M&G reports huge appetite for multi-asset solutions

Jonathan Willcocks, M&G Investments

Multi-asset funds are proving increasingly popular among investors looking to diversify away from bonds and boost income, claims M&G’s Jonathan Willcocks, while Europe is expected to become the next sub-advisory battleground

News that M&G’s flagship Optimal Income fund, one of Europe’s largest bond funds with a strong nine-year track record, suffered €3.8bn of redemptions in the second quarter of 2015, seeing its size shrink to €29.6bn, leaves Jonathan Willcocks, global head of retail sales at M&G Investments, surprisingly upbeat.

Redemptions from the flexible bond fund, which has a wide investment remit in bonds, but also in equities, for up to 20 per cent of its total assets – were mainly driven by underperformance against its peers. Returns were hurt in the first part of the year, as manager Richard Woolnough took the decision to shorten duration to interest rates, in preparation for rate rises that have not yet materialised.

European government bonds saw sharp yield compression following the ECB’s announcement of quantitative easing at the beginning of January, and price increases benefited competitors with longer duration, explains Mr Willcocks. However, since the end of April, yields have been backing up again, wiping out bond market gains. More recently the relative performance of the fund has recovered against its peer group.

The fund has also faced criticism over its ballooning size, which affects equity returns.

Further reading

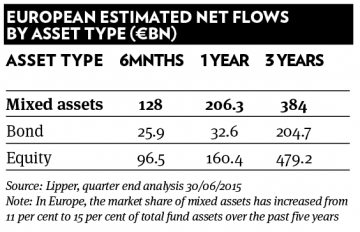

But there is also a more structural reason for the heavy outflows. Investors are clearly moving into multi-asset solutions, says Mr Willcoks, and particularly those providing an income.

“Having had this tremendous run in fixed income over the last five to six years, with rates now at record lows, investors feel they need to diversify and gain exposure to other asset classes,” he explains. “Also, they want a long-term income stream that is going to grow over time to keep pace with inflation.”

With life expectancy having increased dramatically over the past decades, investors have realised both capital and income need to keep pace with inflation in the retirement period, which can last more than 20 years.

“Moreover, those who in the past bought flexible bond funds out of cash, often do not have the risk appetite to buy a pure equity income fund and would much rather buy a half-way house,” he says. “This explains the huge increase across Europe for all fund groups in multi-asset and increasingly in multi-asset income products.”

The UK-based international asset manager, which is owned by Prudential, runs £256.5bn (€361.2bn) of funds in equities, multi-asset, fixed income, real estate and cash for clients across Europe and Asia. The fund house offers a range of multi-asset Ucits products for cross-border distribution, investing in equity, fixed income, currencies and convertibles. The non Ucits retail schemes (NURS) in the UK also invest in property directly.

The multi-asset funds have different levels of equity allocation limits, ranging from the maximum exposure of 60 per cent of the Dynamic Allocation Fund to the 30 per cent of the recently-launched Episode Defensive Fund.

The most popular of the range is the Income Allocation Fund, which invests 30 to 35 per cent in stocks.

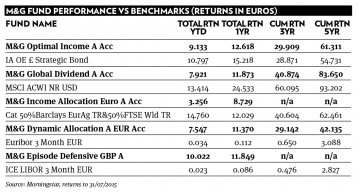

“We have started to see tremendous success in our Income Allocation funds. Indeed we have seen a number of investors switching into them from the Optimal Income fund,” says Mr Willcocks.

The M&G Income Allocation Funds are designed to generate an annual income of 4 per cent, and grow this over time. This feature is particularly appealing for the baby boomer generation, which owns 75 per cent of the investable wealth in Western Europe, reports Mr Willcocks.

Born between 1946 and 1964, the baby boomers started to retire in 2011, while those born in 1964 will not start to retire until 2029. Demand for this type of product will last for the next few decades, he says.

Also, demographic trends have driven investors’ demand for equity income growth funds since 2009, such as the M&G Global Dividend Fund, investing in companies delivering long term income growth, he says.

Distribution trends

The M&G Optimal Income Fund and the Global Dividend Fund have been two of the most selected funds by PWM’s panel of nine European fund selectors in the first half of the year. The unconstrained bond fund was the also the best-selling bond fund in 2014 in Europe, according to Lipper, with €7.2bn net sales.

Changes in distribution trends triggered by the global financial crisis have had a deep impact on products selected by private banks, believes Mr Willcocks.

Rather than just buying building blocks to use in their own funds of funds solutions as before the crisis, after 2008 many global private banks started striking partnership programmes with a limited number of fund groups, across all asset classes, demanding service on a local level, all over the world, and with a closer relationship.

“We signed up about 13 global private banks in distribution deals over the last five years, because of this big shift in trends, as bankers want to offer ‘best of breed’ products on a guided architecture list,” he says.

These banks include major global players such as UBS, Credit Suisse, Deutsche, BNP Paribas, SocGen, ABN Amro, BBVA, Santander and Intesa Sanpaolo. Products such as the M&G Optimal Income and Global Dividend greatly benefited from being placed on their guided architecture platforms, he says.

In the past year and a half, multi-asset funds have started appearing on those bank’s lists, notes Mr Willcocks. In particular, fund selectors in Europe, also including a couple on the PWM panel, are using the M&G Income Allocation Fund within their fund of funds range, he states.

While private banks have historically wanted to carry out the asset allocation themselves, if the fund delivers an income, the fact that it is multi-asset becomes a secondary issue.

“Private banks may not buy a dynamic allocation fund, because it might replicate what they are trying to do, but we are seeing banks buying the Income Allocation Fund, because it is delivering a good income, which is used as a stable building block within the income fund of funds solutions,” he adds.

Also, many private banks in Europe are building out their own multi-asset teams, with most of these using funds or sub-advisory mandates from independent third-party asset managers. This offers the fund house the opportunity to continue to be a building block provider.

“I am seeing a massive growth in the retail sub-advisory market right now, and we are involved in a number of conversations with distributors on this topic,” he says.

Currently, M&G manages investments on a sub-advisory basis for the likes of mutual fund giants and pioneers Vanguard and Fidelity in the US. Mr Willcocks acknowledges that Europe, where these arrangements have yet to take off in the American fashion, could well prove to be the next sub-advisory battleground.

Regulation driving sub-advisory boom

The key driver to sub-advisory growth is uncertainty about the future regulatory landscape, believes Mr Willcocks. From January 2017, Mifid II is set to introduce a ban on retrocessions to independent distributors and fund management delegation would enable them to build the cost of advice within the product. But it is still uncertain how each local market regulator will define ‘independent’ and ‘restricted’.

Private banks will definitely want to have an independent proposition and offer a ‘clean’ share class, ie one stripped of trail commissions to distributors, as put forward in the UK under the Retail Distribution Review.

Retail banks, on the other hand, may choose to go down the restricted route. Many are beginning to build multi-asset solutions, which allows embedding the cost of advice within the product. This might prevent the unintended consequence of Mifid II, ie small clients losing access to financial advice, as happened in the UK under RDR. It is no longer commercially viable for an independent financial adviser to offer personal financial advice on an ongoing basis to end clients, explains Mr Willcocks.

Lack of access to financial advice for smaller clients is driving the growth of the robo-advice channel. But this works only for well known brands, he believes. “Brand becomes very important to get traction in the robo-advice space,” he says, explaining that he is going to focus on well known online platforms.

M&G’s direct book, offered in the UK since 1931, provides “a stable asset base”, but the firm has no plans to develop it further. “It is too early to tell whether we can expand this direct channel in the rest of Europe; we’ll have to see how technology develops and how the digital revolution goes through.”