Management Selection Team

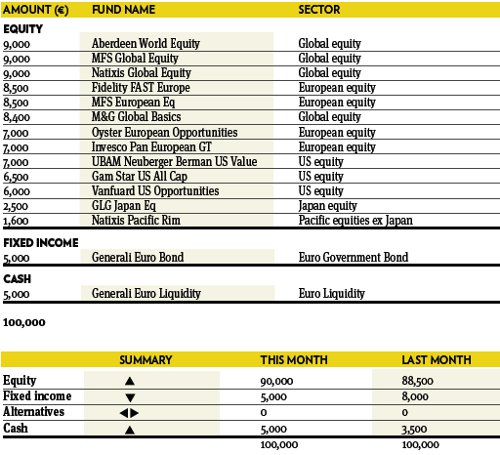

“In May the portfolio lost against its benchmark. By the end of the month, we deemed it more convenient to take a neutral stance on our asset allocation, with the only exception the duration of the bond component, now half in bonds and half in cash. We rotated out of the most outperforming funds, Nordea European Value, UBS US Growth, and Natixis US Value, to buy some laggards: Invesco GT Pan European Equity, Vanguard US Opportunities, GAM US All Cap and UBAM US Value. We maintain a less defensive stance on the portfolio, given the sharp and rather ample re-pricing of risky assets in May.”