New concepts with a health warning

Innovative products can help clients to achieve their objectives and manage risk, but many are viewed with cynicism and have a long way to go to shake off the image of being little more than fee-generators

Despite some encouraging pockets of sales in Asia, it is becoming difficult to raise a smile among Europe’s fund houses. Most are struggling to keep afloat against the unpredictable currents of macro and policy-driven stockmarkets.

June saw a reverse of earlier positive trends, with €25bn in investments redeemed across the continent in that month alone. With concern about markets heightened amongst investors, the laboratories which were once regularly spinning out new versions of old products, emulating innovations in laptops, ’phones and computer games, are now entering an extended go-slow period.

Watchers fear mass redundancies among funds staff at UBS could be repeated elsewhere and that some smaller, specialist houses could shut up shop for good. In this gloomy climate, innovation has a bad image, with confidence in both equity and bond markets currently at or below levels last seen at the time of the Lehman Brothers collapse back in 2008, says Robert Parker, senior adviser to Credit Suisse and a fund industry veteran.

Few assets have performed for investors in 2008, with the exception of the Swiss Franc, gold and a handful of other commodities. Increasingly popular exchange traded funds (ETFs) can also prove dangerous in the wrong hands. “If you have a market panic, it is always going to be more significant with high levels of liquidity,” warns Mr Parker.

This sense that latest inventions can have a negative influence is commonly held, with new-fangled ideas regarded with more than a touch of cynicism. Says Mattia Nocera, CEO of Belgrave Capital Management, which oversees €6bn for its parent Swiss Banca del Ceresio Group: “The real issue with innovation is about private bankers and asset managers asking: ‘How can we find a different way to charge a client some fees to manage their money?’”

Principal protected structured products, posing innovative structures and pay-offs, have really been used as a device to help the banks hold onto clients’ assets in times when customers are chasing liquidity, he believes.

“Many have five to seven year structures, which you just can’t get out of and you can only make money at the end of the period,” says Mr Nocera. “But whoever sold the structure is making money for themselves during those years, as they have locked clients in for a long period of time.”

Hedge funds have often been tarred by the same brush as structured products, because their liquidity has been restricted by managers, many of whom are motivated by a quest for quarterly performance fees, believes Mr Nocera.

Although hedge funds have proved innovative in the way they can smooth returns in portfolios by protecting downside risk and anticipating rising markets, investors have reacted against them by flocking to ETFs. “When the reaction came to lack of liquidity, it was through super-liquid ETFs which can be bought and sold every day,” he says.

“But stocks are also easily tradeable. The difference is that an ETF is strapped into a product with an extra fee for someone who manages it. To me, there is something intrinsically wrong with the concept. An index is passively constructed. But shouldn’t you really just buy the good stocks and avoid the bad, both of which change over time? We are essentially believers in active management.”

Innovation has been responsible for some of the failings of the financial industry, particularly in the structured products arena, believes Jervis Smith, head of clients for Global Transaction Services at Citi, with these crisis-era mistakes likely to recur in the long-term. “Human greed led manufacturers to conjur up triple A ratings from packaging lots of triple B products like CDOs,” he reflects.

“We are already seeing some of these excesses repeat themselves in structured and synthetic products.”

There is no problem in using derivatives as part of the product architecture in investment strategies, says Mr Smith, providing the derivative market is always dwarfed by the underlying market. “That is where the risk of synthetic ETFs lies. Derivatives are being bought on a market which is not big enough to hedge the positions.”

In particular, investors have become very suspicious of some of the more cutting edge structured products, built on less liquid underlying investments, says Mr Parker at Credit Suisse. “Since 2008-2009, they have began to avoid anything opaque and prone to illiquidity, as when there is sharp market movement, they cannot price it.”

