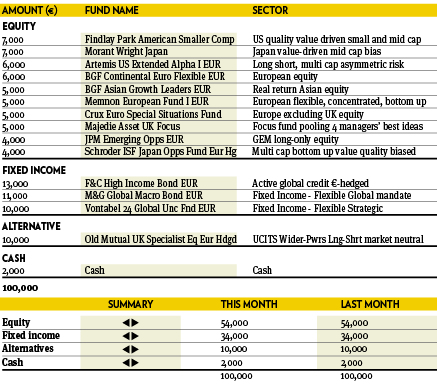

Fund selection - September 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The world economy is doing better than expected. In particular, growth in the eurozone, China and Japan has picked up and second-quarter US economic growth was revised upward. While a slowdown is sure to come, it does not appear to be near, as early warning-indicators of threats to world growth, such as logistic surveys and metals pricing, continue to be strong. Equity markets have remained relatively calm despite rising political issues. Macro conditions remains healthy, interest rates are low and inflation is subdued. Encouraging earnings trends continue to signal double-digit earnings growth this year and next. In this environment we continue to favour stocks over bonds, with a regional preference for Europe and emerging markets, as well as the preference in style investing for value versus growth in both Europe and US.Our fund selection in all asset classes remains unchanged.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“The last few days of August saw markets reverse their earlier losses to close down only marginally negative. Unfortunately for the portfolio, our European bank position gave back some of its July outperformance. However we remain comfortable with this allocation, recognising that value opportunities can be volatile and that, as an investor, you need to be patient. Testament to the benefits of thinking long-term is our investment in Indus Asia Select. We first invested with this manager in 2014 and it has since returned nearly 60 per cent per cent in euro terms, outperforming its benchmark by 17 per cent. Happy with the portfolio, we have made no changes.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“Despite significant political tension surrounding North Korea, markets remained remarkably stable, though August is traditionally a quiet month. Currency moves curtailed returns with most markets losing money in euros which strengthened in the month. Economic data continued to be strong, underpinning recent sentiment, though there seems little room in prices for disappointment. The best performer of the selection was the euro-hedged Old Mutual UK Specialist Equity fund, with the JOHCM Continental European at the back of the pack. We are replacing the JOHCM Continental European fund with the Crux Euro Special Situations Fund. We remain conscious of market levels and the scope for a pullback going into the final quarter of the year.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended August with a negative performance. Top contributors were the emerging markets equity funds, Comgest and Fidelity, worst detractors Schroder European Opportunities and Exane Equity Select Europe. We still retain a positive outlook on equity markets, given the improvement in global growth and the cautious approach of central banks to the reduction of liquidity, and more so on emerging markets, them being the main beneficiaries of a weaker dollar. Some volatility due to geopolitical tensions is not modifying the positive picture for risky assets in the medium term, according to our view.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“The financial markets clearly tracked the worsening in the geopolitical and political climate in August. Even so, the fact that the equity markets held up relatively well reinforce our conviction to maintain risk budget from previous month in the portfolio. Moreover, the economic environment has been favourable on the whole, in particular in the eurozone. In this context, we keep our bets on the technology sector, European small caps and high yield bonds.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“In August, most major indices showed a negligible to modest decline in their local currencies, despite an above average quarterly earnings season. Markets shrugged of the US non-farm payroll miss, instead focusing on US wage growth of 2.5 per cent from last year, and the US manufacturing sector growing at its fastest pace in six years. Within fixed income, rate rise expectations receded helping government bonds to rally, though high yield and investment grade credit were fairly muted over the month. Currencies have shown more volatility during the month with the US dollar continuing to fall against the pound and the euro. We have become more positive on the euro relative to the dollar, despite the possibility of some short-term profit taking. Within the portfolio we have made no changes to the overall asset allocation with equities remaining our preferred asset class. We saw no reason to make any changes in our implementation and the portfolio remains unchanged.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio has been tweaked on both the equity and the alternative sides. First, an investment in Japanese markets has been initiated through an ETF at the expense of US and emerging Asian stocks. As Japanese markets have been lagging for a while, it appears valuations are now quite supportive on the back of strong earnings and a remarkable resilience to a stronger yen. On the alternative investments side, the arbitrage fund has been trimmed as the lack of direction on many markets leaves this type of strategies struggling, despite an excellent management.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“Who was the naughty child at the back of your class? Mine was a boy called Nicholas Proudfoot. It is rare for a whole class to behave at the same time and the teacher has to constantly make decisions to ignore, reprimand or even expel children based on their behaviour. At the moment Neil Woodford’s fund – Woodford Equity Income – is the holding causing us consternation. So what are we doing? Based on past performance we know his high conviction style occasionally gets him into trouble but we still believe he can get back to being top of the class. There has been no change to weights or asset allocation.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“IPM Systematic Macro is a diversified, market neutral hedge fund. What characterises this fund is that it does not rely on directional positioning, instead it assesses the relative attractiveness and exploits the discrepancy in fundamentals by taking long and short positions. This makes this vehicle seriously different from most other market neutral hedge funds to start with. On top of this, IPM does not use stop loss functionality but instead positions with prevailing negative value add are normally increased as valuation gets cheaper. The fund comes with a substantial amount of risk, still uncorrelated to other hedge funds, benefiting the alternative part of the portfolio overall. We are satisfied with our alternatives positions.”