Size isn’t everything as fund performance beats brand

Lee Gardhouse, Hargreaves Lansdown

Fund selectors claim brand is unimportant, with the manager, investment process and anticipated returns all higher on the agenda

Accelerated M&A activity is creating a number of super-factories among fund houses, stepping up production to meet demand from the growing adoption of the ‘preferred partner approach’ among wealth houses. This favours big asset managers with a broad product range.

But in a year characterised by geopolitical drama and market surprises, and within an industry undergoing a major period of transition, mid-sized players and smaller boutiques are still giving larger investment manager brands a run for their money.

When it comes down to it, today’s battle of the brands can be broken down into a series of smaller skirmishes between different sectors and niches. It is no longer just a showdown between several mega-players.

So far, the much talked about polarisation of the industry between large companies and smaller boutiques has not prevented players in between the two extremes competing aggressively. They are doing this by launching products that meet investors’ evolving needs in a rapidly changing market environment.

Quality products

“We do not see any evidence of focus being only on the very big names or the boutiques,” says Diana Mackay, founder and joint CEO at fund market analysis and research company Mackay Williams.

“Fund selectors are ultimately looking for good quality products and are agnostic about the size of the group, as long as the funds are big enough to accommodate the money they want to place and the group is able to support them.”

Over the past 12 months to the end of February 2017, a combination of mid and small players dominated European fund flows of PWM’s panel of selectors. Our panel includes fund platforms acting as gatekeepers to banking and asset management groups managing more than €2.9tn ($3.1tn) of client assets.

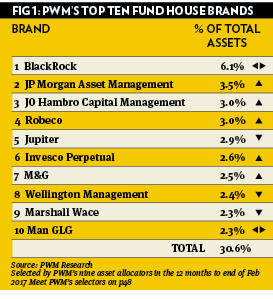

While the world’s largest fund house BlackRock (excluding its ETF business iShares) held its top position in our champions’ league of leading brands, with heavyweight JP Morgan Asset Management advancing to second, four of PWM’s top 10 brands (JO Hambro CM, Jupiter AM, Marshall Wace and Man GLG) are of more modest size, each running less than $50bn in assets (see Fig 1).

Mid-sized players Robeco and Invesco Perpetual both rose by several rungs, compared to the previous period of analysis.

Most of PWM’s panel claim brand is not a key driver in fund selection and what really matters is the manager, the team, the investment process and expected future performance.

While it is acknowledged that a large asset manager is often able to attract some of the best talent, it is up to the fund selector to “separate the wheat from the chaff” within its product range.

Smaller firms are often favoured, as they are generally seen as more nimble and agile, particularly in volatile market conditions.

“Clients quite like the fact that we may introduce lesser known names to them, alongside very well-known ones,” says Delyth Richards, head of investment solutions at Kleinwort Hambros, rebranded last year after the merger between Kleinwort Benson and SG Hambros.

Of Kleinwort’s ‘high conviction universe’ of 60 funds, which attract the majority of inflows, around 20 per cent are smaller boutiques and 80 per cent larger brands. However, the 10 per cent cap in any fund ownership drives the UK bank, which runs £16bn ($20bn) across mainly discretionary portfolios, to prefer funds with a minimum of £500m ($620m) in assets.

Top picks

PWM’s fund selectors have selected 160 different funds from 90 different fund houses over 12 months to the end of February 2017

Performance promise

“The brand of the fund house is unimportant when selecting managers or funds,” states Lee Gardhouse, chief investment officer at Hargreaves Lansdown Fund Managers, the UK’s largest direct-to-consumer fund platform with £70bn in client assets.

“Conviction in the future performance of the fund is the most important factor in the selection process.”

If two fund managers have equal potential, then prices come into play when drawing up his ‘Wealth 150+’, the list of favoured funds made available to UK investors. In many cases low charges are exclusive to HL clients, obtained thanks to scale.

Countering the widespread belief that a large fund house brand attracts retail money, Mr Gardhouse states that it is rather the asset class or the fund manager that is appealing.

