Italian fund houses struggling to cope with foreign invasion

Italian fund houses are used to having free rein in their domestic market, but international firms are now a growing presence in the country. Yet both sides stand to benefit if they partner together

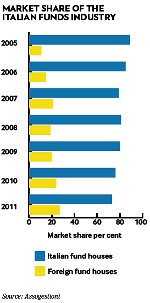

Italians’ long-standing love for foreign brands has certainly contributed to drive the growth of cross-border mutual funds in the country over the past few years, while the domestic industry has been suffering. But deeper reasons have led to the decline of the Italian asset management industry.

Apart from a few exceptions, such as UniCredit’s Pioneer Investments, or to some extent Azimut or Mediolanum, which are showing international expansion ambitions, Italian fund houses have always distributed their products through captive channels, enjoying a 15-year-long boom period to the year 2000. But many have found themselves lagging behind as competition from international houses increased and Italian distributors more and more opened their doors to foreign funds.

“Italian fund houses have lost their momentum and position because they have rested on their laurels,” believes Giacomo Campora, CEO at Allianz Bank, blaming senior management for their lack of pro-activeness and innovation.

Since the end of last year in particular, in the aftermath of the eurozone crisis, private investors moved away from funds to liquid instruments such as deposits and bank bonds offering attractive interest rates, as banks refocused their business model on direct money gathering, aiming at replenishing their balance sheets.

This trend was perhaps even stronger in Italy than in other European countries. Monetary and fixed income funds still represent the majority of total fund assets in the country and investors in these instruments are more likely to disinvest.

However, banks such as Allianz Bank, Banca Generali, Banca Mediolanum or Banca Fideuram that distribute through networks of tied agents, or promotori – an army of around 30,000 financial advisers in total in Italy – have traditionally been quite successful in selling funds, thanks to their advice-based sales model; and have helped boost the fund industry in recent times, especially of foreign brands.

“We had positive net inflows every year and never had net outflows during the crisis,” states Mr Campora. “But while the business of international fund houses, Pimco in particular, is significantly growing on our platform, assets managed by our domestic asset management firm, previously Ras AM, and other domestic fund firms that we distribute are contracting.”

In promotori networks, the growth potential for mutual funds is “very high”, he believes. “We are reaching only 10 per cent of the client base that may be interested in investment products, the market is not saturated,” says Mr Campora, stating that individuals become interesting when they invest at least €50,000 with the bank.

With €14bn assets in mutual funds, which represent 70 per cent of its total assets, Allianz Bank offers around 1,500 funds from 15 different fund managers on its off-the-shelf platform.

Reflecting a trend witnessed in the global industry, assets on the bank’s platform concentrate in few blockbuster funds. No incentive is given to advisers to sell any specific fund, stresses Mr Campora, but word of mouth has a viral strength in spreading the news about the success of a specific product.

At Allianz Bank, the top 30 funds in terms of assets under management represent 85 per cent of the total €14bn. The single largest fund is Group Allianz’s fund house Pimco Total return, euro share class, managed by Bill Gross, with around €1.5bn.

The majority of clients’ moneys on the open architecture platform are in various types of fixed income funds, from euro area to total return, as clients have a conservative risk profile. Multi-asset funds, balanced/flexible funds with an equity component are very popular, and some specific equity funds are also used in small doses. Income-generating products will increasingly be more successful, he says.

The marriage business

But the bank’s most innovative product offering is the unit-linked platform based on a more guided approach launched in 2009, where the 10 most successful asset managers of the bank’s mutual fund platform were each given a mandate to manage a multi-asset, flexible portfolio.

In this game, which puts each manager in competition with the others, there are few rules valid for all. The underlying funds must be the manager’s products, and there is 10 per cent limit to the average annual maximum volatility of the portfolio. The selected managers are big brand names including BlackRock, Carmignac, Franklin Templeton, JP Morgan, Morgan Stanley, Pictet, Allianz Group’s Pimco, Schroders, Swiss & Global and Allianz Global Investors. Each manager decides the asset allocation and the bank acts as a referee, explains Mr Campora.

The platform has gathered around €2bn, largely net new money, mainly over the two years up to August in 2011, when the eurozone crisis hit. Today, money gathering is still satisfactory, he says.

At the start, the money flows were evenly spread among the 10 managers, but then they have rewarded the best performers as time passed. “Money goes where there is performance,” says Mr Campora. The unit linked wrapper is efficient as the client signs only one contract and can switch to a portfolio to another, very quickly, with no fiscal impact or fee, he explains.

