Rewards for stockpickers amid market volatility in Asia

Lena Tsymbaluk, Morningstar

Volatility in Asian markets is likely to continue through 2016 and beyond, but there are real opportunities in individual stocks

Investors in Asian equity markets endured a tough and volatile year in 2015, with returns significantly lagging world markets. The MSCI AC Asia ex Japan index showed a total return of -9.17 per cent in dollar terms against a -2.36 per cent return for the MSCI AC World index. The markets’ ups and downs were driven by the uncertainty surrounding the Fed’s plans to raise interest rates, falling commodity prices and weak economic newsflow out of China.

Chinese equities, which make up a third of the MSCI AC Asia ex Japan index, were a major source of the volatility. Following a strong momentum-driven rally in the first half of 2015, the Chinese stockmarket tumbled in August as Chinese data for July pointed to a deepening slowdown in the economy. Measures introduced by the Chinese authorities stabilised the market somewhat. However, the unexpected devaluation of the yuan on August 11 raised uncertainty over Chinese economic policy and triggered a collapse in the Chinese market. The market stabilised in the fourth quarter amid a pick-up in risk appetite and ongoing policy support from both the central bank and the government.

Volatility continued into 2016 as Asian equities were once again severely hampered by equity falls in China. The Shanghai Composite collapsed by nearly 23 per cent in January amid renewed growth concerns and questions about the government’s ability to manage markets. Circuit breakers, which were put in place by the Chinese government to protect against erratic trading, proved to be too tight, exacerbating investors’ anxiety and encouraging panic selling.

Most commentators believe Asian markets are likely to struggle with similar challenges to those they faced in 2015. Many Asian economies continue to move towards a structurally lower growth rate, due to weak global demand for Asian exports and China’s economic slowdown. Economists forecast China’s GDP growth for 2016 and beyond to remain below the 7 per cent mark as the economy undergoes a major transformation. The worries include high leverage, over-reliance on credit for growth, oversupply in property markets, and overcapacity in industrial sectors.

From an asset allocation perspective, investors remain wary of Asia, and Morningstar head of UK investment strategy, Andy Brunner, believes Asia remains a challenging call given ongoing macro headwinds and slowing growth for the region.

While now may not be the best time to increase weightings to Asian equities, the scale of underperformance and valuations relative to developed markets suggest there are real opportunities developing among individual stocks that could eventually rerate significantly once confidence improves.

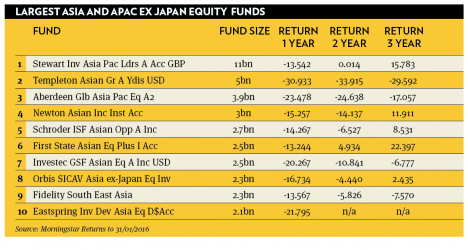

The largest funds in the category include Stewart Investors Asia Pacific Leaders, Aberdeen Global Asia Pacific Equity, Investec GSF Asian Equity and First State Asian Equity Plus. Aberdeen focuses on high quality business models with high returns on assets and capital, while First State and Stewart Investors favour firms with sustainable drivers of earnings growth and high corporate governance standards. Investec uses the group’s trademark 4Factor process, a proprietary quantitative screen assessing earnings, valuations, technical, and strategy.

The best-performing funds (over three years) include Stewart Investors Asia Pacific Sustainability and Veritas Asian. Veritas adopts a thematic approach to Asia, focusing on dividend yield and earnings momentum; assets are allocated between core and trading sleeves based on market conditions.

Lena Tsymbaluk is a manager research analyst at Morningstar