Fund selection - December 2016

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“We further increase our equity overweight, adding to the value-biased AA MMF Aristotle US Equities. The continued conviction in equities as an engine of portfolio growth is based on a combination of improving fundamentals, stabilising market conditions and expected fiscal stimulus in the US. The result of the US election and the market’s response reinforces this positive environment. We sold emerging market bonds as renewed concerns regarding interest rate hikes and a stronger US dollar will be negative for emerging markets and their currencies.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“With the unexpected election of Donald Trump, 2016 will go down in history as the year political pundits got it wrong. Markets reacted by continuing to sell rates and buy the dollar. Despite losses on emerging market debt, the portfolio was up, primarily due to sizeable gains on our unhedged US equity position, with Hermes delivering particularly strong performance. With the potential for further upside due to tax reform and infrastructure investment, we have increased this SMID cap exposure funded from cash.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“The election of Donald Trump set the tone for the month as improved growth in the US, inflation and deglobalisation were swiftly priced into markets. The largest moves were seen in bond markets as the much talked about hikes from the US federal reserve became a closer reality. The euro-hedged Schroder Japan Opportunities fund was the best performer. The Odey Odyssey fund lost money with its bearish positioning holding back performance. We remain cognisant of volatility with politics a key area of focus in driving market sentiment.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended the month in positive territory. Main contributors were JPM US Steep, Robeco US Select Opportunities, Vanguard US Opportunities, M&G Global Dividend, MFS Global Equity, Neuberger Berman US High Yield and Nomura US High Yield. We make changes in response to the shifting macroeconomic environment: closing our position in emerging bonds in local currency at a profit to invest in Carmignac Patrimoine, a flexible asset allocation fund, and reinforcing our position in Exane Archimedes, undergoing some weakness.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Equity markets continued to rally, particularly in the US, where the economy may benefit from likely tax cuts and plans to boost infrastructure spending. US small caps are introduced as we believe large amounts of cash on bigger companies’ balance sheets and a generally low appetite for capital cost will drive M&A, which should support small-caps. We reduced our exposure to Reits, which have shown strong performance recently but valuations are worsening and they are also sensitive to expected shifts in monetary policy.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“The broad outlines of the policies of the Trump administration became clear in November. Deregulation, tax reform and infrastructure spending are all likely to be positive for growth. It remains to be seen whether the protectionist noises are a negotiating stance or a genuine change in policy. For the time being markets are reacting favourably. Within the portfolio we have trimmed the exposure to alternatives and fixed income and added to the existing holdings of Robeco US Premium and Henderson Global Technology where we remain positive.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“As the style rotation from growth to value has been going on, the balanced portfolio has been adapted accordingly. Fund managers tend to stick to their usual bias, which can cause a meaningful underperformance. On top of the style bias, the geographic diversification of the portfolio has been increased some more on the equity side. On the alternative investments, the event-driven and the higher income portfolios have been increased at the expense of the global macro portfolio, which failed to deliver and was recording loss after loss over a series of months.”

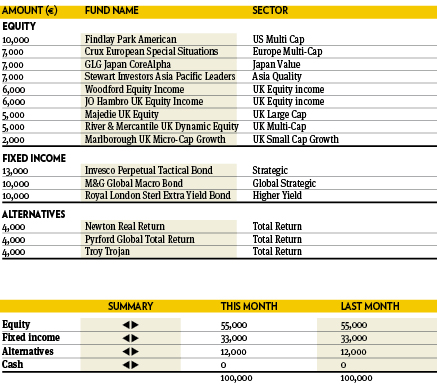

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“The media seems to be ever more reliant on politics to create content. But markets do not like uncertainty. With more events being held up as big news it is no wonder that investors end up not making a decision. I will just wait until ‘X’ event has passed before I make a decision to invest leads to a state of paralysis. Some events are important but we have to remember that it is companies’ ability to grow their profits and pay their shareholders a return will be the key to your long-term returns. Try to invest where you feel there are long term reasons to be positive.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“SEB Global Fund exploits a systematic approach to capitalise on behavioural inconsistencies in the equity space. It views quality and value as the most important drivers for long-term performance combined with a sell-side sentiment factor to efficiently capture market movements. ESG factors play an increasingly important role and the universe of potential investments has broadened out, increasing the potential for alpha. With investors starting to shun quality stocks, the fund has performed well and our conviction stays firmly on a high level.”