“We are in the business of marriage, not of love affairs,” he explains when talking about the bank’s partners. “The winning managers are those who have consistency of performance every year, over time.”

Sub-advisory is a growing trend in Italy, as distributors prefer to create their own bespoke offerings by delegating the management of client assets to reputable foreign fund houses. In 2010 Banca Generali too took the sub-advisory route in its multi-brand fund of funds Luxembourg BG Selection Sicav, created a couple of year before.

In addition to the existing nine compartments, where in-house professionals select in-house and third-party products, the bank gave a mandate to twenty-two international managers to manage twenty-six new mono-brand compartments of fund of funds in specific asset classes. The Sicav has gathered €5.2bn in less than four years.

“Clients have shown a remarkable interest in this initiative, even in complex market phases like the one we are going through, as the product offers diversification and flexibility,” says Piermario Motta, newly appointed CEO at Banca Generali. The bank manages around €25bn in total assets of which €17bn in managed investments.

“To respond to market volatility and economic-financial developments, it is necessary to implement a dynamic and flexible approach which makes it possible to identify and select the best expertise and take advantage of international market opportunities. The evolution of Bg Selection is consequence of the market evolution,” says Mr Motta, anticipating his plan in the next few months to add new compartments within the Sicav and appoint new international fund houses to manage them.

Mediolanum International Funds in Dublin has one of the largest sub-advised platforms in Europe and employs around 15 different international managers for a total of around €14bn in sub-advised assets which distributes through its promotori-based bank in Italy.

“International asset managers are selected for their expertise, longer track records and better performance,” says Oscar di Montigny, marketing and communication director at Banca Mediolanum. “The potential for growth for foreign managers in the Italian market is very high, but only through partnerships with local partners which enable to identify the right and bespoke solutions for end clients.”

Private banking units of the largest banks, such as Intesa Sanpaolo, UniCredit, Montepaschi, Deutsche Bank have also become an interesting channel of distribution for foreign funds over the past two to three years, as they have established strategic partnerships with international asset management firms.

“If you are successful in crafting those partnerships, you can get a significant market share,” says Sergio Albarelli, senior director for Southern Europe at Franklin Templeton. Seventy per cent of the €22bn in total assets that the firm manages in Italy is generated through retail distribution, banks and promotori. Within that, 20 per cent is through private banking. “The potential growth of mutual funds in Italian private banking is huge,” he says.

UniCredit Private Banking harmonised its open architecture approach across Europe by establishing strategic partnerships with 10 international fund houses, including Franklin Templeton, Pictet and BlackRock, as well as Pioneer Investments. Mutual funds represent 30-35 per cent of the total €86.5bn total private banking assets in Italy, explains Andrea Lacalamita, global head of product development and innovation at the pan-European bank.

Since the beginning of the year, around 75 per cent of the total €530m new money in funds has flown into preferred partners funds. These today represent almost 50 per cent of total fund assets. Funds include off-the-shelf funds, gestioni patrimoniali – Italian multi-manager discretionary private banking portfolios – unit linked products and the advisory platform MyGlobe launched in 2009. This platform was recently launched in Unicredit’s private banks in Germany in a version where rebates are given back to clients. The plan is to bring this feature to the Italian market, once some fiscal aspects and limitations of IT infrastructure are overcome, he says.

The advisory platform has helped boost mutual funds sales, as investors pay one advisory fee and perceive there is no conflict of interest when advisers recommend a specific fund, an exchange traded fund (ETF) or a security, says Mr Lacalamita.

Another measure the bank introduced at the beginning of the year also went towards the reduction of any conflict of interest with regards to financial instruments. The commission linked to selling Unicredit bonds the bank pays to advisers is now spread over time, whereas before it was paid upfront . “This initiative enables the private banker to select products exclusively in the client’s interest,” claims Mr Lacalamita.

“We are keen to increase mutual fund penetration, as this would mean higher recurrent fees for the bank, which is an advantage for the bank but also for the client.” When a bank has a stable source of income, its bankers can focus on advising clients, and will not be driven by any budget requirements, he explains.

Popular Products

Products that have been recently most in demand have been fixed income, buy-and-hold types of funds with a pre-defined maturity, such as the corporate bond fund launched for Unicredit clients with Goldman Sachs Asset Management and with Pioneer, says Mr Lacalamita

Total return or global flexible funds greatly appeal to retail distribution, but thematic funds are also popular, explains Luca di Patrizi, country head for Pictet Asset Management in Italy, which manages around €7bn in the country.

