Principal Global Investors senses opportunity amid sub-advisory surge

Nick Lyster, PGI

The bulk of Principal Global Investors’ future growth will come from HNW individuals, says Nick Lyster who runs the US firm’s European operations, with private banks’ renewed appetite for sub-advisory partners a prime target

With European private banks increasingly choosing to sub-advise the management of client assets to specialist investment firms, a significant distribution channel for asset managers is opening up.

This is particularly appealing to US players like Principal Global Investors (PGI), which more than 10 years ago started a strong push into the old continent to increase the company’s share of third party assets.

“We saw a real growing business in sub-advisory last year, and recently we have been in a lot of sub-advisory searches from wealth managers and private banks,” boasts Nick Lyster, European CEO of PGI, the Iowa-based multi-boutique firm which manages $343bn (€308bn) in global client assets, of which $12bn have been sourced from Europe.

The growth in fund management delegation has been partly driven by regulation such as the retail distribution review (RDR) in the UK, which has banned retrocessions and brought a focus on fees and transparency, and also, in Europe, by expectations that MiFid II will ban kickbacks from 2017.

Creating their own fund, and delegating the management of assets to specialist investment firms, is an effective way for private banks to overcome the challenge of having to charge clients to give advice, as it allows the embedding of an advisory fee within the product.

If this is the more cynical explanation for sub-advisory growth, a higher level of control on products and client base is also a key driver, believes Mr Lyster.

Through sub-advisory arrangements, banks can overcome concentration risk in funds. This usually prevents them from investing in small, specialist funds. “Moreover, they will have a lot more control over the investment guidelines and design the product exactly to their specifications,” he says.

Control over the quality of the fund is greater, particularly when changing managers, as it avoids the headache of moving clients to the new recommended fund, often a time-consuming and ineffective operation.

“If you lose control of your client base, in this world of compliance, it is a real concern. Control over your clients is important,” warns Mr Lyster.

Sub-advisory can also be a way for private banks to differentiate themselves, as long as they are able to award mandates of a certain size, generally believed to be in the $50m to $100m range, depending on the asset class.

Private banks have typically placed emphasis on finding ‘best of breed’ managers, but these are usually the top performers. As a result, all institutions tend to offer the same funds and managers, with little differentiation in strategies.

“I think we are going to see more differentiation in how private banks approach the asset management side,” says Mr Lyster. Some may decide asset allocation is not their core skill and instead “work closely with one or two probably large global asset managers,” he ventures.

The firm has grasped deals to manage money for a handful of major European banks, including Credit Suisse, Barclays, ABN Amro Neuflize and Mediolanum. Investment mandates include global and US high yield, Asian and global emerging market equities, as well as global unconstrained bonds, which are benchmark-free.

“We are going to see a lot more of unconstrained fixed income products, as there is going to be potentially a blood bath in fixed income, or at least a lot more volatility,” says Mr Lyster, and the recent sell-off in global bonds may be an anticipation of that. “These instruments are useful to make fixed income work in the next five years of either rising rates or fears of rising rates.”

If the firm is seeing “bigger volumes” in sub-advisory, distributing off-the-shelf funds still remains critical. “The bulk of our growth in the future is going to come from the HNW space and maybe mass affluent as well, either through funds or sub-advisory,” he explains, reporting that some of the firm’s funds have been put on “approved lists” of private banks.

“For a client, going to one organisation and having the possibility to have so many different discussions is quite attractive,” he says. “And the idea there is a big firm behind the boutiques is something that reassures clients, particularly since the financial crisis.”

When approaching wealth managers and private banks, the firm’s strategy is to focus on a few specialised, unique funds for “real value add”. These may include the preferred securities fund, one of the firm’s oldest funds in Europe, set up in 2003 and today running around $1.7bn in client assets.

In the current low yield environment, the product has drawn investors’ interest, “as it offers good yield, being mostly invested in investment grade”. This is also a space where PGI does not have strong competition, claims Mr Lyster.

