Is the sun set to rise on japanese equities?

Taeko Setaishi

Japanese stocks are at their most undervalued in years while companies continue to display strong fundamentals, according to the boutique investment house Atlantis. Elliot Smither reports

Emerging markets, and particularly those in Asia, have seen record inflows in recent months. However, with worries over inflation beginning to emerge, some fund managers believe it is time for investors to shift their focus towards previously unloved countries that may just prove to be a bargain.

Japan is one such country. Tokyo has endured 20 years of poor equity returns, since its stockmarket peaked in 1989. And while markets across the globe rebounded following the financial crisis, Japan’s continues to lag, despite its companies displaying strong fundamentals.

This situation could create opportunities for investors, believes Taeko Setaishi, director at Atlantis Investment Management, an independent Asia-focused house founded in 1994 by two ex-Schroders managers, now running $4.3bn (E3.15bn).

Yet investors looking to access the most mature market in Asia will find it lags behind many of its regional counterparts in one important aspect, believes Ms Setaishi, who advises the Atlantis Japan Opportunities fund from the group’s Tokyo office.

“In terms of language, Japan is an underdeveloped country,” she says. “The prime minister cannot speak English, whereas the leaders across the rest of Asia tend to be able to. The same goes for people in business. In the past this has not been a problem for Japanese companies, because they had technical advantages and everyone wanted to buy from Japan. But that is no longer the case.”

This lack of foreign language skills becomes a problem for foreign investors looking to gather information on Japan’s small to mid-cap companies, which Ms Setaishi believes offer the best potential for growth. “Except for a few big companies, if you go onto the websites, it is all in Japanese. There is nothing in English. Also the number of brokers in Japan has fallen a lot, while a number of money management companies have totally given up on Japan.”

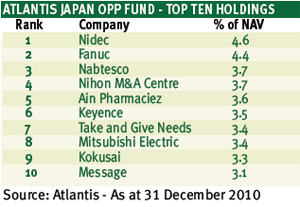

Her fund currently holds $15.5m, spread across 45 holdings, with a bias towards small to mid-cap companies selected on bottom-up investment criteria, a mindset present in most Atlantis funds. However, some of the fund’s top holdings are currently in large cap companies because of their extremely attractive valuations, says Ms Setaishi.

Many Japanese companies are highly dependent on exports for profits, and have been hit hard by the strength of the yen, which rose 13.2 per cent against the dollar in 2010. These companies have been forced to become much more efficient in order to compete due to this high exchange rate, and if the yen does weaken then they could well be in for some very healthy profits, believes Ms Setaishi.

Furthermore, Japan’s location, with easy access to rapidly expanding markets across Asia, gives its companies an advantage over European and US firms. However, she does concede that much depends on the movement of the yen, and any further strengthening of the currency would adversely affect Japan’s economy.

Yet Japanese equities remain at their most undervalued in years, says Ms Setaishi, creating opportunities for both short and long-term investors.

“Since 1989, there have been significant ups and downs in the Japanese market, and so if you can get your timing right you can make quite nice profits. We try to be long-term investors, but because of the cyclicality of the market I think Japan will continue to show fluctuations.”

Little attention was previously being paid by companies to their investors, complains Ms Setaishi. “Companies paying dividends were always paying a fixed amount year after year, regardless of how the company was doing. This is starting to change with companies now talking about how they should reward their shareholders, but typically for Japan, they had to have pressure from outside to change.”

As a boutique investment manager, Atlantis needs to find a niche in order to survive, explains business development manager, Roger Mortimer, who is based in London. “The competition now isn’t just from the other fund managers, it’s from ETFs, but I don’t know if, for example, you can get an ETF that covers the Japanese small-cap market.”