Asset allocation positions point to confidence in recovery

Wealth managers are responding tactically to extreme market conditions, with alternative assets attracting substantial allocations. Stephen Wall and Cath Tillotson discuss the strategies in use for HNW clients' portfolios

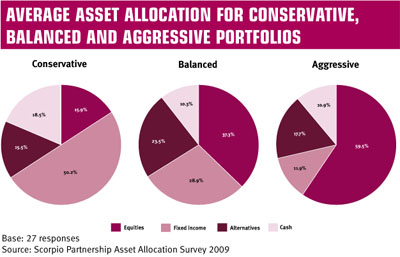

Players in the global wealth management space reacted to the global downturn as expected – and as clients had demanded – with a more defensive asset allocation position with high allocations to cash and fixed income. Talk is often cheap but the industry has walked the walk this time. In reaction to the rhetoric on asset allocation strategies, Scorpio Partnership reached out and examined the strategies currently in use for HNW client portfolios across a range of industry players. The result: while the positioning is more defensive in the current environment, there is also a wide variance in asset allocation strategies suggesting managers are responding tactically to extreme market conditions. Looking at the results in more detail, a conservative portfolio on average is allocating 50.2 per cent to fixed income and 18.5 per cent to cash. Indeed, more than half of the participants surveyed reported allocations to fixed income in excess of 50 per cent in their conservative portfolios. For cash, on average, allocations were in double digits through conservative, balanced and aggressive portfolios. Even in aggressive portfolios the cash allocation average is 10.9 per cent. However, while conservatism has gained a natural place in the current allocation environment, the bias towards equities in aggressive portfolios suggests a confidence in a long term recovery in the financial markets. Indeed, 75 per cent of respondents reported allocations in excess of 50 per cent for aggressive portfolios. Further, the much maligned alternative asset classes, including hedge funds, real estate and private equity, continue to feature as a core asset class in spite of sustained and broad-based underperformance. The majority of participants continue to allocate up to 25 per cent of all portfolios to alternative assets showing the on-going opportunity for specialist managers to generate returns in current market conditions. Going deeper into the construction tools of HNW portfolios, Scorpio Partnership’s work highlights the major role in today’s business model of the model portfolio. Three-quarters of respondents use model portfolios to manage client assets. Indeed, almost half have more than 10 portfolio profiles from which they can select, which gives flexibility to meet clients' needs. As a further rebuff to its cynics, the market is also far more entrenched in the open architecture world than given credit. On average, less than one-quarter of portfolio allocation is fulfilled using in-house investments. Indeed, 44 per cent of respondents only use third party investments in portfolios, while only 15 per cent allocate to portfolios primarily using in-house investments. As with the continued use of alternatives, there are clearly still opportunities for specialists to generate returns. Indeed, the main driver to using external managers is access to a specific investment expertise and, in selection, the attraction is the quality of the investment professionals followed by the performance track record of the fund and brand of the house. Stephen Wall is director and Cath Tillotson is partner and head of research at wealth management strategy think-tank Scorpio Partnership