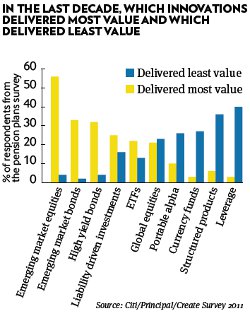

Amin Rajan, CEO of Create Research and author of a 2011 report Investment Innovations: raising the bar, also believes structured products are an example of an innovative trend which has transformed the industry in a negative way.

“Structured products have the seductive appeal of asymmetric returns, protecting the downside, while delivering the upside,” says Mr Rajan.

| Margaret Harwood-Jones, BNP Paribas |

“But investors should know that comes at a price in terms of charges and guarantees that are not what they are cracked up to be.”

He cites the example of the recent generation of products offering downside protection should markets fall by more than 50 per cent. “But what if they fall less than 50 per cent? That is still a 4 times standard deviation event. There is no point in having a product to protect this when you have mean reversion and markets tend to bounce back, as they did in 2009.”

The most important recent transformational innovation of all in asset management, says Mr Rajan, has been liability driven investing (LDI). “Most supposedly new products such as emerging market bonds and ETFs are just derivatives of existing asset classes. LDI is a breakthrough innovation, as it enables institutions, such as pension plans, to look at their investments in a different way.”

Clients of investment managers can run two separate portfolios, one of them to immunise themselves against unrewarded risks such as interest rates and currency fluctuations, and the other to enhance their returns. “This is how investment should always have been, but it only came about as a result of the crisis,” says Mr Rajan.

The next round of innovation, he believes, will see these initially institutionally oriented techniques spreading into the wealth management market, as the responsibility for retirement planning is increasingly taken on by individuals and their families.

The US trend for these target return accounts, designed to match liabilities, will eventually take root in Europe too, says Mr Rajan. “With a target date fund, once you have hit the target date, you need to immunise the portfolio. We are at nascent stage with these strategies, and I can’t see why they won’t work in Europe.”

To operate successfully, the research from Create shows these products must have a dynamic glide-path, switching easily between equities, bonds and other asset classes over the cycle of the investment, depending on the market environment.

Stop-loss mechanisms are vital to protect against market events such as those which occurred in 2008 and more recently during the summer of 2011. Also, once the account gets into target range, the assets must be locked into cash or bonds to meet forthcoming liabilities. Once the target payout, typically around $1m, has been reached at retirement and contributions stop, the plan will be spread across annuity purchases and retirement drawdowns. Once such a product has been designed and introduced in Europe, it will cause massive ructions in the life insurance industry, believes Mr Rajan.

“There is no insurance company in the world that can underwrite annuities at the rate which these products envisage,” he says. Building a stop-loss mechanism will also prove an expensive business.

“The path to innovation in the DC space will not be a linear one,” says Mr Rajan, who nevertheless expects such dynamic asset allocation products to dominate the retirement savings market by the end of the decade.

Europe’s fund management heavyweights, such as Mr Parker, long ago identified the DC space as one for expansion, but are still reluctant to put massive resources into these ‘lifestyle’ products. They remain unconvinced of whether the European public will be seduced by them.

Truly innovative trends in asset management have not come in the area of product design, but rather in methods of investment, valuation and the opening up of new markets, believes Mr Parker. “It is fair to say that product innovation has temporarily taken a back seat. But investment process innovation never takes a back seat. We are constantly trying to add economic and capital market indicators to get this right.”

Global asset allocation is far more influenced today by capital flows than 10 years ago. “Traditionally, a lot of what we did was valuation based. We always used to ask: ‘are equities cheap relative to bonds?’ Now everything is about multi-factor models, with more macro-economic input. Over the next three months, valuations will become almost irrelevant, as the market becomes driven by macro factors, such as credit and default risk.”

The development of these techniques in asset allocation, to include a raft of new technical, capital flow and policy-based indicators is an huge plus for new multi-class systems of asset allocation, which have sidelined investment consultants and given the largest fund houses a new role in deciding investment policies, believes Mr Parker.

