Why invest in global emerging market small cap equities?

Small companies are often better placed than their larger equivalents to benefit from the rise of the emerging market consumer class, while also offering diversification benefits

The interest for investing in emerging market small caps has increased considerably in the past couple of years but the number of strategies available to investors remains limited. The alpha proposition within the asset class is undoubtedly very compelling – roughly half of the funds with a more than three year track record in our sample outperformed the MSCI EM Small Cap index net of all fees. This is an unusually high number compared to most other equity categories. Going forward, we expect to see continuous strong returns, both absolute and relative to the benchmark, in this highly inefficient asset class.

As the increasingly wealthy and better educated emerging consumer moves up the hierarchy of needs, this consumer will gradually demand ever more access to goods and services in segments such as technology services, transportation and healthcare. Companies targeting these domestic consumption segments are often found within the small cap space, as larger cap stocks are more skewed towards sectors geared to global GDP such as energy, metals and mining. Thanks to a larger exposure to fast-growing domestic markets and less reliance on global factors, emerging markets small cap stocks have, and likely will, offer higher growth rates relative to their large cap equivalents.

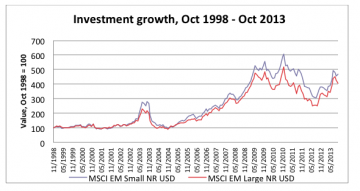

Most investors are familiar with the fact that small caps have higher growth rates and also stronger long-term returns compared to large caps. More surprisingly, and quite in contrast with general perception, those superior returns have occurred at similar levels of risk (as measured by volatility), as can be seen in the table below. Thus, if history is any guide, small cap emerging market stocks will offer superior risk-adjusted returns at higher growth rates than the broader GEM universe.

Further strengthening the investment argument, for investors with exposure to Western financial markets, an investment in emerging market small caps offers significant portfolio diversification, more so than its geographical large cap peers. Coupled with the return profile discussed above, emerging market small cap makes a strong case indeed. Evidently, this goes for investors holding EM large cap stocks as well, as the small cap segment returns are somewhat detached from the large cap segment as seen from the correlation matrix below, albeit not to the same extent as compared with Western markets.

To illustrate how the risk reward profile for investors can be enhanced explicitly, assume a portfolio holding 15 per cent emerging market small-cap equities and equal share (42.5 per cent) of US and European equities. While comparing this portfolio with an equally weighted US and European equities only portfolio, it becomes clear that the risk reward can be enhanced (see the last column). With a very similar volatility profile, the return side of the equation has increased significantly apart from the recent three year period (which is due to the recent relative underperformance of emerging markets). Over the longer term, the emerging market small cap enhanced portfolio increased the return profile with 0.86 per cent - 1.23 per cent annually depending on the period which corresponds to a total a cumulative outperformance of 5.54 per cent over five years, 8.29 per cent over 10 years and 15.94 per cent over 15 years.

What do we look for in a successful manager?

To succeed in the complex world of small cap emerging markets, a credible and successful team with experience of investing across a full market cycle is in our opinion a prerequisite. GEM small caps tend to have little or no analyst coverage, implying that the manager must be able to do a lot of the number crunching himself, demanding strong and credible analyst resources as there is little other research to rely on. Strong trading skills are also important as the asset class tends to be thinly traded with sometimes substantial intra-day volatility.

Our goal has been to identify a manager that is able to generate alpha in most market conditions. Instead of crudely dividing the universe into “growth” and “value” buckets trying to determine which one to opt for, we have tried to identify a relatively style-agnostic manager that focuses on finding the best possible investment opportunities within the asset class. Portfolio construction must rely on strong risk management primarily to enable the manager to understand the risks taken in the portfolio and to avoid unintentional bets and strong systematic biases. We believe that a disciplined yet pragmatic strategy offers the best odds of beating the benchmark in most market conditions by achieving a balanced “all-weather” portfolio.

Boutique managers typically are fairly successful in niche markets, primarily for three reasons. Truly solid boutiques tend to suffer less from manager turnover as they generally constitute “the last stop” for high performing managers. Secondly, due to limited possibilities of raising significant assets in niche markets, the bigger houses have so far tended to allocate relatively limited resources to smaller asset classes. Thirdly, boutiques tend, on average, to have more prudent capacity targets to safeguard the alpha.

Our search resulted in the selection of US-based boutique manager and small cap specialist Copper Rock. Their emerging markets team consists of the three very senior portfolio managers having more than ninety years of combined experience in small cap investing. The small size of the team enables the team members to share information quickly and efficiently. The portfolio is diversified across all sectors to ensure as many uncorrelated alpha sources as possible and to focus specifically on stock specific risk. The process is designed to work in most market conditions.

Axel Norlund, director, portfolio Manager and Jakob Jessen, executive director, head of equities, Nordea Alternatives & Manager Selection