Innovation adds sparkle to Perrier’s fund factory at Amundi

Yves Perrier, Amundi

Amundi CEO Yves Perrier prides himself on having instilled a highly efficient culture at the French firm, but regrets missing out on the purchase of Pioneer’s funds arm

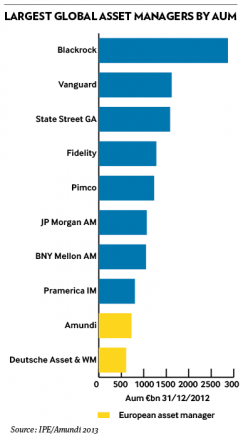

Like many CEOs, Yves Perrier is fond of statistics. “We are first in Europe and ninth in the world,” says the former semi-professional footballer who holds the top job at Amundi in Paris, overseeing €777bn in client assets from his 14th floor offices, offering commanding views of both Montmartre and the Eiffel Tower. Assets were up 5 per cent in 2013.

No sooner are we seated when he offers a staggering series of metrics about cost-income ratios, operating margins, asset growth and market shares. Those who know him in the highly paid village of French fund management – dispersed over the deep, yet still elegant south of Montparnasse, the developing hinterland around the Gare de Lyon and the soulless concrete wind-trap of La Défense – joke about his obsession with margins and running a fund management “factory”.

Mr Perrier does not fail to disappoint. His idol in his beloved sport is the extreme controller himself, creator of the ultimate football factory at Manchester United, Sir Alex Ferguson. He jokes that Sir Alex’s only fault is he was “not tough enough” with his players.

He even employs a “chief of staff” to make sure the fund house’s headquarters is run according to military-style precision, helping him in his ultimate ambitions to provide efficient investment solutions for both retail and institutional markets and to make sure the products get into every tentacle of the associated distribution networks – Société Générale, Crédit du Nord, Caisses Régionales and LCL – throughout France and third party banks abroad.

After being appointed CEO of Crédit Agricole’s funds arm in 2007, he carried out an unpopular, often tetchy merger with Société Générale’s asset management house to create Amundi in 2010 and insists he instilled a new culture in the group, rather than amalgamating old values and customs.

“Amundi does not resemble either Crédit Agricole or SG culture,” he barks affably, despite joint ownership by the two banks. “The culture of Amundi is about an asset manager which in some parts looks more like a traditional UK manager with a strong domestic platform and ambitions in Asia.”

The more unusual aspect, he says, is that his staff can cook up traditional investment funds, mechanised ETFs and often controversial structured products all under one roof. He also talks about tailoring offerings separately for mass affluent clients within branch networks. “Their first objective is not to earn money but not to lose it.”

A “deluxe” version of the platform is offered to wealthier private clients, “looking more for alpha”. This is very different from most dis-intermediated groups, which seldom talk about end clients and their needs.

There is also a strong belief from Mr Perrier, that not only can he exploit these channels to the max through setting up the slickest production line in Paris, but that he can also combine industrialisation with the personal touch.

Again, he begins to rattle off more stats than you can shake a stick at: the world’s second best cost-income ratio of 53 per cent against an industry average of 70 per cent; plus a low cost of production in relation to size of assets. “This makes us the most competitive in the world. We have clearly succeeded in the containment of costs,” he boasts.

But what is the evidence that he has managed to innovate at the same time? Back in 2008, he had no involvement with ETFs, but now Amundi ranks fourth in Europe, when it comes to selling these cheap and cheerful passive products, he says.

“We had the capacity to enter the market when others did not because we have the teams,” he says. “People and the efficiency of the organisation are key to innovation,” while Amundi also represents 18 per cent of Europe’s guaranteed products market.

People and the efficiency of the organisation are key to innovation

The ETF manufacturing and distribution machinery is just beginning to get fired up, he says, with bulk business the aim. Amundi has secured a massive order from a Japanese client to invest potentially tens of billions into the French group’s ETFs and Mr Perrier hopes enquiries about active European equity strategies will follow. Amundi’s high yield funds have also been big sellers in Japan.

