BlackRock’s boots on the ground build local presence

Alex Hoctor-Duncan, BlackRock

A recruitment drive in its growth markets is allowing BlackRock to build partnerships with more domestic firms, according to Emea boss Alex Hoctor-Duncan, while reporting rising demand for products offering income

Raising awareness of the value of saving and investing for the long term is high on the agenda for Alex Hoctor-Duncan, head of Europe, Middle East and Africa Retail business at BlackRock, the world’s largest fund manager, running $4.72tn (€4.23tn) in total assets.

Technology can play a key role in achieving this goal, he says, as long as it is used appropriately. “So far, technology has created an environment where spending gives people instant gratification, but it has not done the same for saving,” says Mr Hoctor-Duncan, a 18-year veteran of the firm, having led the sales efforts in Emea and the UK before landing this newly created role in 2009.

Booking a holiday or buying online on web-sites such as Tripadvisor or Amazon has become so easy and immediate for consumers, but the same experience is generally not available to savers, he says.

“Technology is an absolute must to connect back to the investor and robo-advisers can be a really good thing, if they can engage savers to save more and invest for the long term.”

€29.2bn

According to Lipper, in 2014, BlackRock ranked first in Europe among pan-european master groups with estimated net sales of €29.2bn

Robo-advisers providing low-cost automated portfolio management advice are filling the gap left by many banks and brokerage firms, which over the years have shifted their focus to serve higher net worth investors, leaving an opportunity for firms to target the mass affluent segment.

Popular with the “millennials” and young professionals, these US-born algorithm-based platforms, which generally use exchange traded funds (ETFs) to construct portfolios, are gradually gaining ground in Europe, for example in the UK with online discretionary managers such as Nutmeg.

In a deal that underlines the key role of technology in reshaping financial advice, BlackRock itself has recently acquired San-Francisco-based FutureAdvisor, a robo-adviser crafting automated portfolios for investors, founded in 2010 by two former Microsoft engineers. While the initial focus will be in the US, over time the firm expects to expand the platform to clients globally, including Europe.

Unlike competitors, the asset manager does not plan to target individual investors with the digital offer – which will become part of BlackRock Solutions, the firm’s risk management and technology platform –but hopes to offer it to banks, brokerage firms, and financial advisers, who can in turn serve their clients.

BlackRock’s fund distribution strategy in Europe very much relies on partnering with wealth management firms, be they independent, retail and private banks or insurance companies, irrespective of their business or advice model, explains Mr Hoctor-Duncan.

His division, which includes actively managed and indexed funds (excluding iShare’s ETFs) sources more than $235bn in client assets from Emea, of which more than 50 per cent is from the UK and the remainder from continental Europe. Italy, Germany and Switzerland are the biggest growth markets and have contributed to the largest sales growth over the past couple of years, particularly through advisory networks.

The “dramatic” number of hires at the firm in these three countries, where the fund house has been active for roughly two decades, has enabled BlackRock to become more local, and work with a higher number of domestic wealth management firms.

The distribution approach is substantially the same across all client segments, explains Mr Hoctor-Duncan, stressing the importance of understanding client needs and culture. “Being able to offer both ETFs through iShares, as well as indexed and actively managed funds, gives the firm a pretty unique insight into how clients can construct portfolios in the future.”

In the private banking space, the shift from open to guided architecture, which has seen private banks reducing the number of managers they partner with, is the “most often talked about trend,” he believes, but not “necessarily followed through”.

“I don’t feel there has been this huge change, as we have been a partner of big banks for 15 years. We have a scale platform, a wide breadth of product offering and skills embedded inside the products.”

A small number of clients have always been and will continue to remain important to BlackRock, he says. In Emea, the firm’s top 10 clients (by net sales) account for more than 50 per cent of its net sales sources.

It is the type of products clients require that has changed over the years, he says. If private banks tend to use products more as a building block inside their propositions, and retail banks want the complete solution, wealth management businesses of all types are increasingly looking for income. Multi-asset strategies and absolute return solutions that help investors navigate through market volatility and global uncertainty are also in high demand.