Much of the innovation in business models, he believes, has been taking place in the developing economies. He commends the role of asset managers and private banks in introducing local currency debt funds, replacing the hard currency products of old, in emerging markets.

“Western asset managers like us and JP Morgan have been trying to set up businesses in the emerging markets. This has been the theme until now,” says Mr Parker.

“But over the next five years, we will see the emergence of world class asset managers from emerging markets into our part of the world. HDFC could move from being an Indian house to an Asian house. Renaissance, the big Russian player, moving into Africa, will also be an innovator to watch.”

At BNP Paribas Securities Services, Margaret Harwood-Jones expects to see a similar trend among her wealth and asset management clients, with “a surprising number” of Chinese managers keen to set up fund structures in Luxembourg.

“We are spending a lot of time thinking and talking about how managers from Europe can generate success in Asia,” she says.

“But it is very interesting to see major Asian asset managers, regional players, showing that they have global ambitions. If they are going to succeed in Europe, they need to know how to get access to wealth managers, which platforms do they need to be on and which types of products work in particular markets.”

Investment Innovations: Raising the Bar is available free to PWM readers on www.create-research.co.uk

View from the back office

The European mutual fund industry, particularly on the retail side, generally revolves around putting a “new spin” on old themes, argues Jervis Smith at Citi. “In some of the markets, like Asia, you have to do that. But on the institutional side, the winners will be those who provide solutions to problems.”

Looking at bulk-scale assets management, large firms are advised by Mr Smith to “stick to their knitting”, while there is an understanding that it is difficult for many distributors to attract new assets or customers without some shiny wrappers to their product range.

“On the retail side, there is always an inclination to launch new products. There is not much net new money around in mutual funds. To say to people ‘stick with what you are already doing,’ in the face of outflows, can prove problematic. It is very difficult to go down with your ship rather than launch something new.”

Immediately after the 2008 crisis, the European financial services industry went through a period of product simplification, following clients’ demands, but many providers are already going back to their old ways, believes Margaret Harwood-Jones, at BNP Paribas Securities Services.

“You are not getting less complexity any more,” says Ms Harwood-Jones. “In fact you are getting the same amount or more than before. But what you are getting, is a need for much greater understanding and transparency.”

Most products she sees have simply been copied from a group’s offering in another market and then adapted slightly for local needs, but often badged-up as a latest innovation. “Evolution rather than revolution is the core characteristic of the asset management industry,” she says.

PARKER’S POWER PLAYS

HOT SHOTS

STATE OF ART asset allocation techniques, based on multi-factor models, to included capital flows, interest rate movements, economic and political factors in addition to the stock valuations of old

EMERGING MARKET innovation, particularly debt products denominated in local currency, developed through partnerships with local companies, replacing the old hard currency bonds

NEW PLAYERS entering the market from a secure Asian base, such as HDFC from India and Russia’s Renaissance Capital, which can build on regional experience in private banking, asset management and capital markets to expand their reach into other developing and developed markets

PRODUCT DEVELOPMENT includes innovations in traded, insurance-linked investment products, where risk is taken away from the insurance company and an uncorrelated asset class is built

NEW FANGLED FAILURES

PORTABLE ALPHA: “It is a gimmick,” says Mr Parker. “The asset manager comes to you and you ask them for an equity portfolio against the FTSE 100. They can’t manage equities so offer you US credit and put a swap on top, to buy the FTSE and sell credit, adding extra risk. If you want equities, go to an equity manager.”

130/30 FUNDS never caught on because nobody understood or believed in them. Launched by traditional long-only managers trying to muscle in on what they thought was a lucrative hedge fund space.

COMPLEX ETFs Less transparent, illiquid ETFs cause problems, says Mr Parker. Underlying assets can be difficult to shift, despite being in an apparently liquid ETF wrapper. “Plain vanilla ETFs, on the other hand, are not innovative, but a very good vehicle.”

Robert Parker, senior adviser to Credit Suisse