Higher interest rates to boost hedge funds but fees must be fixed

Nicolas Campiche, Pictet Alternative Advisors

Allocations to private assets have swelled in recent years, but with the sector getting expensive, hedge funds are beginning to look more attractive

Investor demand for private, illiquid assets has increased significantly in recent years, boosted by expectations for higher returns than are typically found in liquid assets, and a continued quest for yield in the low interest rate environment. On the other hand, the poor performance of hedge funds, along with high fees, have triggered substantial redemption waves in that sector.

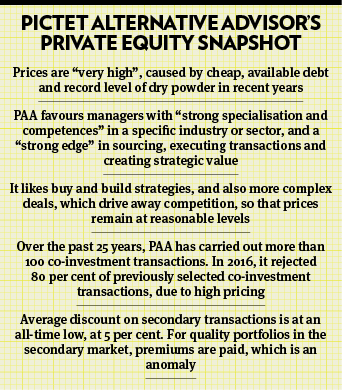

But the picture may change in the coming months, according to alternative investment specialist Pictet Alternative Advisors (PAA), as opportunities get scarcer in real assets and with prices at historical highs, while hedge funds may benefit from the normalisation of interest rates.

Significant inflows

“Since the global financial crisis, there has been an acceleration of asset growth, especially in private equity and real estate, driven by institutional clients and very sophisticated private clients,” states Nicolas Campiche, CEO of Pictet Alternative Advisors.

Private clients, particularly those in Europe, have been under allocated to real assets, he says, and many started to dip their toes in the water only in the past five years, with “significant amounts” invested in private equity.

The independent unit within Pictet Group manages more than $20bn in client assets, of which 80 per cent is in customised solutions.

Over the last 18 months, net new commitment in private assets has swelled to $3bn, which shows “unabated and renewed” client interest in this space, while hedge fund redemptions have hit $1bn during the same period.

The hedge fund business appears definitely “more challenging”, but a new trend is also emerging. Some clients have recently shifted assets from fixed income into hedge funds, seeking higher returns and portfolio diversification, he says, warning that using hedge funds as a proxy for fixed income “ended up in tears” the last time it happened, back in 2006.

“We continue to recommend an overweight allocation to alternative investments,” he says. Wealthy clients at Pictet have an allocation to alternatives ranging from 15 per cent, if only investing in liquid alternatives, to up to 45 per cent, if they are able to access illiquid, real assets.

“Private assets will continue to provide significant premium over liquid markets, with real estate protecting investors against an inflationary environment,” predicts Mr Campiche. On the liquid strategies side, the focus is on low beta strategies, such as market neutral or directional plays not relying on market beta to generate returns, such as global macro, despite its disappointing performance in recent times.

Normalisation in the macro-economic landscape, with central banks playing less of a key role in markets, and higher interest rates should benefit hedge fund strategies, expects Mr Campiche. “But fees are one issue to be fixed in the industry,” he says, wishing for a better alignment of interest between clients and managers.

“On the hedge fund side, by and large we reached our objective, which is a premium over cash,” he says. In a multi-strategy hedge fund portfolio, PAA aims to generate 200 to 300 basis points over Libor, net of fees.

“We have the benefit of hindsight today to say that reducing allocation to hedge funds five years ago and increasing exposure to private equity generated extra return. However, going forward it is less of a clear picture. Both private equity and real estate prices are expensive, and returns are likely to go down.”

Gatekeeper

PAA’s “conservative position” on private assets led it to take tough decisions, acting as a “gatekeeper” on clients’ behalf.

“We have tremendous demand from our clients to increase their allocation to private markets, but we have decided to limit the size of our funds,” says Mr Campiche, believing the amount raised could be easily doubled, in both private equity and real estate. “But we think there are no longer so many opportunities in the marketplace today.”