Fund selection - March 2015

Each month in PWM, 9 top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Julien Mechler

Chief investment officer, AA advisors. Based in: Paris, France

“We maintain our base scenario that the US economic recovery continues at a relatively strong pace. Nevertheless a stronger dollar and deteriorating news flows are pointing to a longer than expected recovery. Fed chairman Janet Yellen has made clear that the first steps towards monetary normalisation do not imply the start of a monetary tightening cycle. This environment is beneficial to growth investing, so we reduce exposure to the value-bias AA MMF Aristotle US Equities and increase holdings in Alger American Asset Growth, which focuses on companies undergoing dynamic positive changes which should generate rapid earnings and free cash flow growth.”

Thomas Wells

Senior Multi Manager Fund Analyst, CFA, Aviva Investors. Based in: London, UK

“Spring sprung early this year with January marking the month where our large European equity allocation was finally richly rewarded. Markets have now substantially rebounded from their October lows – when we last added equity risk. Looking ahead we are anticipating potential downside in the UK related to the May general election. We have reduced our long-only equity bucket by trimming Investec UK Special Situations. Maintaining our investment mantra of cautious optimism, we have doubled our position in AIMS Target Return, providing the portfolio with positive but low equity beta. We reduced cash to 7 per cent.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“We did not change our positioning. Performance was strong because of our allocation to European equities (45 per cent) and to US dollar (about 40 per cent). Exane Archimedes had a positive month, while Nordea European High Yield and Neuberger Berman High Yield both grew nicely. Global equity funds had another bad month, and we are evaluating a rotation out of them. Albeit detrimental, we are still keeping our hedging on the yen, but with less conviction than before. Templeton Mutual European is suffering once again for its exposure to Russia-related companies and Greece.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“Positive equity market returns were compounded by currency gains from overseas investments as the euro weakened versus major global currencies, resulting in a strong start to the year for euro-based investors. The Japanese market led the move upwards ironically buoyed by the weakening yen lifting prospects for exporting companies. The BlackRock Asian Growth Leaders Fund was the best performer of the selection. The US market was the laggard as investors turned to other markets following a strong run in 2014. We remain cautiously optimistic on the outlook for markets, but ever vigilant on the potential for volatility but welcome the opportunities this will present.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Since the beginning of the year, almost all countries have reported their Product Manufacturing Index with mixed results. If we globally remain positive on fundamental factors (economic outlook and monetary policy), we have a neutral view on companies’ earnings – although they should remain a positive contributor to equity markets for the year to come. Geopolitical tensions in Europe and chances of broader sanctions for Russia are encouraging us to gradually decrease our equity sensitivity. The perspective of a later rates hike in the US is also calling for a greater allocation toward tactical trading strategies.”

Peter Haynes

Investment Director, SGPB Hambros. Based in: London, UK

“Financial markets experienced a volatile start to 2015 as they attempted to digest a raft of economic, political and corporate data during the month. European equities rallied following the long awaited announcement of QE in the region and Jupiter European Growth was one of the strongest performers in the portfolio. Also within the equity selection, First State Asia continued to benefit from its overweight position in Indian equities. Within the alternatives allocation, the dynamic asset allocation of the Lyxor ARMA 8 fund enabled it to benefit from the continued compression in global sovereign bond yields during the month.”

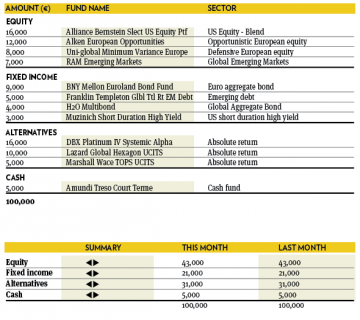

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The overall asset allocation remained unchanged on the balanced portfolio, broadly balanced, risk wise, between fixed income and equity investments. The only changes are to the debt side, which refocused on euro sovereign duration, at the expense of US duration, as central banks’ policies are likely to go in opposite directions. Overall, the foreign exchange exposure remains meaningful as pressures remain on the euro. Equity investments remain roughly equivalent on Europe and US while emerging Asian equities are meaningfully overweight.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“While maintaining overall equity exposure this month we switched some of our exposure from US equities into Europe, increasing our allocation to the Blackrock Dynamic European Equity fund. We maintain our constructive stance on UK equity income within the UK allocation and value in the US. Outside of equities we continue to prefer actively managed strategies within fixed interest – particularly those with high allocations to credit risk. Fixed income allocations in aggregate are controlled in size, however, due to lower return expectations, and we maintain material allocations to absolute return portfolios focused on relative value within equities.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“The hunt for performance and alternative strategies remain in focus as bond yields keep falling. We introduce a new global macro hedge fund from Goldman Sachs, a Ucits carve out from the successful GS Global Opportunities Fund launched in 2001. The strategy is a liquid high conviction multi-strategy fund active in fixed income and FX via six sub strategies. We like the breadth of the fund’s investment process with top-down and bottom up market views implemented in both directional as well as relative value sub-strategies. We believe it can add diversification to our portfolio and generate returns over time. We reduced fixed income correspondingly.”