The biggest brand in the UK is fund manager Neil Woodford, he says. The UK equity income fund managed by Mr Woodford is the largest fund on the platform, other than the firm’s own 10 multi-manager funds, which represent about 20 per cent of total fund assets.

In a boutique it is easier to find a manager who has “the ability and willingness to take a big enough view against the market to be able to deliver significant levels of different performance to the index,” says Mr Gardhouse. In big investment houses, fund managers are generally asked to maintain a low tracking error or take relatively small bets relative to the index.

While PWM’s top 10 brands have remained unchanged compared to last year’s analysis, there is less money allocated to these big names, with a trend to allocate assets across a broader range of houses, up from 70 to 90.

Fund selection

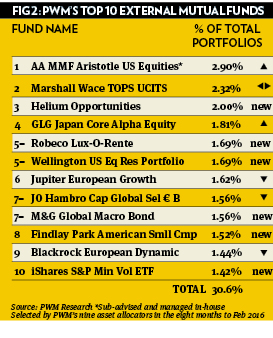

What has changed most is the composition of the top 10 underlying funds manufactured by the leading houses and chosen by our selectors. Indeed, from a universe of 160 different funds selected, the 10 most popular picks have acquired a significant new look (see Fig 2).

Two of the six new entries are US active equity funds, Wellington US Equity Research Portfolio and Findlay Park American Smaller Companies. Allocation to these as well as AA MMF Aristotle US Equities – a fund sub-advised and used by ABN Amro Investment Solutions, and also selected by FundQuest – was boosted by positive outlook for the US equity market, which attracted the most inflows.

More than 15 per cent of total assets we tracked over the past 12 months headed for the US, as the stockmarket surged, driven by improving economic fundamentals and president Donald Trump’s promises of tax cuts and infrastructure spending.

Moreover, the iShares S&P Minimum Volatility ETF jumped 40 positions to 10th, a clear sign of the increased use of passive vehicles, particularly in efficient markets such as US large caps.

Fund Buyer Focus Top Brands

1. BlackRock

2. JP Morgan

3. Fidelity

4. Pictet AM

5. Schroders

6. Invesco

7. Deutsche AM

8. Nordea

9. M&G

10. Robeco

Thanks to iShares, which attracted €26.6bn of net sales in Europe, BlackRock held its top position of best-selling fund promoter for 2016 too, with net sales of €46.7bn, well ahead of Aviva (€22bn) and Nordea (€18.3bn), according to Thomson Reuters Lipper.

Even if we exclude iShares, BlackRock still retained its number one slot in the cross-border and boutique brand rankings in the latest Fund Buyer asset management research study for Europe. JP Morgan and Fidelity in second and third, also maintained their positions.

However, it was the mid-sized brands that “vied for attention with product flavours that paid brand dividends,” dislodging some established groups from the top 10, explains Ms Mackay at Mackay Williams.

Geopolitical uncertainty and volatility fuelled a huge appetite for mixed asset funds, and firms such as Nordea, appreciated for its investment strategies, and its stable return fund in particular, jumped 14 positions and raced into the top 10, ousting Franklin Templeton from fourth, joining Europe’s elite top five for the first time.

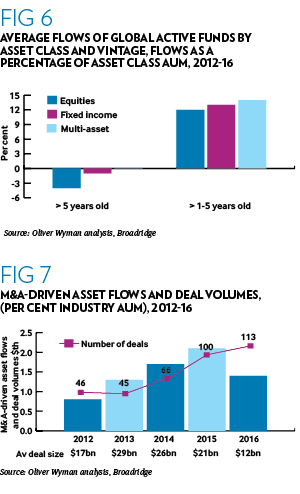

“The disruption in the brand ranking is due to the change in appetite,” says Ms Mackay. There is undoubtedly a long-term trend for wealth managers and fund selectors to hold mixed asset funds in clients’ core portfolios, as these are seen as offering “diluted access to the equity markets”.

But in the satellite part of the portfolio, the preference goes to funds in more niche areas. This trend favoured firms such as Pictet Wealth Management, known for its thematic and niche products, which advanced six positions in the Fund Buyers’ ranking.

