the UK vote to leave the EU a systemic event, it has the potential to create continuing uncertainty keeping volatility volatile,” states Daniel Brüesch, head of PB Investment Office at Bank Vontobel.

“We find it appropriate for general portfolio stability to raise exposure to US Treasuries, a ‘safe-haven’ asset with an elevated running yield compared with alternatives.” US 30-year yields 2.3 per cent versus zero for 30-year bonds of the Swiss Confederation and 0.4 per cent for 30-year German ‘Bunds’.

ACTIVE VS PASSIVE

Disappointing performance from active managers, the efficient and cost-effective way ETFs provide to express tactical views, especially in a risk on/risk off environment in efficient markets, were the main reasons behind the rising use of these passive vehicles in client portfolios last year (see Fig 9).

However, the future may be more favourable to active managers, according to 50 per cent of private banks (see Fig 10).

“Following industry trends, flows should favour passive investments. Investors are becoming more fee sensitive and active management has struggled recently,” says Niladri Mukherjee, director of portfolio strategy at Merrill Lynch Wealth Management. “However we do expect active management performance to improve as return dispersions rise going forward.”

“Relative value opportunities and sector rotation stemming from political events favours direct investments and actively managed products,” adds Corrado Cominotto, head of active asset allocation of Banca Generali.

MARKET VOLATILITY

More than 50 per cent of respondents expect volatility to be high, while 40 per cent believe it will be medium, and only 11 per cent expect it to be low.

3.1%

On average, private banks expect global GDP to grow by 3.1% in 2017, compared to 2.8% in 2016

“Volatility will rise as a function of increased political news flow, and intermittent concerns about global central banks stance,” says Northern Trust’s Ms Nixon. “Investors have to look through that short term volatility, look through the noise and not be swayed and urged to act based on a tweet or a front page headline,” she says. And staying invested is important in order to benefit from those few best days in the year that tend to get a lump of the whole year returns.

Portfolio diversification is the portfolio management techniques used most to mitigate market volatility, followed by currency hedging and active tactical asset allocation.

The latter, together with higher investments in private markets, is also believed important in generating higher returns.

SECTORS

When it comes to sectors, in the equity space, almost 70 per cent of private banks are overweight financials, while more than half favour IT and energy.

“Financials and IT sectors will be direct beneficiaries of a reflationary economic environment, whereas telecom and utilities will most likely suffer from higher interest rates in the developed economies,” says Enio Shinohara, head of Portfolio Solutions at BTG Pactual.

The preference of the panel is for US banks, where Mr Trump’s focus on deregulation is an additional benefit, as European banks may continue to struggle with zero interest rates.

Others have a contrarian view. “The re-rating of US banks is more advanced than in Europe, we have a preference for European banks at this stage,” says Philipp Bärtschi, CIO at Bank J. Safra Sarasin.

One asset class in which UK bank Coutts has “a lot of conviction” over the next few years is subordinated financial debt. “We like it because it is relatively insensitive to changes in interest rates and continues to look undervalued – largely due to widespread negative sentiment towards banks,” says Alan Higgin, Coutts’ CIO. “The higher income and attractive yields paid on subordinated financial debt more than compensates for the additional credit risk and presents us with an overlooked investment opportunity.”

More than 80 of respondents claim to implement cross-border, long-term themes in client portfolios. The top three (prompted) most used cross-sector themes are population, urbanisation and ageing (75 per cent), automation and robotics (66 per cent) and digitalisation (59 per cent).

EXPECTED FUTURE USE OF ASSET CLASSES

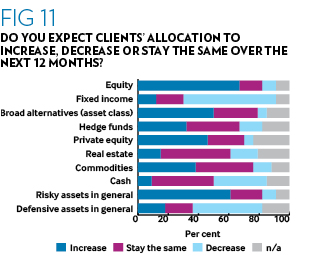

Allocation to equities, and broad risk assets is believed to increase this year (see Fig 11).

“Given short-term yield is fixed to zero, and longer duration is perceived as risk, due to the broken trend of falling bond yields, increasing equity exposure is to be expected,” says Deutsche’s Mr Nolting. While equity valuations are considered as somewhat stretched, EPS growth should provide further upside potential.

48%

48% of banks in the PWM GAT survey have a tactical overweight to European equities (ex uk), vs 85% last year

Private equity and property investments will remain at a high level but should not accelerate further as prices have soared, he says. Commodities remain difficult to invest in, given the contango of the oil structure, and clients do not see the safe haven story for gold as a valid investment case.

Only a third of respondents, however, think clients will increase exposure to hedge funds, versus more than 40 per cent last year. Huge outflows, relatively poor performance and high fees have clearly taken their toll. “Diversified hedge funds vehicles will neither attract attention nor fresh money as yield potential is considered as inferior to stocks,” says Mr Nolting.

HSBC, which has an overweight to hedge funds, believe exposure to these alternative assets will increase, favoured by higher dispersion “With equity markets likely to only drift up in low-to-mid single digits, returns will not be attractive for investors who just go ‘long’ and buy and hold equities. Instead, returns should be enhanced by looking for tactical opportunities and relative value opportunities,” says Mr Sells. “Hedge funds are well placed to do this, and the higher dispersion we are already seeing should help them.”

Also hedge funds tend to show very low correlation to the bond market, and therefore, they can act as a good diversifier.

VIEW FROM CREATE: CLOUDS ON THE HORIZON

On the face of it, the results are encouraging: 2017 may well deliver better results than 2016. Around 35 per cent of respondents expect higher risk-adjusted returns while 30 per cent expect them to be lower.

But as one drills deeper into the survey results, a more nuanced view emerges: investors are mindful of two big risks lurking in the background.

The first one concerns the policies of the Trump administration. It has promised to tear up every major treaty on trade and security. No wonder, the survey respondents are not so sanguine about US equities nor about EM assets.

The second risk concerns Brexit. We have only seen the first round portfolio adjustments with respect to the UK assets. Worse may come if the divorce is especially messy, as seems likely. Moreover, the knock-on impact on EU assets could well come, if Brexit intensifies the politics of fragmentation in Europe.

Elections in France and the Netherlands could be a political minefield. The data about the attractiveness of European equities need caveats about their underlying assumptions.

Amin Rajan, CEO, Create Research

Banks participating in PWM’s Global Asset Tracker

ABN Amro Private Banking, Banca Generali, Bank J. Safra Sarasin, Bank Vontobel, Barclays, BBVA Banca Privada, BNL-BNP Paribas, BNP Paribas Wealth Management, BNY Mellon, BTG Pactual, CaixaBank, Citi Private Bank, Coutts, Credit Suisse, Deutsche Bank, Fideuram-Intesa Sanpaolo Private Banking, HSBC Private Bank, Itaú Private Bank, Bank Julius Baer, KBC Private Banking, KBL EPB, Kleinwort Hambros, LGT, Lloyds Bank Private Banking, Lombard Odier, Merrill Lynch Wealth Management, Northern Trust, Pictet Wealth Management, Popular Banca Privada, RBC Wealth Management, Santander Private Banking, SEB Private banking, Shinhan PWM, Société Générale Private Banking, Standard Chartered Private Bank, Union Bancaire Privée, UBS Wealth Management, UniCredit Private Banking

To download a PDF of the Global Asset Tracker, click here: