Will emerging market corporate bonds prove to be a permanent fixture?

Both top-down and bottom-up analysis are key when considering allocations to emerging market corporate bonds, while investors should tread carefully when it comes to high yield

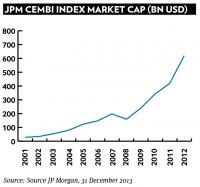

Emerging market (EM) corporate bonds issued in hard currencies are definitely an expanding fixed income asset class, with total assets tripling from $200bn (€155bn) in 2007 to $600bn at the end of last year, according to JP Morgan, with a strong push since 2011 onward.

This success can be explained by the relatively benign environment companies operating in emerging countries face today. However, it is undeniable that the massive injection of liquidity by central banks and the yield compression in more traditional asset classes play a big role.

In order to assess whether emerging corporates are an investment opportunity, rather than a temporary fad, we first have to investigate its main features.

From a geographical standpoint the main indices are dominated by the largest emerging economies, Brazil and Russia being by far the main issuers. This is not surprising since, in this asset class, the capability of companies to fund in hard currencies is closely related to the faith international investors place in their country. Banks make up one third of the universe, with oil, gas, telecoms and real estate also well represented. But the rating structure is the key feature we want to focus on.

Overall the EM corporate index pays a 300 bps spread over US treasuries with a five year duration. This figure is just 30 bps higher than its sovereign hard currency peer, while duration is two years shorter.

We draw a distinction between the investment grade side of the universe, about 70 per cent of the index, and its high yield counterparty. EM Investment Grade (IG) corporates offer on average a 200 bps spread over treasuries with less than six years of duration. They are now relatively attractive compared with EM sovereigns and US IG corporates. They are reasonably liquid and, in a rising yield environment, may be better off thanks to their potential for spread compression.

High yield (HY) corporates offer yields slightly above their US peers, but their volatility is historically much higher: suggesting it may be wise to be cautious. Moreover HY liquidity is still an issue. In fact, under normal market conditions, bid-ask spreads are roughly in line with US HY, but, as market volatility increases, they tend to suffer violent set backs.

Finally, default protection differs considerably among countries. The main Latin American economies tend to be fairer, while Russia and China, to give two examples, raise concerns. After adjusting returns for these caveats, we conclude that EM HY should be carefully handled, although individual opportunities may certainly exist.

Works both ways

The number of Ucits mutual funds dedicated to EM corporate bonds is still small, though rapidly expanding. It is dominated by a few players who made the first move into the asset class. Virtually all the managers involved have strong top-down macro capabilities, since they started as sovereign hard currency specialists and subsequently diversified into the new asset class. Hardly any fund has been launched by developed corporate IG or HY specialists. This may suggest just how key country analysis is in understanding the asset class. However, as for any other credit investment, bottom-up fundamental analysis should be regarded as the core of the investment process. Managers boasting a soundly-based credit research process, tested and proven on the developed market side, should therefore be favoured.

Having satisfied the above requirements, the actual choice of a mutual fund rests on its portfolio positioning. We would therefore favour asset managers focused on the investment grade side, providing a broadly diversified portfolio, complemented by a satellite allocation to cherry-picked HY issues. We may consider them both as an alternative to sovereign hard currency funds, bearing a substantial US interest rate risk, and as a stand alone satellite asset class in multi-asset portfolios.

The main risk we see at the moment arises from flows – hot money may rush for the exit as market volatility increases. Unfortunately we can hardly assess how big a portion of the overall investment in the asset class it is.

Paolo Biamino and Antonino Cipriano, Fund Selection Unit, Euromobiliare AM