In Italy, 25 per cent of Pictet’s assets growth is due to thematic funds. “With thematic funds you can sell a story, an investment case. Water, bio-technologies or digital communications are all concepts that are easy to explain to the end client.” Moreover, they have generated good returns, with the Global Megatrend Selection fund returning 50 per cent in cumulated performance over three years to the end of April 2012.

On the fixed income side, emerging market debt in local currency, in which Pictet was a pioneer five or six years ago, has also appealed to the imagination of retail investors. “The lesson that traditionally domestic-focussed Italians have learned over the past three years is the importance of geographical diversification. Even in the retail space, demand for emerging markets both in equity and debt has been growing in recent years,” says Mr di Patrizi.

A few years ago the firm introduced a “high quality advisory investment service” similar to that offered to pure institutional investors, based on an updated analysis of correlations between funds.

“We spend much of our time talking about how to build an asset allocation and how to build a successful portfolio by using our funds but also our competitors’ funds,” he explains.

“Our approach is different from that of our typical Anglo-Saxon competitors, who have more a product push mentality. We prefer to have a more global approach.”

Distribution challenges

The recent tax legislation change introduced by the Italian government, which favours bank deposits over mutual funds, is not good news for the fund industry, but the main problem on the fiscal side remains the lack of incentive to invest for the long term, says Mr di Patrizi.

Italian authorities should introduce the concept of a tax that decreases gradually as the period of investment becomes longer. This would encourage people to invest for the longer term. “This is one of the biggest difficulties in Italy, because people tend to have short-term investment horizons,” he explains.

Compared to other European markets, the Italian market is more open but it is very dear. The retail distribution network is “one of the greediest” in the world, explains Mr di Patrizi. High rebates are a big issue, reaching 60-70 per cent the total annual management fees asset managers pay to distributors.

“Newcomers must be able to make big volumes rapidly; otherwise they find it difficult to survive,” says Mr di Patrizi.

A greedy distribution network is a challenge but Italian distributors, in particular private banks, are able to recognise quality, more than other European markets, such as France or Spain, states Franklin Templeton’s Mr Albarelli. “If a manager offers a combination of good products and services, they can gather assets in Italy.”

The firm has been successful in its two main core areas of expertise, emerging market equities and global fixed income and in adapting products to Italians’ conservative risk profile.

“Italian investors, even private banking clients, are pretty conservative and prefer not to have currency exposure risk,” he says. Euro hedged share classes, which Franklin Templeton introduced five years ago in Europe, are key for the Italian market and today they represent 40 per cent of total assets in the country. Italian investors’ interest in bond investments generating regular yields and euro hedged share classes explains the success of products such as the Templeton Global Bond and Total Return funds.

“The Italian market is open, sophisticated and really good for asset managers that have a strategy,” says Mr Albarelli. “There are no barriers to entry, as long as you are able to convince local distributors and end clients you have a valid value proposition.”

| Sergio Albarelli, Franklin Templeton |

The importance of brand and service

When liaising with financial advisers and private bankers, it is important they fully understand the quality of the brand and service, the concept of investing for the longer term and the consistency of an investment process, says Franklin Templeton’s Sergio Albarelli.

“If you do not convince either the promotore or the private banker about the quality of the brand, you do not sell.” But brand needs to go hand in hand with action to support clients, he says, explaining the importance of building a solid infrastructure to service the retail networks. This is the strategy that Franklin has put in place since it established its presence in Italy in 1994.

The same infrastructure is not necessary to serve funds of funds or wrapper account managers, but these channels, although being a significant part of the market, are not where the “big money” is.

“Clients are very quick in punishing you if you don’t provide good service, even if you are a top manager,” says Mr Albarelli, making reference to some “avoidable mistakes” in client service made by some asset management houses with a strong reputation during the financial crisis.

“You need to be proactive to make sure clients understand what is going on. This is the approach we adopted in 2008-2009. Our marketing documents in the six months between October 2008 and March 2009 doubled. We remained close to clients and we have acquired new clients because of this valuable service.”

Innovative marketing channels are also essential. “Website, videos with portfolio managers, conference calls, market material are more and more vital for the success of any asset manager in the country playing into the retail and private banking distribution networks,” says Mr Albarelli.

But the type of contact asset managers are allowed to have with promotori networks can be quite strictly regulated.

“We ask all our fund providers not to talk directly to our promotori,” says Giacomo Campora at Allianz Bank. “We do not allow any fund house to tell their own story. We do not communicate anything to the promotori that has not been approved by our compliance. Allianz Bank is ultimately responsible for how products are presented to our clients.”