Former glories

Innovation and client focus were the drivers behind the rising groups, displacing managers without replacement products for their fading blockbuster funds.

“There are a lot of big funds living off their past track records,” says Gary Potter, co-head of the F&C Investments multi-manager team, BMO Global Asset Management, stating “a long preference and bias for smaller funds,” and comparing large funds to clumsy supertankers.

“The bigger the ship, the harder it is to turn around, however good the ship.”

Boutique houses, he believes, tend to produce “much better, more consistent investment returns and smaller funds are more nimble, particularly in volatile times”.

Unlike banks running model portfolios, where compliance teams dictate the rules for fund selection, in terms of minimum track record, fund size, and countries where it is registered for sale, the firm has no such restrictions. And in some cases, BMO Global Asset Management’s Multi-Manager team own the entire fund.

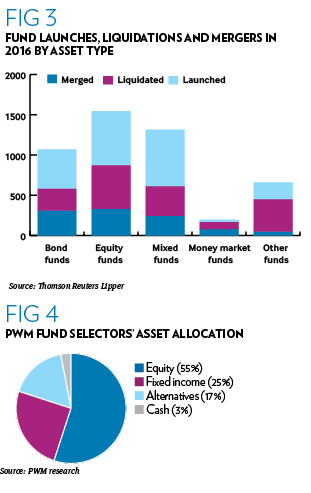

Rising M&A activity in the industry, which often leads to fund mergers, is not that positive for fund selectors, believes Mr Potter. A bigger fund size can negatively affect performance, and be frustrating for managers, leading them to leave.

“One of the by-products of M&A is that brighter, talented managers move off to smaller businesses,” says Mr Potter.

“Increasingly, there could be lots and lots of money tied up in very big funds that don’t perform well, because talented managers have left. Ultimately the client is the one that suffers.”

Don’t panic

However, before making panic-withdrawals from funds, following the announcement of mergers, it is important to assess potential consequences.

“A merger is something we pay great attention to,” says Stéphane Pouchoulin, CEO at FundQuest Advisor, pointing to how crucial it is for players involved in the deal to address any potential operation, IT and infrastructure issue.

It is also vital to monitor any changes in the leadership of portfolio management of funds affected by the merger, if held on the platform.

“Generally we have strong opinions on who will take the lead in portfolio management in a merger, on a fund by fund basis,” he says.

Informing clients about these expectations is also important and branding is also a key question to address, adds Mr Pouchoulin.

“Very often in asset management mergers, it all falls apart because the culture is so different,” says Ms Mackay.

The big firm's view

A big asset management firm is not necessarily bureaucratic. On the contrary, it is better equipped to deal with uncertainty and volatility than a small company, because it is able to rapidly deploy resources in any space, when needed, claims Massimo Greco, head of European funds management at JPMorgan Asset Management, which manages $1.7tn in client assets globally.

“You can be large and entrepreneurial and flexible at the same time,” he states, explaining the firm’s portfolio managers invest their own money in the strategies they manage. “Being small often means running things on a shoestring, and not being able to adapt efficiently to a changing world.”

Also, managing a big fund does not necessarily lead to a deterioration in performance, and it really depends on the asset class, he explains.

“We take a rigorous approach to liquidity management and capacity in our funds and we always put clients’ interest first as opposed to the growth of the fund and associated revenues,” he claims. “We have a history of closing our funds to subscriptions early, to avoid any issue of deterioration in performance, due to size,” he states, explaining the firm’s focus on managing liquidity risk too.

Some of the firm’s big and successful funds have been around for a long time and continue to have inflows. The JP Morgan Global Income, launched in December 2008, a global multi-asset income strategy running almost €19bn ($20bn) in assets, has continued to be popular with European investors, thanks to its performance, he says. Size does not appear to be an obstacle for this global multi-asset fund, says Mr Greco. “There are a lot of small players trying to imitate us without any success.”

Over the past five years to April 5, 2017, the JP Morgan Global Income fund generated a total cumulative return of 34 per cent, measured in euros, versus the category average of 29 per cent, according to Morningstar.