“The need for income everywhere across the whole of Europe is getting stronger and products that can generate consistent income – whether it is equity, multi-asset or fixed-income, are sought after,” says Mr Hoctor-Duncan.

With today’s low interest rates and ultra-low yields, traditional fixed income strategies may no longer deliver the income or stable returns clients need. With volatility in bond markets increasing, diversified, more flexible, less constrained strategies are better positioned, as they can look across the entire global fixed income market for opportunities and adapt quickly to changing market conditions. No single risk factor, such as credit, duration or geography should determine the return.

“Today it is key to look for new sources of income or return. We have seen a huge acceleration in flows in our unconstrained fixed income product,” he states, explaining how the firm has strengthened its education programme to advisers and wealth managers on this topic as well as others, such as multi-asset.

Top dog

Since the beginning of this year, BlackRock has been the most selected brand by the panel of PWM’s nine fund selectors. BlackRock products have drawn more than 8 per cent of total money invested

The tendency of a few top performing funds attracting the majority of client assets will continue. “One of the challenges of the industry is to generate more blockbuster funds, whether it’s BlackRock or not,” says Mr Hoctor-Duncan, questioning the efficiency of the industry.

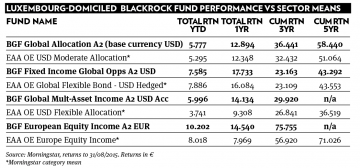

Among the firm’s blockbusters is the Global Allocation Strategy, with a 25-year track record, running $100bn worldwide, while the European cross-border version has $22.6bn.

The European traditional active equity franchise is also a “big success” for the asset manager, having grown to $43.5bn in total assets over the past six years thanks to positive performance, “at a time when asset allocators were going underweight European stocks in their portfolios”.

While the general consensus among asset managers is that the growth of the sub-advisory business is accelerating, driven by regulations such as Mifid II, set to introduce a ban on retrocessions to distributors in 2017, Mr Hoctor-Duncan brings a different perspective.

“I haven’t seen a sudden change in strategy from any particular client or geography. Our sub-advisory business has been pretty stable,” he says, not wanting to disclose details.

But unlike some of its largest competitors, this is not an area where the firm is “so proactive”. Assets in mandates are not necessarily stickier than in funds, he notes, acknowledging though that offering bespoke solutions enables the firm to explore its skills in a different way and learn from it.

That Europe may become the next sub-advisory battleground for asset managers, particularly US-based ones looking to find new distribution routes, does not concern him at all.

Throughout his BlackRock career, he has often seen US managers look at Europe as just another region to grow assets. “Every five years or so, someone else comes along, has a go and then they disappear the minute it gets a little tricky,” he says.

“But managers have got to bear the test of time and be there when it is a bit harder, because that is when you find out what partnership and relationship means,” says Mr Hoctor-Duncan. “There is something important about being stable, local and on the ground in good and difficult times.”

Salary independence

The biggest challenges to face over the next decades are linked to an ageing population, and the fact people are not saving enough and not investing for the long term, says Mr Hoctor-Duncan.

Moreover, when they do save, they hide in cash. Mass affluent clients hold 45 per cent of their assets in cash, according to BlackRock research. Large private banks also regularly complain their clients hold up to 40 per cent of their assets this way.

This means investors will never be able to save enough to grow their retirement pots to an adequate size. And if they are exposed to inflation, it will be even harder, he explains.

“We have got to change our priorities in life. It has become normal to be in debt, to spend rather than to save and invest. If we can rebalance this a little bit, it will make a huge impact in 10 to 15 years’ time.”

The focus of discussions about pensions and retirement age should shift from the idea of working longer and longer to that of salary independence, says Mr Hoctor-Duncan.

“While we are working we are salary dependent, as salary is funding our life. But our goal should be salary independence, so that I could choose to work or not to work,” he ventures.

Investing in the stockmarket for the long term pays off and can fund life in retirement. According to the firm’s research, every pound (in real terms) invested every year into the UK stockmarket for 20 years will generate an income of a pound (in real terms) for the rest of people’s lives, and will pay an income of three pounds a year if invested for 40 years.

“If we remain over reliant on cash, the opportunity of salary independence may take too long,” he adds.