Wealthy individuals tend to make confident property investors, but they still value solid advice which can help them maximise returns

Alternatives

Solid yields compensate for real estate wobbles

Capital values in commercial property have fallen, but yields remain high and prime locations continue to attract investors

Bolder portfolios ready to re-embrace alternatives

Alternative investments such as private equity and hedge funds are making their way back into balanced portfolios, but due diligence and manager selection are more important than ever

Private equity: the appeal of the real

Investors looking for returns are considering increasing private equity allocations, but need to be reminded that patience is a virtue in this field

Private credit opportunities opening up in time of distress

Distressed prices are creating interesting opportunities in private credit, but clients need to be reminded that it takes a while for these investments to bear fruit

Lyxor research reveals stark performance differentials

Investors are warming to alternative investments, but providing clients with ample performance data can help them decide which strategies to adopt, according to Lyxor

Is Ucits suitable for hedge funds?

Gavin Ralston, Chairman of EMEA & Global Head of Product at Schroders (left), and Dermot Butler, Chairman at Custom House Group, discuss whether or not Ucits funds suit hedge fund strategies

Hedge fund flexibility wins new friends

When managing a fund of hedge funds, asset allocation is certainly important, but selecting the right managers is what really drives performance

Alternatives swing back into style

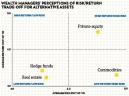

The wealth management industry appears to be redefining risk, with hedge funds becoming the defensive asset of choice

Gold unlikely to lose its lustre as a safe haven

Gold prices may be extremely high, but fears over the global economy should see the commodity continue to attract nervous investors

Global Private Banking Awards 2023

PWM Digital Edition (June - July 2023)

Wealth Tech Awards 2023

Join our community

|

|

|

|

|

|