“When I used the word industrialisation in 2008, people were saying ‘he does not understand the funds industry’. This was especially true in France, where industry has connotations of a lack of glamour.”

But rival French groups are now looking to ape the Amundi model, he claims. He dismisses the notion that cost-cutting and a factory-led mentality are enemies of innovative product development. “You need both parts. Productivity is a condition of development; they don’t oppose each other. If you are not lean, you don’t run fast,” he suggests, adding that his approach has led to €10bn in new money last year, compared to outflows of €25bn experienced by one of his key French rivals.

Key growth priorities for Mr Perrier are not however on troubled home turf, where his bank networks bled €10bn last year from mutual funds into higher-yielding balance sheet-linked products, but in Italy, Belgium, the Czech Republic and India. “We are building the equivalent of SocGen in France, but outside France,” he claims, with inflows of €2bn from foreign private banks alone during 2013.

He has also decided to exit areas of questionable activity, going against the advice of some of his key lieutenants in the group.

The main decision was about being in hedge funds, which the group closed down in 2009, due to a view that the financial crisis, with its gates and side-pockets, was leading to an adverse reaction from clients, which Amundi could not afford to accommodate.

“There was a lack of transparency in all these hedge funds based offshore and we felt it would be unfavourable for us to continue to work with this type of business,” says Mr Perrier. “In Amundi, the major risk you manage is a reputational risk. We were one of the first to make this move. Some of our internal teams were not in favour of this, but now everyone realises we are right, as experience demonstrates this.”

Some things could have worked out better and he regrets his failure to purchase the Pioneer funds franchise, available for an extended sales window in 2011, although the Italian house may yet be hawked around potential buyers once more.

“Pioneer would have been a very good deal and we found significant synergies,” he says. “They would have re-inforced us in Italy, Poland and Germany, but it was not possible due to the Italian Central Bank.”

A recent acquisition of Smith Breeden, adding €4.7bn in assets, has brought Amundi expertise in dollar-based fixed income management. “We can sell this to all our distributors and third party clients in Asia and the Middle East, where three quarters of institutions are denominated in US dollars. The potential leverage of this is huge,” he says.

Although there are some groups he would like to acquire, there is more than one lucky escape he also likes to talk about. “I have done 10 deals in my life, having looked at 100. All the deals I didn’t want to do, despite their advice to do them, are my biggest achievements.”

The one that particularly sticks in his mind is the decision not buy TCW from Société Générale in 2012. “Each day I congratulate myself that we did not do that deal,” says Mr Perrier, much to the amusement of his entourage in the immaculate Amundi building.

“TCW was not a company, but a sort of hotel for some star investment managers. It had value for the people, but not the shareholders.”

Unlike some CEOs, who like to predict flow trends two years in advance and build products accordingly, Mr Perrier says a successful group must maintain a constant range of products, fitting the needs of all clients.

“When I joined the group, I was very surprised how people would create a fund and push it through the network,” he says. “I used to say: ‘Yes, this is interesting, but is the client interested in this product?’ The whole organisation of Amundi is now dictated by clients.”

This extends to having a sample panel of 100 retail customers, who are quizzed prior to the launch of any new mass market products. “This is all part of the industrialisation of commercial activity,” says Mr Perrier, who embarked on a huge rationalisation plan, slimming down unwieldy product ranges since 2008.

“One of the problems of retail networks is that nobody is able to understand all the products,” he says. “Now for each network in France, we have a range of not more than 10 products.”

But despite the often entertaining, verging on ostentatious comments from Mr Perrier, there is a lot more for him and his peer group to achieve, says the CEO of a competing funds house in Paris.

“Yves has done a very good job and is one of the few who completed a successful merger between the asset management divisions of two banks,” says the rival. “But we are still waiting for step two. If you want to grow in the US, Asia and all over the world, like he claims, you have to be a listed company in order to finance that ambition. He bought Smith Breeden in the US, but that is such a small piece. As a whole, the French asset management industry is losing market share and has fallen way behind the Anglo-Saxon model. Yves still has something to prove.”