Fintech on Friday: Alternative investments deal with digital disruption

Amin Rajan, Create

Downward pressure on fees and the ability to connect with new client segments are driving digitisation in the alternatives sector

“What the internet did to the music business, digitisation will do to finance. It’s not ‘if’ but ‘when’.”

So says a hedge fund manager participating in the new global survey from KPMG and Create-Research, Alternative Investments 3.0: Digitise or Jeopardise.

Like most other activities in finance, alternatives investments are information intensive. Data is their lifeblood. Digitisation is becoming becomes the North Star of the industry.

Previous waves of information technology mostly automated routine manual processes to reduce costs. The current wave, on the other hand, seeks to deliver end-to-end solutions within more joined-up businesses by delivering strong operating leverage.

This is being done via significant arbitrage information advantages from machine learning; friction-free client experience from innovative intuitive engagement; lower costs and competitive fee structures from more productive staff and operational excellence from systems that deliver a ‘single source of truth’.

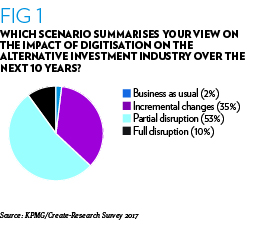

Unsurprisingly, on a 10-year view, the majority of alternative investment managers surveyed expect current business models to be disrupted (see Figure 1).

Just 2 per cent of respondents anticipate a ‘business as usual’ scenario. The rest see it as a treadmill to oblivion, since digitisation is rapidly becoming a necessity rather than a choice.

Thirty-five per cent anticipate ‘incremental changes’. This, in the belief that the pace of adoption will remain moderate over this period, due to the persistence of various technology and legacy issues.

More importantly, among the remaining majority of respondents, 53 per cent anticipate ‘partial disruption’ and 10 per cent ‘full disruption’.

Like its peers in other sectors, alternative investing is set for a big makeover – but with one difference. Its revolution will be evolutionary, given its cottage industry nature, which enjoins managers to perform a delicate juggling act between short-term profitability and long-term survival.

The drivers of digitisation

Two sets of drivers were singled out in our survey, namely new cost disciplines and new client segments.

Taking them in turn, 54 per cent of respondents identified rising pressures on fees and charges as a key driver. These have come to the fore in this decade, as investment returns have become influenced to a large extent by monetary policy, through quantitative easing (QE) by central banks in the US, Europe and Japan. The rise of passive funds has also resulted in securities benefiting as much or more from inclusion in various indices than from their intrinsic worth.

In this environment, most alternatives managers have struggled to meet clients’ return expectations, thereby intensifying fee pressures. Fees and charges have thus become a key source of outperformance, once compounded over time. End investors are becoming increasingly fee conscious, with price becoming a key point of competition.

At any rate, cost disciplines will become vital to avoid the curse of “profitless prosperity”, as managers scale their business by penetrating new markets and client groups (cited by 41 per cent of respondents).

So far this decade, market growth has been the main driver of AuM. Organic growth is the new mantra. There is now an urgent need for alternatives managers to enter hitherto underserved client segments such as insurance companies, high net worth investors and defined contribution pension plans.

These segments are becoming all the more important now that defined benefit pension plans – a key preserve of alternative managers so far – are advancing rapidly into their run-off phase due to ageing member demographics.

Unsurprisingly, therefore, 34 per cent have identified a rising generation of new end investors as a factor, demanding more immediacy, connectivity and ubiquity. And 26 per cent have identified millennials as a distinct investor group in this context.

This self-directed ‘internet generation’ is expected to be the biggest employee group in the key economies over the next 15 years.

It is also expected to be the beneficiary of the biggest wealth transfer in human history as their baby boomer parents pass on. Their inheritance is estimated at $30tn in the US, according to CNBC data. Outside the US, the figure is expected to be just as high.

The next wave of business expansion will most likely come from organic growth. Competition will intensify.

Winner takes all

In light of these drivers, Figure 2 provides a snapshot of how the alternative investments industry will change in three key respects, as digitisation progresses over time.

Firstly there is client context. Customers will demand a better investment proposition – based on fees, returns, engagement and experience – that will mark the shift from a product-centric to a client-centric business

Secondly, industry context. Competition will intensify and profitability will erode. Those able to deliver the required proposition will do well, in what may well turn out to be a winner takes all world.

Finally there is corporate context. Business growth will depend on improvements in process efficiency, time to market, investment capabilities, client base and skill sets.

Notably, wih these projected developments, overall profitability is unlikely to improve. Early adopters of digitisation will clearly gain an advantage, defying the old adage that ‘the pioneers take all the arrows’.

Amin Rajan is founder and CEO of Create-Research