The short term high yield fund managed by one of PGI’s boutiques, Post Advisory Group is also appealing to investors, he says. Another fund that he says has gained traction, particularly in private banking channels, is the long-short emerging market debt fund, managed by Finisterre Capital. The Ucits fund was launched on PGI’s platform in Dublin, after the global firm acquired the hedge fund boutique specialised in EM debt one and half years ago. It has now gathered more than $600m in client assets.

If a fund can be in Ucits, then it should be, because that’s where the demand is

“If a fund can be in Ucits, then it should be, because that’s where the demand is,” says Mr Lyster, not hiding his disappointment with regards to private banks’ attitude towards AIFMD-compliant funds.

The Alternative Investment Fund Managers Directive is driving some alternative foreign managers away from Europe, he says. PGI too has taken the decision not to register some of its real estate funds in Europe, believing larger opportunities can be found elsewhere.

Principal has nine AIFMD-compliant funds on its Dublin-based Qualified Investors Funds (QIF) platform.

The whole asset management industry has gone through this lengthy process to be able to promote AIFMD compliant funds to sophisticated investors, including private banking clients. “And yet, private banks are being ultra conservative, mostly saying ‘funds have got to be Ucits’. But I think they are missing out on some interesting opportunities,” he states, feeling that the pool of investors in hedge funds and other alternative investment funds is “a lot more limited”.

The accidental multi-boutique

As the asset management arm of the Principal Financial Group, one of the largest providers of pension plans in the huge US 401(k) market for self-selected pension plans, PGI historically built its investment management capability for retirement clients, both defined benefit and defined contribution. But today its major growth is expected to come from activities as a sub-adviser in both the institutional and non-institutional space, with wealth management the fastest growing segment.

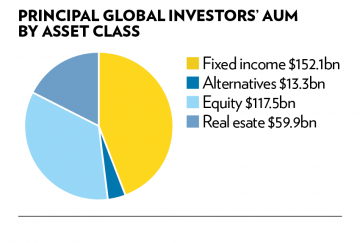

Although fixed income represents around 44 per cent of the firm’s total assets, equities have grown to a third of the pie, also thanks to the multi-boutique approach. The alternative space is one that PGI aims at expanding. Already the fourth largest US manager in real estate, in which it manages a total of $60bn (€53.8bn), the firm is looking to acquire capabilities in Asian and European real estate as well as in infrastructure, and is actively seeking managers in these areas.

Despite managing a wide array of income products, the fund house aims to further enhance income capabilities, particularly in the emerging market space, both in equities and fixed income and is on the look-out for suitable managers. “In the next 20 years, there is going to be a wall of money looking for yield,” suggests Mr Lyster, with trillions of dollars expected from US retirees alone.

PGI comprises nine external boutiques and five “organically grown”, although they are all regarded as “equal” by management, he says. “We probably got into multi-boutique by mistake,” admits Mr Lyster. “We found this small company we liked, and enjoyed the experience with them,” he says, referring to Spectrum Asset Management, which runs preferred securities, acquired by PGI 15 years ago. Today Spectrum manages more than $18bn.

PGI looks to buy up boutiques whose capability can complement existing capabilities or add new ones, in order to meet client needs. These firms have to be “fully resourced”, handling between $1bn and $2bn in assets, with the objective of growing them to $20bn.

In a multi-boutique model, advantages outweigh disadvantages, believes Mr Lyster, but ultimately “there is no right or wrong business model for how to organise an asset management company. The key is how you implement it. It all comes down to communication.”

The multi-boutique structure allows managers within each boutique to focus on managing money, aligned with interests of the clients, he says. Each boutique has its own CIO and remuneration package, approved by the PFG board.

“Tapping into a shared distribution network” is a key driver for boutiques to join a larger firm, while the multi-boutique model allows a large asset management firm to manage capacity, with positive impact on returns, says Mr Lyster. For example, PGI owns three different high yield managers.

“In the active management space, scale really hurts performance, and yet on the distribution and operations side, there are economies of scale.”

If Principal is the brand for the wider market place, all these different boutiques have a reputation, “which is important, but typically in quite limited market segments,” he says.