Gavin Ralston, Chairman of EMEA & Global Head of Product at Schroders (left), and Dermot Butler, Chairman at Custom House Group, discuss whether or not Ucits funds suit hedge fund strategies

Asset Allocation

UK economy faces stormy outlook

CCLA Investment Management’s CIO, James Bevan, explains why the UK needs major economic growth to tackle its debt mountain

Making headway in portfolio management

Today’s world of low expected growth and extreme market volatility means building a diversified portfolio with a long-term oulook is more important than ever

Strong inflows into emerging market bonds reflect changing world order

Worries over the state of the dollar and the euro have seen increasing levels of interest in local currencies in emerging markets

Hedge fund flexibility wins new friends

When managing a fund of hedge funds, asset allocation is certainly important, but selecting the right managers is what really drives performance

ETFs respond to charges

Critics of ETFs claim these vehicles carry hidden risks, but providers argue they are better regulated than many other investments

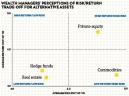

Alternatives swing back into style

The wealth management industry appears to be redefining risk, with hedge funds becoming the defensive asset of choice

Gold unlikely to lose its lustre as a safe haven

Gold prices may be extremely high, but fears over the global economy should see the commodity continue to attract nervous investors

Brazil learning to cope with growing pains

Brazil makes for a compelling medium to long-term investment opportunity, but the country must first overcome high rates of inflation and the effects of a strong currency

Value abounds amid American gloom

The US maybe suffering from slowing growth and worries over the national debt but falling equity prices are creating opportunities for adventurous stock pickers

Global Private Banking Awards 2023

PWM Digital Edition (June - July 2023)

Wealth Tech Awards 2023

Join our community

|

|

|

|

|

|